Market Data

July 22, 2018

SMU Market Trends: Trump Policies Popular

Written by Tim Triplett

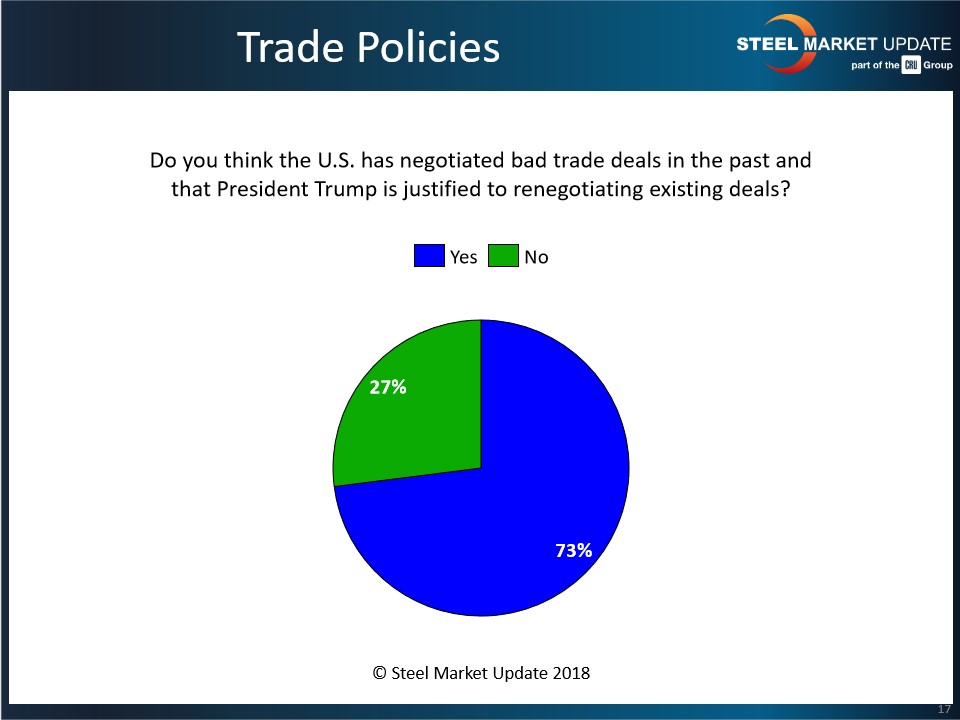

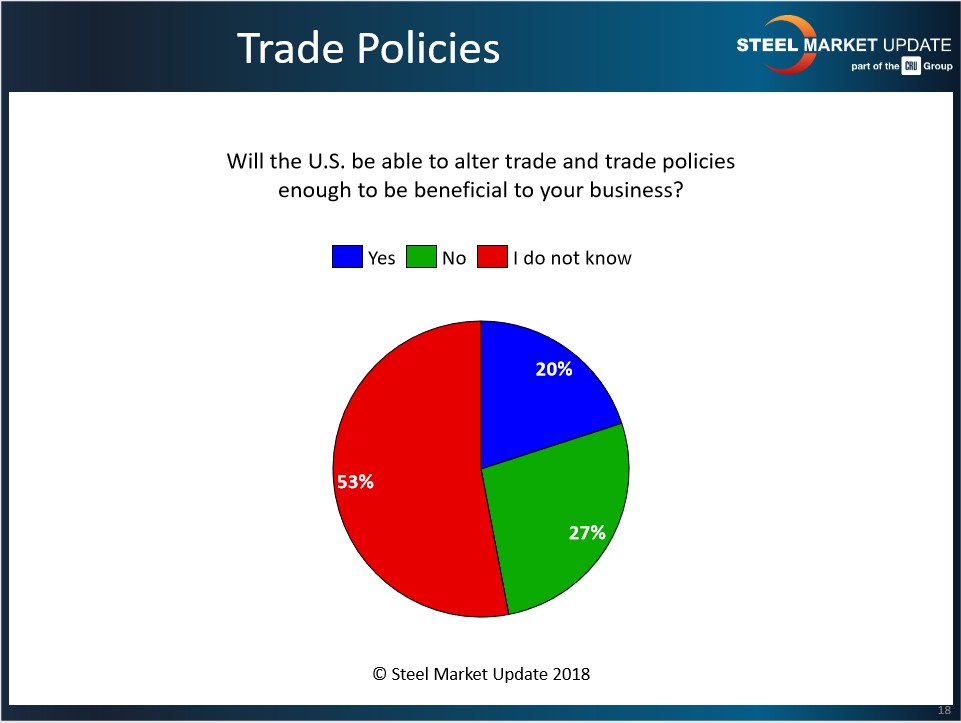

Have China and other nations taken advantage of the United States on the trade front? Nearly three of four respondents to last week’s Steel Market Update market trends questionnaire believe that is true and they support President Trump renegotiating the “bad trade deals” of the past. However, at the same time, only 20 percent of those responding to the flat rolled and plate steel market questionnaire felt the new trade deals would be beneficial to their company’s business. Like many things in the current steel market, confusion reigns supreme with the majority of respondents telling SMU they “did not know” if changes would help or hurt them.

Is the president’s policy justified? Here’s what some executives said:

• “Yes, as evidenced by a middle class built in Mexico within a decade. That was our middle class. Those were our jobs.”

• “How past administrations allowed the U.S. to be pinned down against egregious trade barriers to foreign markets is a mystery, but Trump is clearly justified to rectify this wrong.”

• “I think anything the administration can make better than it currently is should be fair game. It’s just good business.”

• “There’s no guarantee that current methods will work. However, past methods did not, so we have to try something different.”

• “It is a necessary evil and it is painful, but the U.S. will be stronger when we get to the other side of this.”

• “It would be wise to focus on China (80/20 rule) instead of trying to re-do every trade agreement on the globe at the same time.”

Other comments expressed skepticism:

• “I have to give credit to President Trump for doing something about trade, but I’m not sure if the Trump administration has the right game plan, personnel and vision to execute something this complicated.”

• “There are always components of trade deals that can be improved, but the bullying approach that has been adopted will not help the USA or its citizens.”

• “Trade makes the world go around. Some deals might not be best for one country but good for the other. The current administration is going down a very bad path and will end up hurting all in the end.”

While the vast majority of executives responding to SMU support a tougher trade stance, only 20 percent believe the administration will be successful.

Respondents were asked: Will the U.S. be able to alter trade enough to benefit your business?

• “It will prevent unfair dumping of steel through various means and create a level playing field for a fair competition.”

• “More so than any other president has attempted! For better or worse, only time will tell.”

• “Right now, our competitors out of China have an unfair advantage.”

• “Short term, absolutely. Long term, I have serious concerns about our industry.”

Others believe the tariffs will have the opposite effect on their businesses:

• “Restricted trade is bad for business. All of these tariffs and duties will add unnecessary costs and drive business down.”

• “So far, the trade actions have just solidified America as being one of the most expensive places in the world to manufacture goods that contain steel or aluminum, thus providing incentive for companies to offshore their production.”

• “There will be compromises, but the U.S. mills continue to raise prices, so imported steel remains attractive. Not too bright. By being greedy short term, they offset the aid the president is trying to get them long term.”

• “Current trade policy will only be altered when there are clear indications the general citizen is being impacted. It’s too early for that. We have to wait six more months, in my opinion.”