Market Data

July 5, 2018

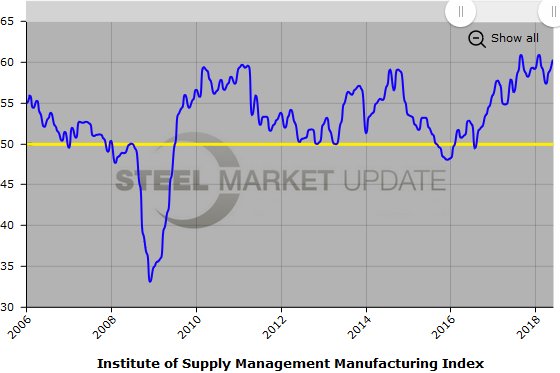

ISM Manufacturing Index Rises Despite Higher Prices and Shortages

Written by Sandy Williams

Manufacturers saw business rise in June at the fastest pace in four months. The ISM Manufacturing Index surpassed expectations by jumping to 60.1 percent from 58.7 percent in May. A reading above 50 indicates growth.

New orders expanded for the 14th consecutive month, but inventories remained too low for a fourth month as suppliers struggled to make timely deliveries. Backlogs of orders expanded for a third month along with lead times. Production expanded 0.8 percent, but shortage of qualified labor and supply chain disruptions continue to limit full production potential, said the Institute for Supply Management.

Raw material prices increased across all industry sectors. Higher prices and shortages were noted for aluminum, steel and steel-based products.

“Demand remains robust, but the nation’s employment resources and supply chains continue to struggle. Respondents are overwhelmingly concerned about how tariff-related activity is and will continue to affect their business,” said ISM Manufacturing Business Survey Committee Chairman Timothy Fiore.

Survey respondents had the following comments:

“The uncertainty of U.S. tariffs and the Canada/Mexico/EU retaliatory tariffs continues to cloud strategic planning efforts. Contingency planning (for tariffs) is consuming large amounts of manpower that could be used for more productive projects. The tariffs are improving margins in our raw material businesses; however, our businesses that are further up the supply chain are seeing significant inflation.” (Miscellaneous Manufacturing)

“The Section 232 steel tariffs are now impacting domestic steel prices and capacity. Base steel prices have already increased 20 percent since March.” (Fabricated Metal Products)

“Strong economic growth continues to put pressure/strain on capacity, lead time, availability and pricing across a broadening array of commodities and components.” (Computer & Electronic Products)

“U.S. tariff policy and lack of predictability, along with the threat of trade wars, is causing general business instability and is a drag on growth for investments.” (Electrical Equipment, Appliances & Components)

“Electronic component supply issues continue to disrupt production.” (Transportation Equipment)

“Business is strong in all regions. Materials are tight. Trucking continues to be a major challenge.” (Chemical Products)

“We export to more than 100 countries. We are preparing to shift some customer responsibilities among manufacturing plants and business units due to trade issues (for example, we’ll shift production for the China market from the U.S. to our Canadian plant to avoid higher tariffs). Within our company, there is a sense of uncertainty due to potential trade wars.” (Food, Beverage & Tobacco Products)

“Transportation costs are going through the roof right now, which definitely impacts the decisions we’re making with regard to quantities we’re bringing in versus truckload and LTL.” (Furniture & Related Products)

“The economy and product demand still continue to be strong. Having trouble finding people [to fill] blue collar positions. Lead times for parts and materials are moving out, and we are seeing commodity cost pressures increase with the threat of tariffs. Additionally, suppliers are asking for more price increases.” (Machinery)

“The steel tariffs continue to drive uncertainty. Projects and services using steel have limited days that prices are good for. Trucking is tight, requiring advanced planning and increasing costs.” (Paper Products)

Below is a graph showing the history of the ISM Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.