Prices

June 12, 2018

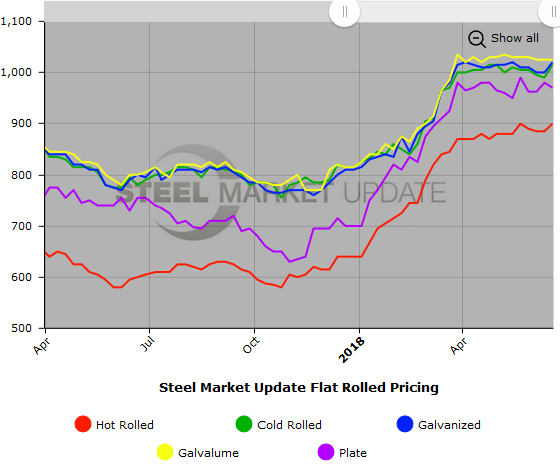

SMU Price Ranges & Indices: HRC, CR & GI Prices Tighten Up

Written by John Packard

Steel Market Update canvassed flat rolled and plate steel buyers over the past two days and discovered hot rolled coil is by far the strongest product, followed by demand for plate. Both are connected to the energy markets, which are very strong right now. Our sources are also telling us construction, especially commercial construction, is booming in just about every region of the country. The net result being flat rolled prices are holding their own and beginning to rise again.

A service center told us yesterday, “While the focus is on supply, demand looks solid even for the summer.”

Another large service center voiced their opinion when they told SMU, “With respect to direction of pricing, I remain concerned that we’ll face very tight supply conditions for HR and plate in the fall, with pricing perhaps less of an issue than availability. So, having said that, I think we’ll go higher from here, but it may be more incremental between $900-$1,000, and may track with the delivered import price including 25 percent tariff, with an $80/ton spread.”

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $870-$930 per ton ($43.50/cwt-$46.50/cwt) with an average of $900 per ton ($45.00/cwt) FOB mill, east of the Rockies. The lower end of our range rose $30 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $15 per ton compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Hot Rolled Lead Times: 4-8 weeks

Cold Rolled Coil: SMU price range is $990-$1,040 per ton ($49.50/cwt-$52.00/cwt) with an average of $1,015 per ton ($50.75/cwt) FOB mill, east of the Rockies. The lower end of our range jumped $40 per ton compared to last week, while the upper end rose $10 per ton. Our overall average is up $25 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Cold Rolled Lead Times: 5-9 weeks

Galvanized Coil: SMU base price range is $49.50/cwt-$52.50/cwt ($990-$1,050 per ton) with an average of $51.00/cwt ($1,020 per ton) FOB mill, east of the Rockies. The lower end of our range rose $30 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $20 per ton compared to last week. Our price momentum on galvanized steel is now pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,076-$1,136 per net ton with an average of $1,106 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-12 weeks

Galvalume Coil: SMU base price range is $50.00/cwt-$52.50/cwt ($1,000-$1,050 per ton) with an average of $51.25/cwt ($1,025 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is now pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,291-$1,341 per net ton with an average of $1,316 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

Plate: SMU price range is $920-$1,020 per ton ($46.00/cwt-$51.00/cwt) with an average of $970 per ton ($48.50/cwt) FOB delivered. The lower end of our range declined $10 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $10 per ton compared to last week. Our price momentum on plate steel is pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Plate Lead Times: 5-9 weeks, allocation/controlled order entry

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.