Prices

August 19, 2018

Zinc’s Price Limps into 2019 Despite Refined Market Tightness

Written by John Packard

By CRU Group’s Zinc Analysis Team

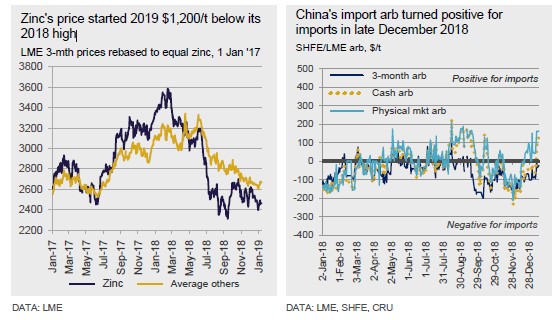

Despite lower-than-expected smelter output in China last year, which contributed to record refined deficits, 2018 marked the turning point for zinc’s price, reports CRU Group’s Zinc Analysis Team. Despite a still-tight refined market with stocks at critical levels, zinc’s price has had a shaky start to 2019, trading at almost $1,200/t below its 2018 high in the mid-$3,500s. A significant increase in concentrate TCs goes some way to explain the demise of zinc’s price, signalling a return to more plentiful mine supply, some of which has already begun to feed through to higher refined output. This certainly played its part in the switch to risk-off investor sentiment and zinc’s price slump.

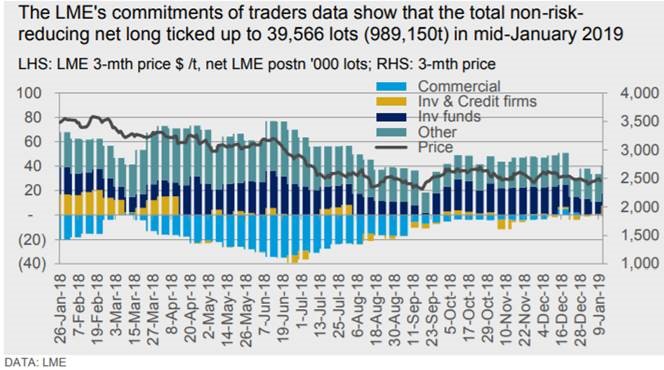

Last summer, the catalyst was arguably the USA’s imposition of Section 232 tariffs on steel products and ongoing trade tensions. But there were also plenty of other bearish factors at play last year, including rumours that China’s State Reserves Bureau was planning to sell some of its stockpiled refined zinc and a couple large deliveries of metal onto LME warrant in warehouses in Europe and the USA, culminating in a slump to the low $2,300s in September last year. The gains made on the LME on the back of the subsequent opening of China’s import arb have since been mostly eroded, with zinc’s recent price performance worse than the average of the rest of the LME metals. The macro outlook suggests that 2019 will be a difficult year, with global growth likely to be weaker than in 2018, slowing from an estimated 3.0 percent to 2.6 percent. The ongoing effect of punitive trade tariffs (along with the threat of further protectionist measures) and tightening monetary policy as historically low interest rates continue to move up (in the USA) or begin to move up (in Europe towards the end of the year) will discourage consumer spending and corporate investment. LME data show that investors’ non-risk-reducing net long in the zinc market has tumbled since early-2018, falling from 60,000 lots to 33,500 lots in early-January. This almost halved what we assume to be speculative tonnage in the market, from 1.5Mt to 838,000t, although it has since ticked up to 39,566 lots (989,150t) due in large part to an increase in the net long position of investment firms and credit institutions.

With LME stocks still at critical levels (total 125,575t on Jan. 14, of which 108,000t were available warrants) the likelihood of spreads tightening again remains high, particularly as there have as yet been no fresh deliveries of metal onto LME warrant since the backwardation collapsed. The dominant position holder is currently holding 50-79 percent of cash warrants (down from 90 percent +) and this has helped to ease tightness for now and given some relief to stockholders.

News of a stimulus package from China on the back of very weak December trade data boosted all base metals (with the exception of Ni) on Jan. 16 following the Chinese Central Bank’s injection of a record $83 bn into the financial system, but prices seem to have lost momentum at the time of this writing. The Chinese government has also promised tax cuts and other measures to protect the economy from a rapid slowdown, although these are likely to take some time to translate into firmer end-use demand.

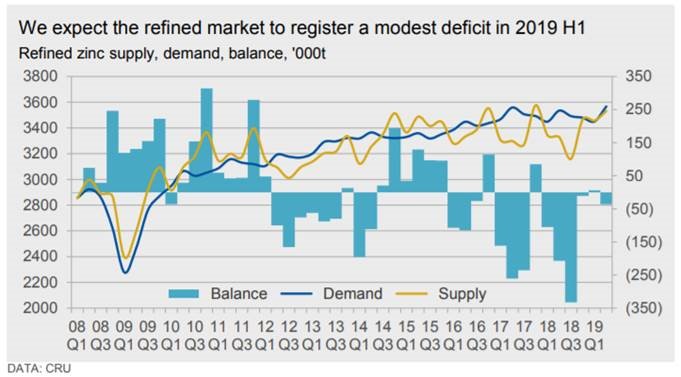

We expect the refined market to register a modest deficit in 2019 H1. After three years of refined market deficits in 2016-2018, the last of which reached a record 650,000t, we are expecting a deficit of just 30,000t in 2019 H1 and a return to modest surplus in the year as a whole. We expect improving mine supply to flow through to higher smelter utilization rates, particularly in China, where many large smelters are poised to produce more. We are also forecasting an increase in ex-China smelter output, due largely to capacity increases. At the same time, we expect Chinese demand to remain flat in 2019 H1 (but return to growth in the second half of the year) and for global demand to grow marginally.