Prices

July 19, 2018

LME Zinc Pricing at One-Year Low--Will GI Extras be Impacted?

Written by John Packard

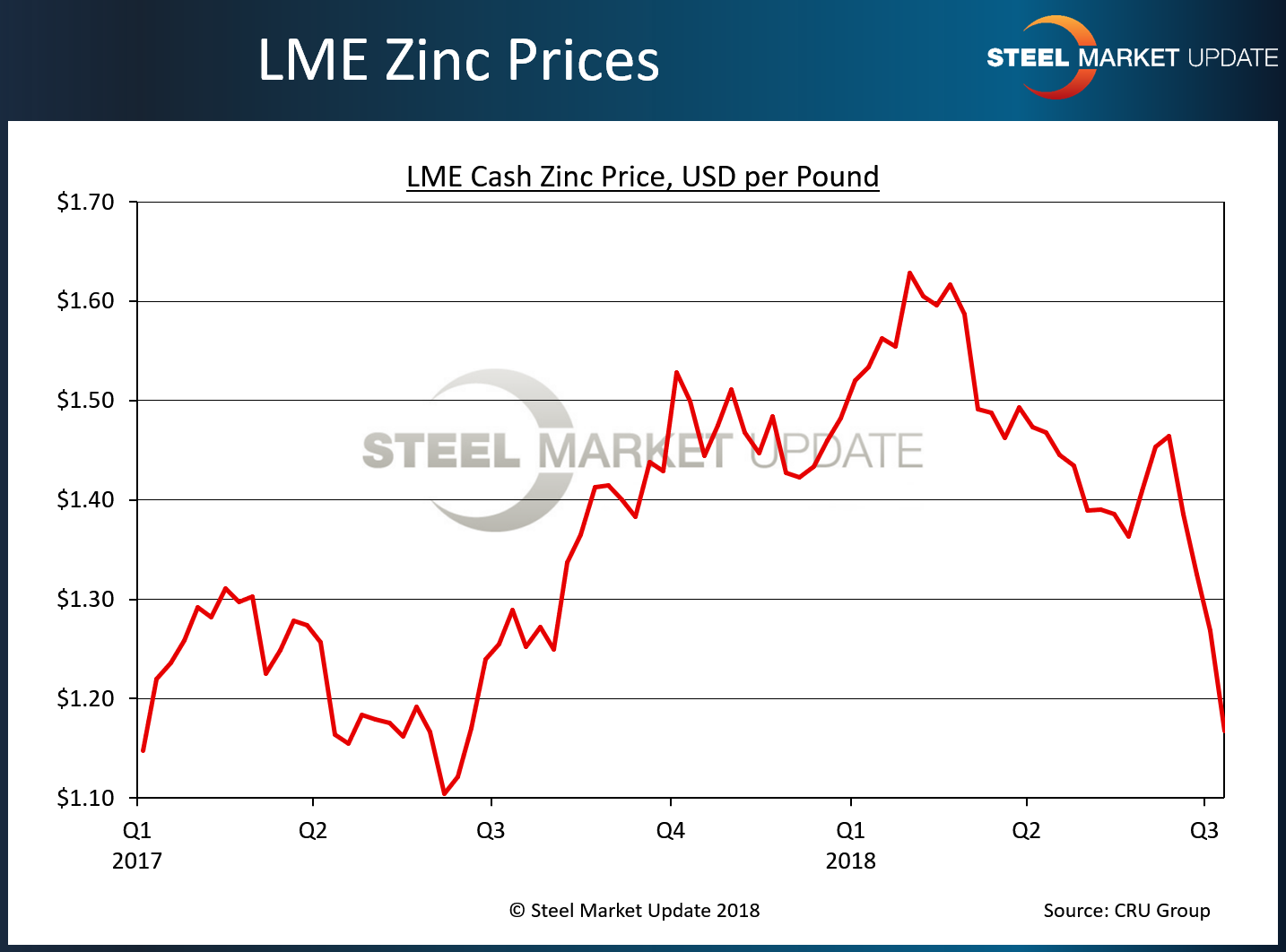

Zinc prices were trading at $1.18 per pound this afternoon. Earlier this week, the metal traded as low as $1.13 per pound, but has since rallied off those one-year lows. Even so, the $1.18 per pound level is lower than at any point over the past 12 months (see graphic below). Does SMU expect galvanized coating extras to be lowered by the domestic steel mills?

Buyers and sellers of galvanized steel are beginning the process of negotiations with the domestic steel suppliers. At $1.18 per pound, the price is well below the levels where the domestic steel mills last announced revisions to their coating extras on galvanized steel products.

NLMK USA and AK Steel updated their extras in late August/early September 2017 when zinc was trading at, or about, $1.45 per pound.

Wheeling-Nisshin extras were updated effective Dec. 4, 2017, when zinc was trading at, or about, $1.45 per pound.

Nucor and Steel Dynamics (SDI) updated their extras effective Jan. 1, 2018, when zinc was at, or about, $1.50 per pound.

U.S. Steel extras where adjusted effective March 1, 2018, when zinc was at $1.56 per pound.

AK Steel and Nucor each have published schedules for coating extras based on zinc costs (usually adjusted on a quarterly basis). We have this information, which we can share with our members should you wish to review it (send email request to info@SteelMarketUpdate.com).

When speaking with the head of commercial from a mill other than Nucor and AK Steel, we were told that lead times on coated products were essentially at the end of September and, if there is to be an adjustment, one of the big mills would move first and probably begin in the fourth quarter. He went on to say none of their customers were concerned about coating extras and were more concerned with their ability to get steel.

A second coating mill told us, “Our domestic demand is excellent. I do not rule out lowering effective pricing a little from now through October due to lower coating costs and/or certain formulas that might be in place, but demand is strong, and I sense that our Tier 1 accounts may have underbought or are pleasantly surprised with the strength of their markets.”

We asked Helen O’Cleary, who is the zinc expert for the CRU Group in London, how they are viewing the movement in zinc pricing and what they are looking for going forward. O’Cleary provided the following bullet points for us to review:

• Zinc’s price has fallen further than we were expecting, and we believe that it’s now diverged from market fundamentals.

• The falls started on the LME as investor sentiment soured on escalating trade tensions and Trump’s announcement of a possible additional $200 billion in tariffs on goods from China sparked heavy selling on the SHFE, which in turn dragged the LME price lower.

• The next price support level is at $2,430/t [$1.10 pound].

• We do not expect this to be breached in the short-term as a tightening physical market in China should reverse the decline on the SHFE to enable the import arb to open – this should also halt the slide in the LME price.

• So, we could see zinc’s price pick up in the short-term.

• That said, more trade shocks will again eclipse market fundamentals.

We encourage galvanized steel buyers to be aware of the price of zinc, which you can accesss by going to www.Kitco.com. We will be adding both zinc and aluminum LME trading prices using CRU data points to our website soon.

As lead times for galvanized slip into the fourth quarter, you may want to have conversations with your HDG providers to see if there are going to be any changes in coating extras in 4Q or 1Q 2019?

You may also want to discuss with your galvanized steel providers whether they are working on quarterly zinc averages or other ways of analyzing zinc costs in relation to their coating extras.

SMU will continue to watch developments in zinc costs and any changes to domestic steel mill coating extras and will report them as they occur.