Market Data

June 7, 2018

SMU Steel Buyers Sentiment Index: Slightly Lower

Written by John Packard

The SMU Steel Buyers Sentiment Index, which measures how buyers and sellers of flat rolled and plate steels feel about their companies’ ability to be successful both now and three to six months into the future, was slightly lower this week. Demand has stayed strong, and buyers and sellers of flat rolled steel generally remain optimistic about their chances for success in current and near-term market conditions. But the numbers have ticked downward in the past two weeks.

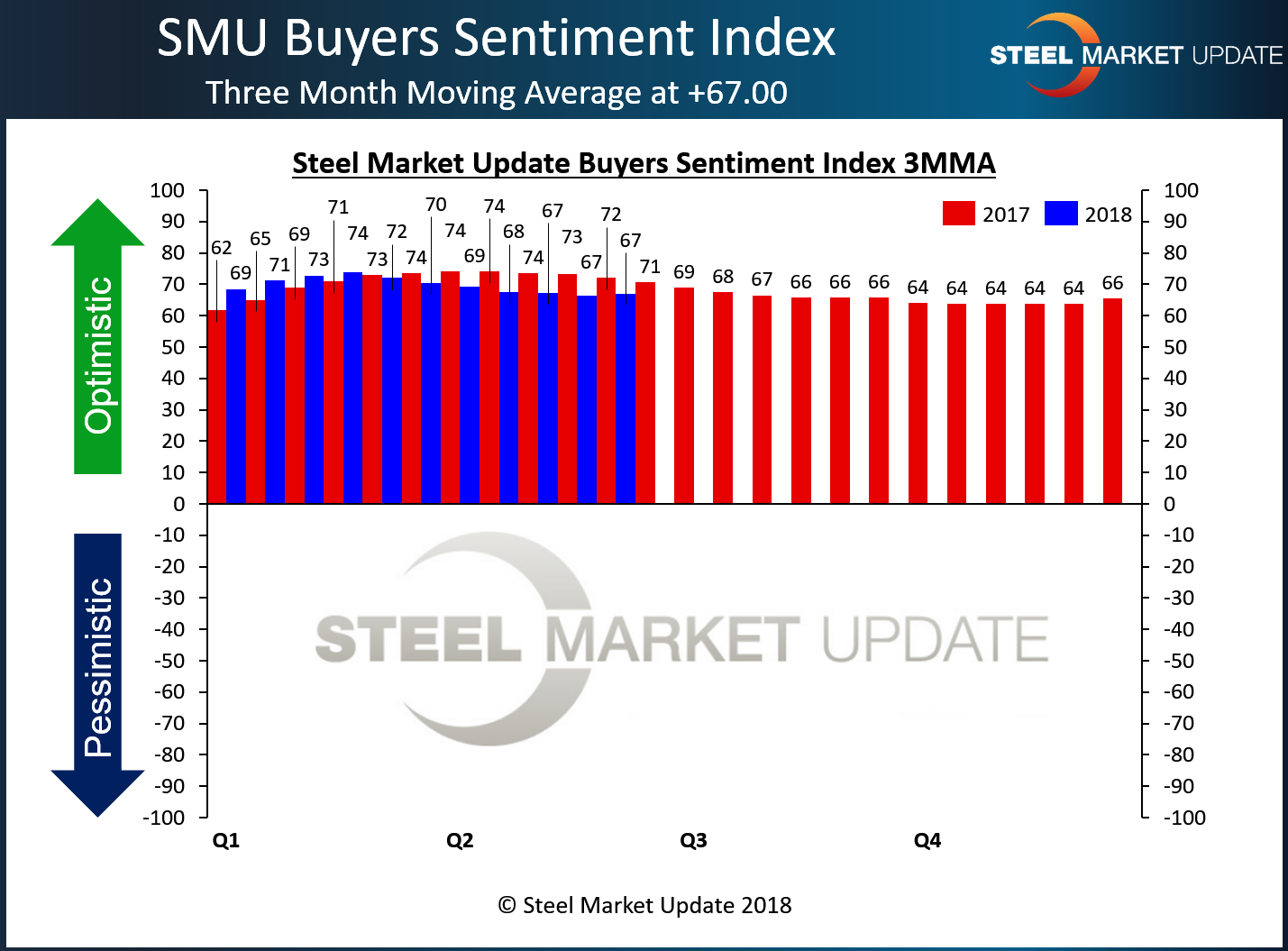

SMU’s Steel Buyers Sentiment Index registered +62 out of a possible +100, down 5 points from mid-May. Calculated as a three-month moving average (3MMA) to smooth out the data, the index is at +67.00, just slightly above the low reading of the year, which was 66.50.

