Analysis

July 9, 2018

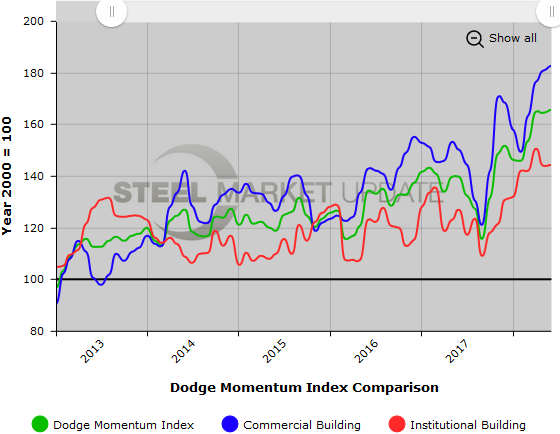

Dodge Momentum Index Edges Higher in June

Written by Sandy Williams

The Dodge Momentum Index, a measure of the nonresidential construction projects in planning, moved higher in June, gaining 0.8 percent to post a score of 165.5.

The commercial component of the index outpaced the institutional component, with gains of 1.1 percent and 0.3 percent, respectively.

“June’s advance marks the fifth straight monthly increase for the Momentum Index, which is now nearing a 10-year high, and suggests that the moderate strengthening of construction activity currently under way will continue through the end of 2018,” commented Dodge Data & Analytics. “At the same time, the gains for the Momentum Index during the most recent two months have been considerably smaller than what took place from last October through April, returning to a pace more consistent with the gradual expansion that’s been present since the recovery began back in 2011.”

Thirteen projects with a value of $100 million or more entered the planning phase in June.

The Momentum Index, published by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which has been shown to lead construction spending for nonresidential buildings by a full year.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.