Market Data

June 21, 2018

SMU Market Trends: Future Sentiment Wavers

Written by John Packard

The data from Steel Market Update’s latest market trends questionnaire shows some erosion in Future Sentiment. The SMU Steel Buyers Sentiment Index measures how buyers and sellers of flat rolled and plate steels feel about their companies’ ability to be successful both now and three to six months into the future. Buyers and sellers of flat rolled steel generally remain optimistic about their chances for success, but looking ahead, fewer are as confident in light of the uncertainty on the trade front.

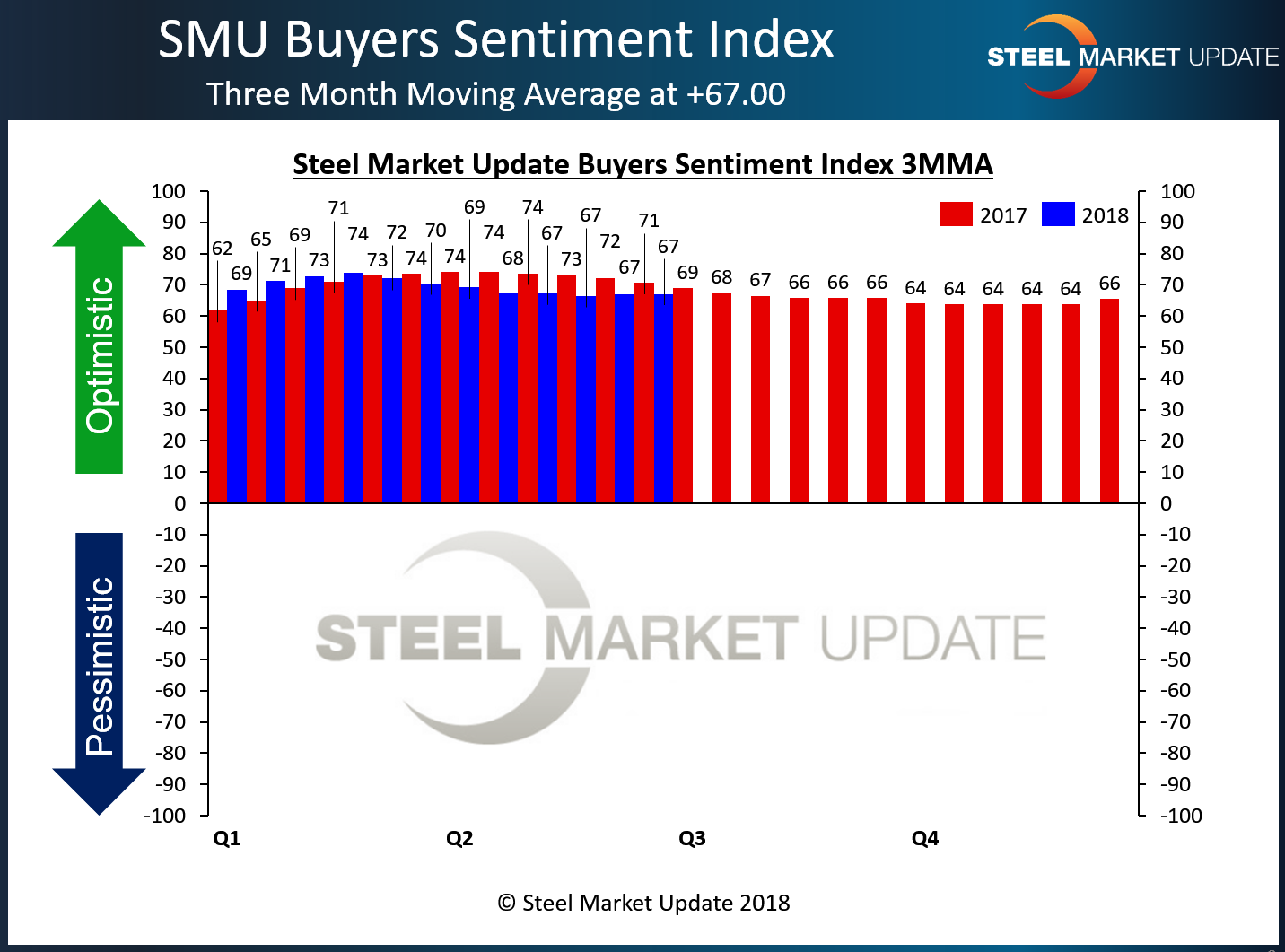

SMU’s Steel Buyers Sentiment Index registered +66 out of a possible +100, up 4 points from early June. Calculated as a three-month moving average (3MMA) to smooth out the data, the index remains at +67.00, just slightly above the low reading of the year, which was 66.50.

