Market Segment

July 31, 2018

NLMK USA Posts Strong Q2 While Facing Tariffs

Written by Sandy Williams

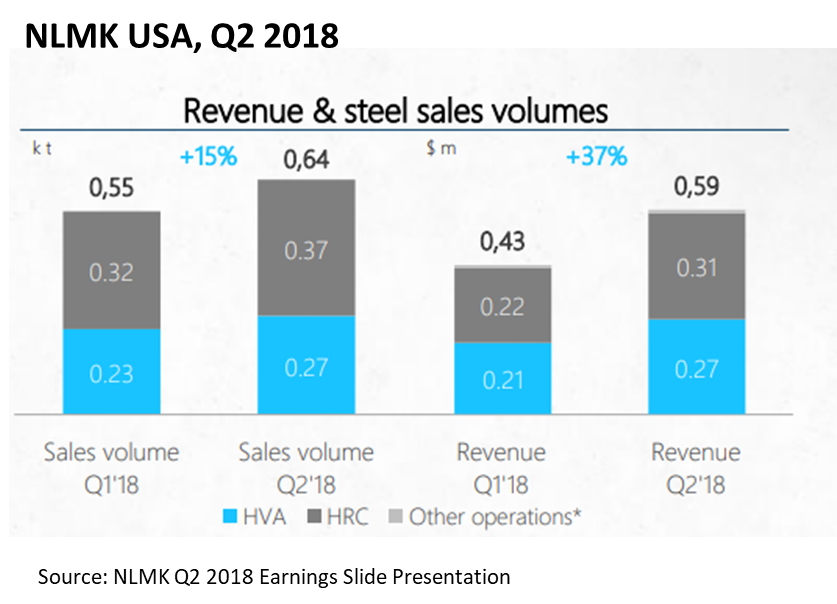

NLMK USA sales jumped 15 percent to 640,000 metric tons in second-quarter 2018. Revenue for the U.S. segment totaled $590 million, up 37 percent quarter-over-quarter and 35 percent year-over-year, due to rising demand and recent steel import restrictions.

EBITDA for NLMK USA increased 90 percent quarter-over-quarter to $76 million supported by growing sales volume and a widening spread between slab and finished steel prices. Average selling price jumped 19 percent from the previous quarter as a result of Section 232 measures, the company said.

Slab sales from NLMK’s Russian flat division to NLMK USA dropped 43 percent in the second quarter due to the imposition of Section 232 tariffs. Slab sales during the quarter totaled 285,000 metric tons compared to 503,000 tons in the first quarter and 551,000 tons in Q2 2017.

Although NLMK USA benefits from higher steel prices resulting from Section 232, CEO Robert Miller says the company will be forced out of business if it is not exempted from the 25 percent tariff on imported steel. Miller said last week that the company has already paid $80 million in duties on slabs from its parent in Russia. American steel manufacturers are blocking the company’s request for an exemption from Section 232 tariffs by stating “literal untruths” in their objections, said Miller. He asserts, along with California Steel Industries, that there is not enough slab availability in the United States despite insistence by U.S. Steel and Nucor to the contrary.

NLMK Group shipments increased 6.0 percent on strong demand for Russian and NLMK USA flat products, which offset declines in other segments. Revenue for the group was up 11 percent quarter-over-quarter to $3.1 billion for net income of $581 million and its highest second-quarter earnings in a decade.