Canada

June 24, 2018

SMU Market Trends: Tariffs on Canada, Mexico to Tighten Supplies?

Written by Tim Triplett

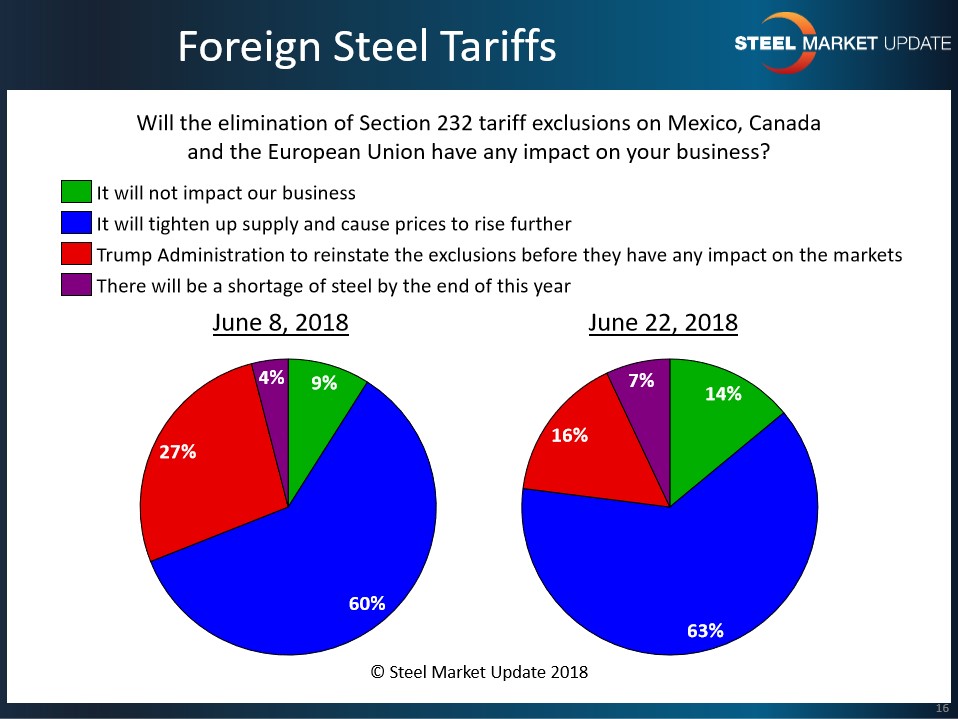

Sixty-three percent of respondents to this week’s Steel Market Update market trends questionnaire expect steel supplies to tighten and prices to rise even further now that the Trump administration has revoked the exclusions and imposed Section 232 tariffs on steel imported from Canada, Mexico and the EU nations. The 25 percent tariffs took effect June 1.

The tariffs on the United States’ closest trading partners surprised and outraged many in the market, but the administration maintains they are necessary to prevent China and other predatory traders from transshipping steel through other nations as a means of circumventing U.S. duties. “Costs will keep going up as supply gets tighter,” said one respondent. “Canadian prices will drop and U.S. prices will rise,” predicted another.

Many observers believe the tariffs are a negotiating ploy by President Trump to leverage concessions from Canada and Mexico in the NAFTA negotiations, and therefore will be only temporary. About 16 percent of respondents expect President Trump to reinstate the exclusions before they have a chance to impact the market. “I believe it will tighten up supply, but I’m hopeful that at least the U.S, Mexico and Canada can come to an agreement before shortages arise,” said one executive.

Not all are that hopeful. About 7 percent tell SMU they expect the tariffs to create a shortage of supply by the end of the year, up from just 4 percent two weeks ago. “It could lead to a shortage,” observed another respondent. “Prices in Canada and Mexico were competitive with the U.S. Add in a 25 percent tariff, and without a rationalization of price in both countries they will be cut out of the equation, which in turn will become problematic and lead to a shortage.” Added another: “One of our main suppliers is a Canadian mill. This has been very painful for both parties.”

Expressing perhaps the most common view, another reader wrote: “Really, we have no idea what’s in store. There are too many variables.”