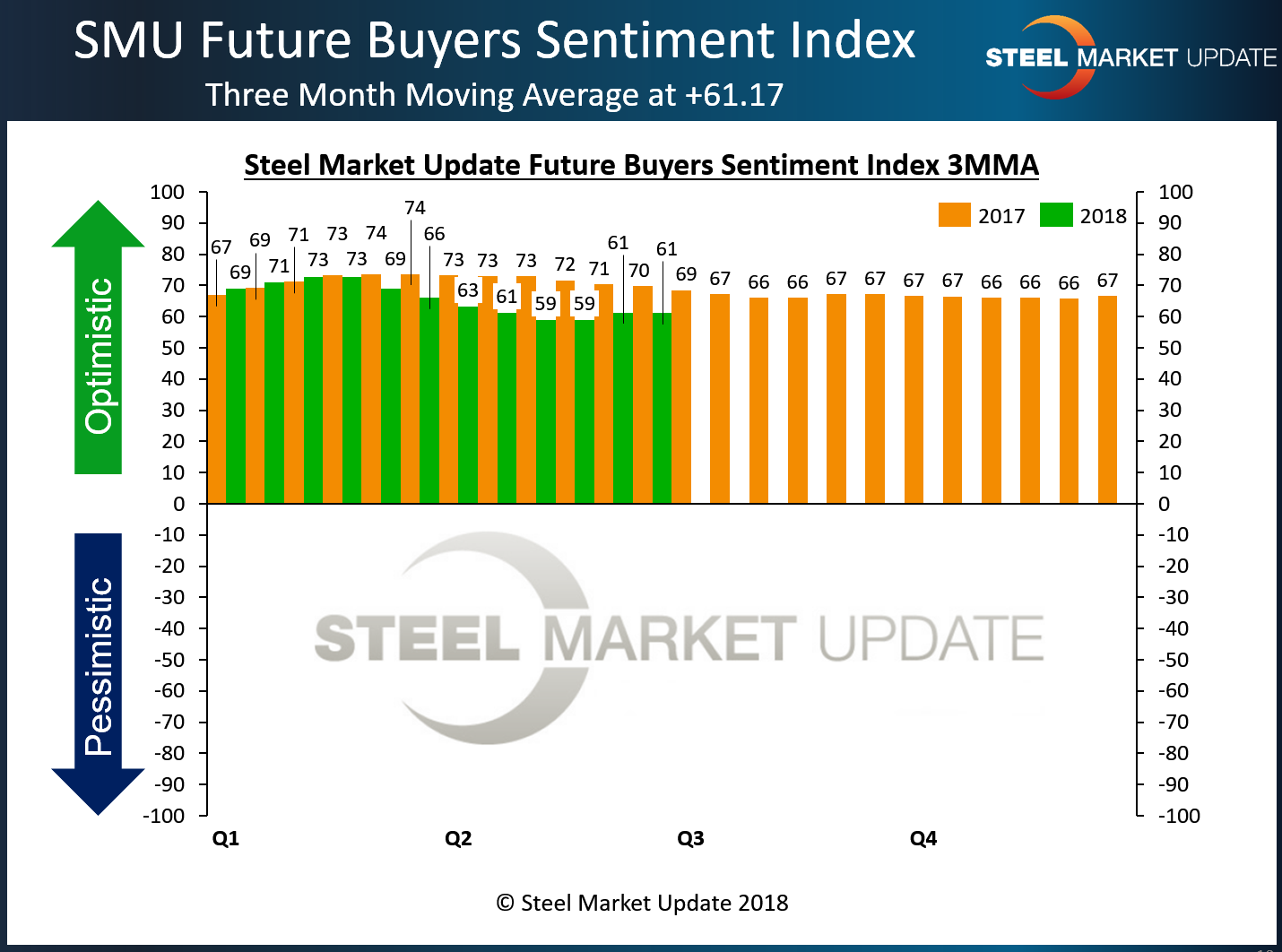

Future Steel Buyers Sentiment Index

Future Sentiment—companies’ view of their ability to be successful three to six months in the future—declined by 6 points to +56, the lowest level since early March. The 3MMA for Future Sentiment inched down to 61.17 from 61.33 in early June.

Both Current and Future Sentiment reached record highs for a single data point in mid-January with Current Sentiment at +78 and Future Sentiment at +77. Industry executives are clearly less optimistic than they were at the beginning of the year, which may affect decisions they make regarding purchasing, capital investment, etc. Most respondents’ comments reflect anxiety about the effects of the president’s steel tariffs on the market.

What Respondents are Saying

- “There’s still way too much uncertainty with tariffs and future trade cases, and now that we are starting trade wars with China and could include others like Canada and the EU.” Trading Company

- “Our business is opportunistic in nature (spot buys/middleman) and with the lack of availability, higher prices and uncertainty in the marketplace we are effectively dead in the water.” Trading Company

- “I’m seeing some slowing down as the market is unsure where pricing is going.” Service Center/Wholesaler

- “Our customers are buying our products offshore.” Manufacturer/OEM

- “We’re at a major disadvantage vs. imported finished goods.” Manufacturer/OEM

- “We’re concerned about supply, but demand is strong.” Manufacturer/OEM

- “I am concerned about the long-term impact of the tariffs.” Service Center/Wholesaler

- “I think the trade situation will get worse and start to drag down our economy due to much higher costs.” Trading Company

- “Three to six months seems like an eternity. Right now, I’m trying figure out how we’re going to do today and tomorrow.” Trading Company

- “We have contracts with mills and processors, so we are relying on our suppliers to be able to get steel in order for us to be successful.” Manufacturer/OEM

- “Prospects are fair if we ‘protect’ the rest of the U.S. manufacturers.” Manufacturer/OEM

- “We can only guess what rules will be in place six months from now. There will be more uncertainty through the second half than I can ever remember in 40 years.” Service Center/Wholesaler

- “Tariffs are bad for business, but a quota system would have catastrophic consequences.” Manufacturer/OEM

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 38 percent were manufacturers and 47 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.