Market Segment

July 25, 2018

Higher Prices Drive Record Sales for Reliance Steel & Aluminum

Written by Sandy Williams

Reliance Steel & Aluminum, North America’s largest service center organization, set a new company record with net sales of $2.99 billion for the second quarter of 2018. Sales grew by 20.8 percent from a year ago and 8.4 percent from the previous quarter. Net income totaled $230.8 million, up 124.1 percent from Q2 2017 and 36.6 percent from the first quarter of 2018.

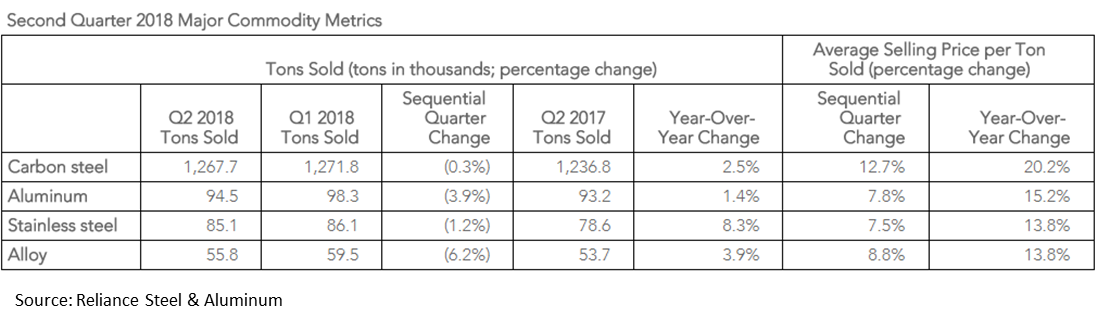

“The metal pricing environment was significantly stronger than we had anticipated, gaining strength as the second quarter progressed, with prices increasing in each month of the quarter across all of our major commodities,” said President and CEO Gregg Mollins. “Solid demand, coupled with ongoing Section 232 activity, drove metal price increases on almost every product we sell. As a result, our average selling price per ton sold increased 9.6 percent compared to the first quarter of 2018, exceeding our expectation of up 5 percent to 8 percent. Tons sold in the quarter were down 0.7 percent, in line with our expectation given pre-buying activity by certain customers in the first quarter of 2018. However, underlying demand remained strong.”

Reliance’s inventory turnover is 4.4 times based on tons, said Mollins. Reliance is passing higher metal costs on to customers before entering material into inventory.

Demand in almost all sectors is strong or strengthening. Increased demand for construction and agricultural equipment is a result of higher capital spending due to tax reform, said COO James Hoffman. Infrastructure and nonresidential construction continue to improve. Reliance is prepared to handle a 20 percent jump in volume to support construction demand, Hoffman added.

Commenting on individual markets, Reliance executives noted that the energy market is recovering as evidenced by growth in rig counts and drilling for oil and gas. Reliance metal processing has seen an uptick due to increased demand for aluminum in autos. Aerospace continues to be a strong end-market for Reliance.

Pricing momentum for aluminum and stainless steel is expected to level off in the third quarter. Stainless steel has had two price increases since the company’s last earnings call and is impacted by higher prices for nickel.

In outlook remarks, CFO Karla Lewis said demand and pricing remained strong in the second quarter and are expected to remain solid for the rest of the year. Shipment levels will be impacted in the third quarter by normal seasonal patterns linked to customer shutdowns and vacations, as well as one less shipping day.

Average selling price per ton is expected to grow 1-3 percent compared to the second quarter. “If metals pricing remains steady, we anticipate some downward pressure on gross margins as we receive higher priced metal into our inventory in the third quarter,” said Lewis.

“Looking ahead, despite some continued uncertainty regarding trade actions, we are encouraged by the positive pricing momentum and continuing solid demand conditions,” said Mollins. “We remain confident in our ability to maximize our earnings power in the current environment and maintain our focus on increasing value to our stockholders.”