Prices

August 16, 2018

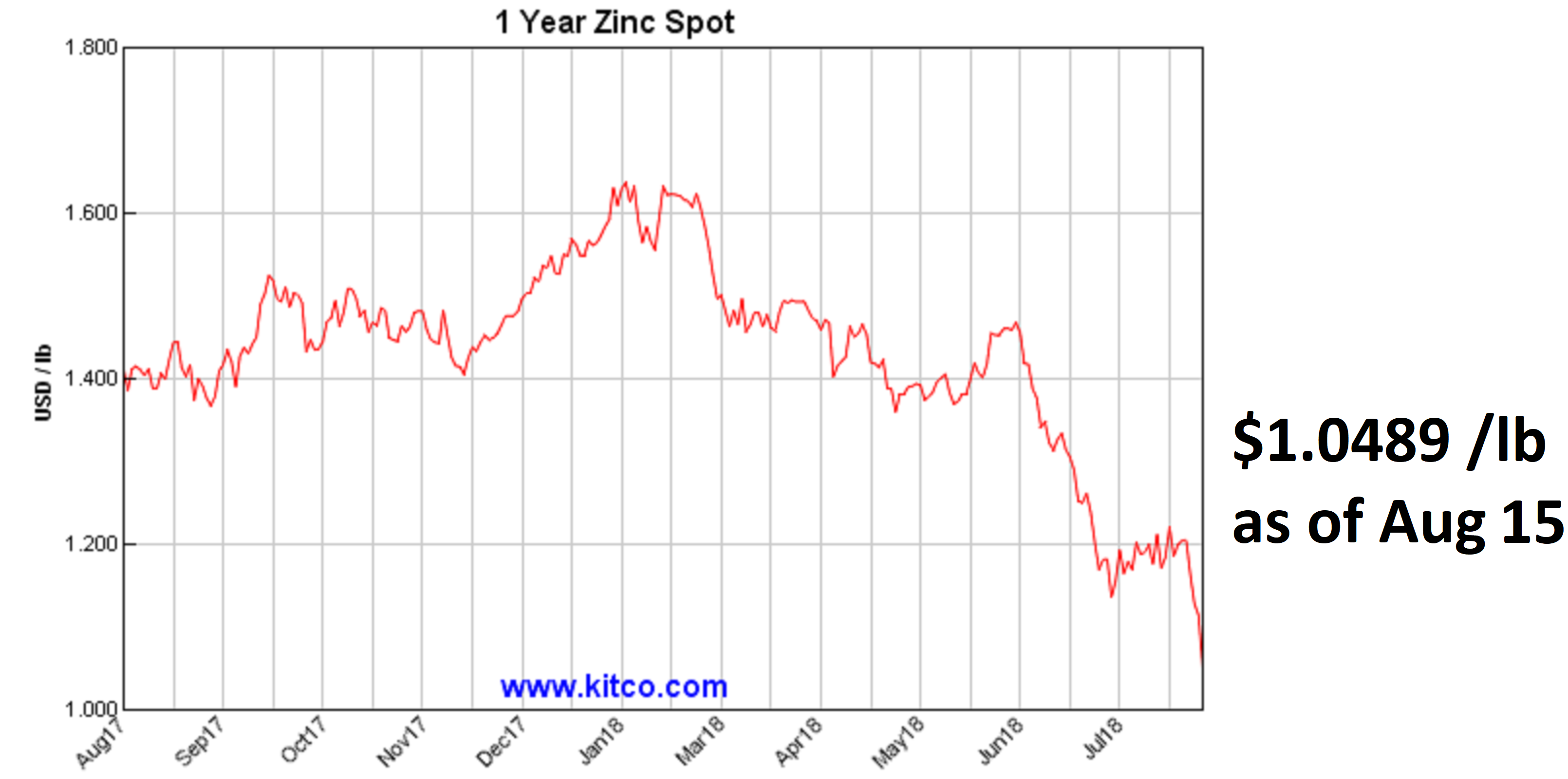

Zinc Stumbles to Two-Year Low

Written by John Packard

Boom, zinc has collapsed taking a big hit on Wednesday when it dropped to $1.05 per pound. At the beginning of 2018, zinc was trading over $1.60 per pound. The $1.05 per pound level was last seen in late fourth-quarter 2016.

Yesterday, during the HARDI steel conference call, coating extras for galvanized steel were discussed. The mill buyers of galvanized on the call told SMU a few weeks back the mills were resisting lowering their coating extras. One of the steel buyers told those on the call, “I had been unable to get the mills to budge [on coating extras]. Now the conversation is changing… [We] anticipate a reduction in coating extras.”

SMU did a quick analysis of zinc and found the weekly average for zinc over the past three months has been $1.30 per pound. The weekly average since the beginning of the year is $1.4257 per pound.

We remind steel buyers to not focus just on the latest swoon in pricing, but to look at the longer-term average and then see what extras were being charged prior to 2018 based on that longer-term average. Also, you need to be aware that there is an adder to zinc paid by the steel mills. The adder is approximately $.08 per pound.

SMU is expecting some adjustments from the steel mills, perhaps sometime during fourth quarter (production). We are carefully watching the market to see if steel buyers can get the domestic steel mills to adjust extras on contracts or spot in the coming weeks.

We also want to remind our readers, CRU’s zinc analyst believes zinc prices are falling based on trade tariffs spawned by President Trump. Back in mid-July, Helen O’Cleary warned SMU readers, “more trade shocks will again eclipse market fundamentals.” Here are the bullet points O’Cleary provided to SMU in July:

- Zinc’s price has fallen further than we were expecting and we believe that it’s now diverged from market fundamentals

- The falls started on the LME as investor sentiment soured on escalating trade tensions & Trump’s announcement of a possible additional $200 billion in tariffs on goods from China sparked heavy selling on the SHFE, which in turn dragged the LME price lower

- The next price support level is at $2,430/t [$1.102 per pound. It broke through resistance on Wednesday of this week, noted SMU]

- We do not expect this to be breached in the short-term as a tightening physical market in China should reverse the decline on the SHFE to enable the import arb to open – this should also halt the slide in the LME price

- So, we could see zinc’s price pick up in the short-term

- That said, more trade shocks will again eclipse market fundamentals…