Market Data

August 23, 2018

SMU Steel Buyers Sentiment Index: Signs of Concern

Written by Tim Triplett

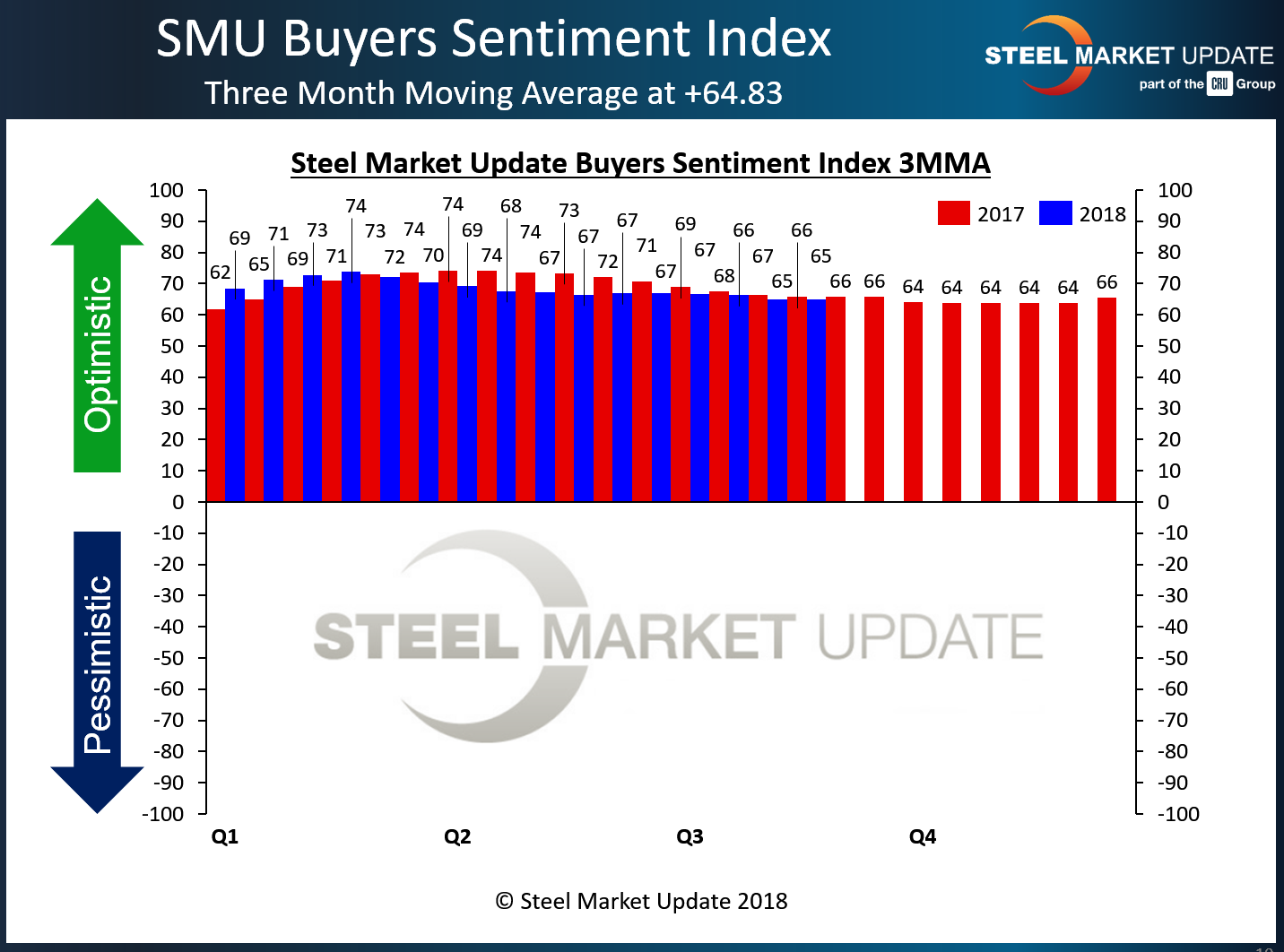

Both Current and Future Sentiment, measured as three-month moving averages (3MMAs) to smooth out the data, are below levels of this time last year, possibly reflecting concerns among steel buyers about the volatile trade situation in the U.S. Data from Steel Market Update’s Steel Buyers Sentiment Index remains at optimistic levels, however, by historical standards.

The Current 3MMA moved down to +64.83 from +66.33 a month ago and +65.67 in mid-August 2017. The reading is currently at it lowest point in 2018. Current sentiment peaked this year at +73.83 in mid-February.

