Analysis

August 1, 2018

U.S. Auto Sales Fall in July as Incentives Decline

Written by Sandy Williams

Most automakers reported a drop in U.S. vehicle sales in July and analysts are predicting more pain to come in the second half of the year.

“Every year there is a clunker of a month,” Mike Jackson, chief executive of AutoNation Inc., told Reuters. “I think July will be that month from a retail point of view.”

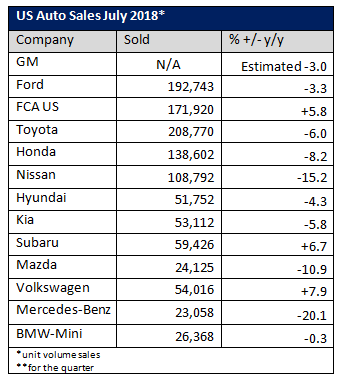

Fiat Chrysler was one of the few automakers to report an increase in sales. Sales of vehicles for FCA jumped 6 percent in July on the strength of its Jeep brand.

Ford sales were down 3.1 percent, and although General Motors no longer reports monthly data, its sales were expected to be down, as well.

Nissan and Honda sales fell 15.2 percent, and 8.2 percent, respectively. Toyota sales slipped 6 percent along with losses at Hyundai and Kia.

Part of the problem was a cutback in incentives offered by dealerships. Incentives fell about 5 percent from a year ago to an average per unit spend of $3,664. It was the first decline in average incentive in 54 months, according to JD Powers. The average new vehicle transaction price was $31,561 for July.

General Motors reduced its earnings forecast for 2018 to $5.14 per diluted share from its previous range of $5.52 to $5.82 and warned that trade conflicts could hurt both U.S. and global car sales.

GM CFO Chuck Stevens said the company was not expecting tariffs to impact the industry in 2018. “What happens beyond 2018, I think there’s a lot of uncertainty in this space at this point in time. We’re going to have to see where it lands and how ultimately that impacts the U.S. industry–and the global industry, frankly.”

President Trump has threatened to impose tariffs of 25 percent on imported automobiles and parts despite warnings by automakers, parts manufacturers, repair stations and dealers that such measures would throw the industry into chaos and disrupt growth in the U.S. economy. Automakers said tariffs could raise the price on some cars as much as $6,000.

“The whole trade war and tariffs are deeply unsettling from an economic point of view,” said AutoNation CEO Jackson as quoted by Reuters. “The threat of tariffs on motor vehicles is a great concern.”

“It will make the other tariffs look like a company picnic,” he added.