Market Segment

August 14, 2018

North Star BlueScope Expansion on Horizon

Written by Sandy Williams

North Star BlueScope may receive funding for an expansion that will add 600,000 to 900,000 metric tons of annual capacity to the Delta, Ohio, facility.

Australian parent company BlueScope has initiated a comprehensive study to determine the feasibility of a $500 million to $700 million investment that would include a possible third electric arc furnace and a second caster. If approved, the project would take 2-3 years to complete. A decision is expected by February 2019.

“We believe the project may deliver BlueScope compelling through-cycle economics, and the study will seek to confirm that,” said CEO Mark Vassella.

During the earnings call, Vassella said he has talked to North Star customers. “They will buy more steel from us if we make more.” Steel produced at North Star is sold domestically in the Midwest, with a focus on automotive and construction companies.

Vassella added that construction of a second caster could be completed alongside the current one with minimal disruption to production.

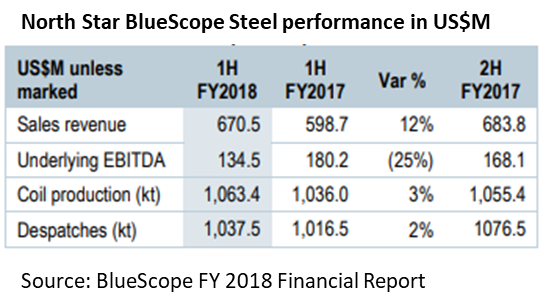

North Star has been operating at 100 percent capacity utilization to meet increased demand. The high utilization rate is driving the expansion, said BlueScope. Shipments in the second half of fiscal year 2018 totaled 1,067,000 metric tons, up from 1,038,00 tons in the first half of 2018.

North Star has been operating at 100 percent capacity utilization to meet increased demand. The high utilization rate is driving the expansion, said BlueScope. Shipments in the second half of fiscal year 2018 totaled 1,067,000 metric tons, up from 1,038,00 tons in the first half of 2018.

Higher electrode, refractory and alloy costs added $5 million to North Star’s second-half costs with another $10 million expected in the first half of 2019. Shipments are expected to be lower in next year’s first half due to seasonality. BlueScope anticipates the average benchmark spread in the first half to be $90 per ton higher.

Underlying EBIT totaled $285.4 million in the second quarter driven by higher selling prices and spreads, as well as U.S. trade measures and economic strength. EBIT for fiscal 2018 increased 6.0 percent from 2017 to $431 million.

BlueScope Group results for the second half were the best since 2008 and full-year results were the best since 2005. Fiscal 2018 sales revenue of about AU $11.5 billion was 9.0 percent higher than in 2017 due to higher steel prices across all segments and higher shipments. Net profit after tax was AU $1.57 billion for fiscal 2018, a 119 per cent or $853.2 million increase on 2017. Fiscal 2018 net profit included unusual and one-off benefits of AU $743.1 million.

“Underlying EBIT strengthened to $745.0 million in 2H FY2018, up $220.7 million on the first half, and our best half since December 2008. It was driven by strong demand and steel spreads in our U.S. and Australian markets. This led to full-year underlying EBIT of $1,269.3 million, up 15 per cent on FY2017,” said Vassella.

First half 2019 EBIT is expected to increase 10 percent from second-half 2018.