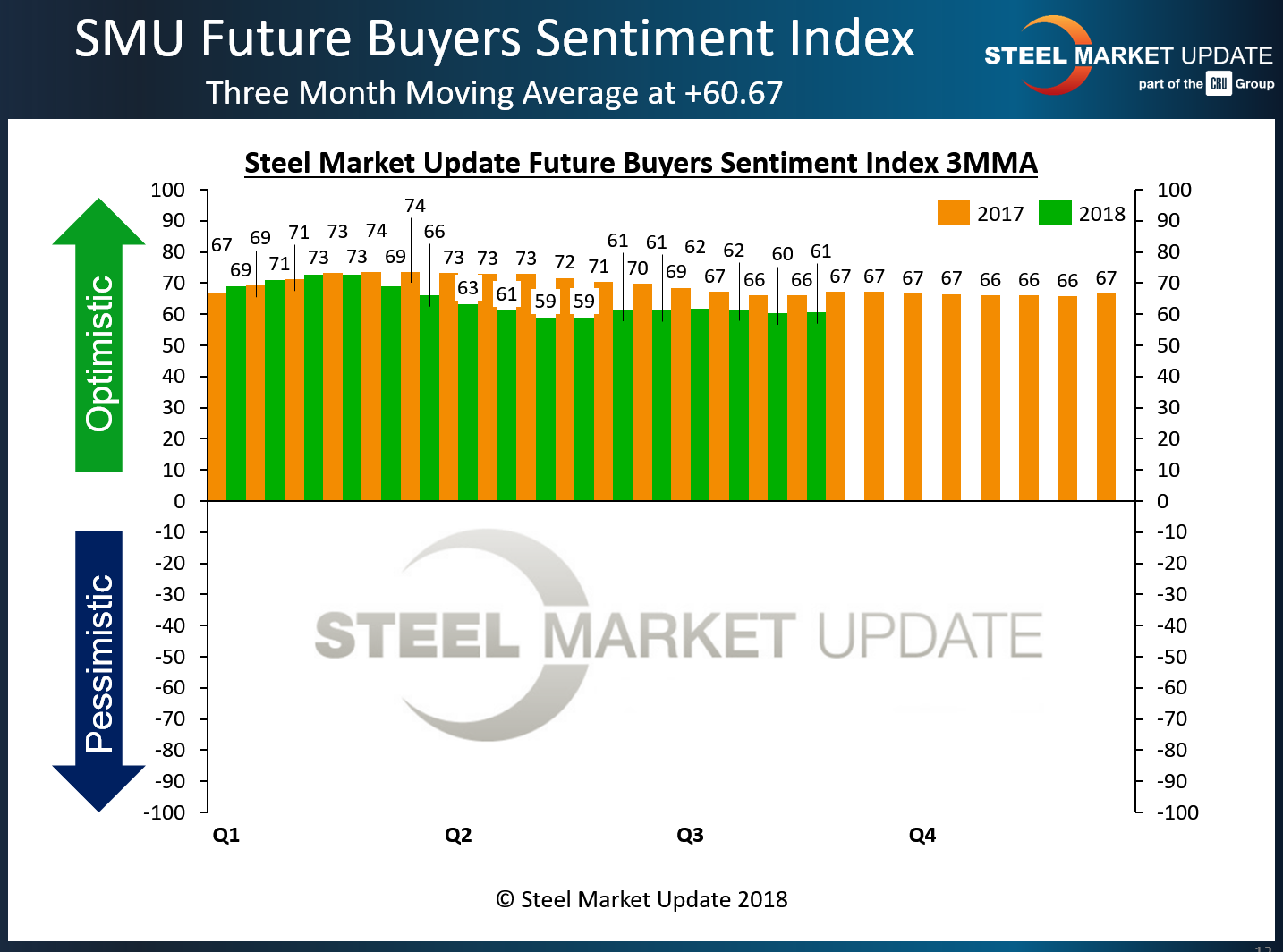

Future Steel Buyers Sentiment Index

Future Sentiment—how buyers and sellers of flat rolled and plate steel view their company’s ability to be successful three to six months in the future—averaged +60.67 in the latest data. That’s a decline from 61.50 one month ago and from +66.00 at this time last year.

What Respondents are Saying

• “Barring a recession, we are positioned well.”

• “The tariff’s impact is so great on the organization that our long-term success is questioned vs. companies that import into the U.S. without any tariff implications.”

• “I am slightly more positive than in previous weeks, but there’s still a lot of uncertainty due to the current administration’s trade policies and too many unknowns.”

• “There continue to be companies selling far below replacement cost in fear that pricing will drop. By doing so, they assist the fall and legitimize it.”

• “We worry about the start of an extended trade war.”

• “Increasing interest rates, inflation, NAFTA, and continued uncertainty on tariffs are precursors to a slowing economy.”

• “I believe I’m seeing a slight slowdown.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 38 percent were manufacturers and 51 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.