Future Steel Buyers Sentiment Index

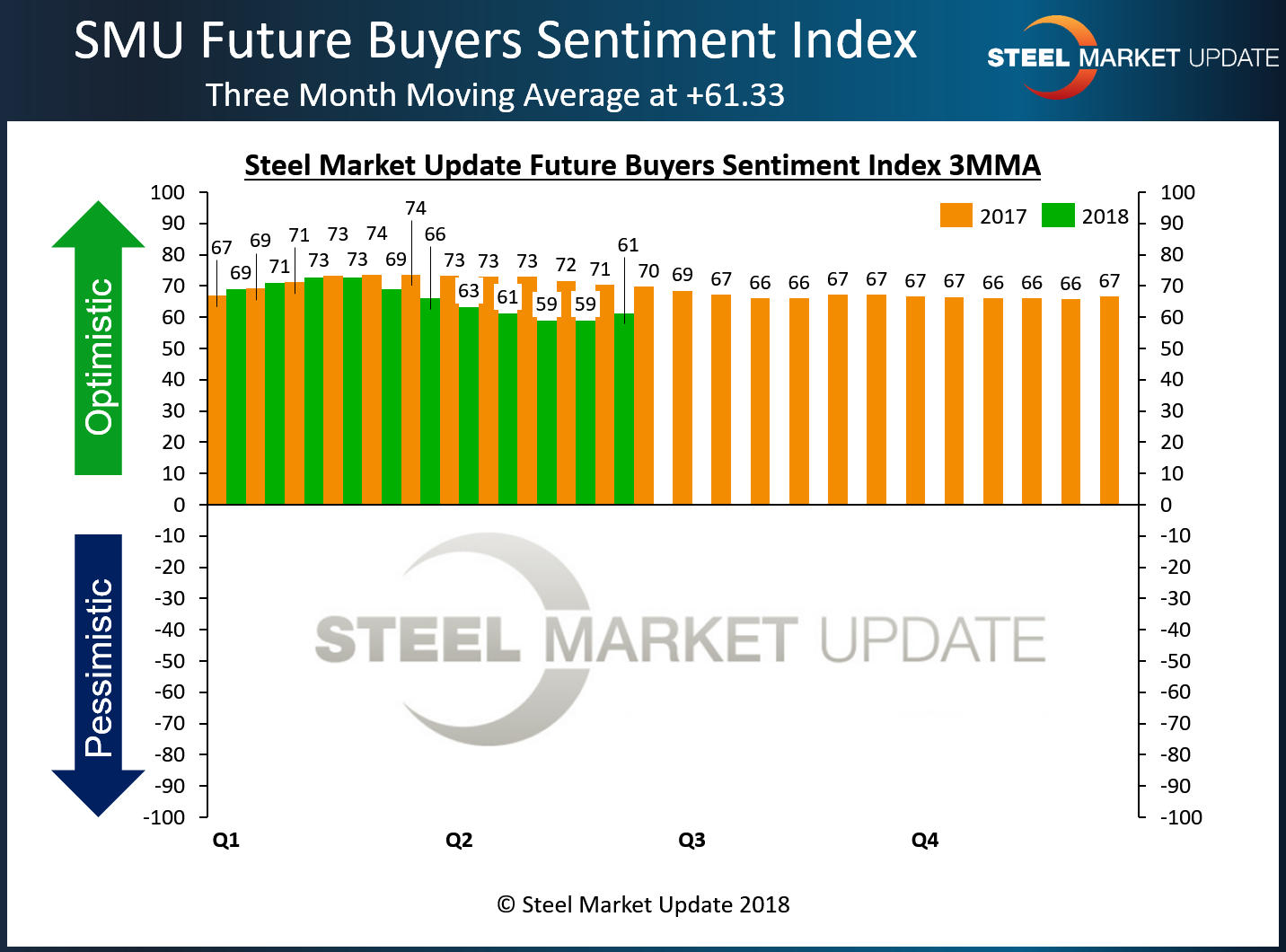

Future Sentiment—companies’ view of their ability to be successful three to six months in the future—declined by 3 points to +62. The 3MMA for Future Sentiment inched up to 61.33 from 59.00 in mid-May.

To put these figures in perspective, both Current and Future Sentiment reached record highs for a single data point in mid-January with Current Sentiment at +78 and Future Sentiment at +77. Therefore, the data indicate that industry executives are somewhat less optimistic than they were at the beginning of the year, which may affect decisions they make regarding purchasing, capital investment, etc. Most respondents’ comments reflect concerns about the effects of the president’s steel tariffs on the market.

What Respondents are Saying

- “We’re very conflicted about the potential future impact of Section 232 and retaliatory tariffs from NAFTA partners.” Trading Company

- “Section 232, our ability to pass along the tariffs [is a concern].” Service Center/Wholesaler

- “There’s still so much uncertainty on trade and costs. I would only venture to say [our prospects are] fair at this point.” Trading Company

- “One of my main sources of supply has a huge question mark due to the tariffs. This could greatly impact our ability to compete.” Service Center/Wholesaler

- “Customers are moving to China to purchase our products.” Manufacturer/OEM

- “With more trade barriers expected, I think [our prospects] could be poor.” Trading Company

- “It depends on if the trade war actually starts and impacts the economy.” Steel Mill

- “The absolute arbitrary nature of Section 232 is making our life very difficult.” Trading Company

- “Not sure what tariffs and their repercussions will do to the economy in general if a variety of products see price rises.” Service Center/Wholesaler

- “Credit is being stretched with customers.” Service Center/Wholesaler

Respondents’ comments were not all negative. “We are still quoting strong,” said one manufacturer. “We have a full suite of products, good delivery and quality, and the market is favorable,” added a mill executive.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 38 percent were manufacturers and 46 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.