Market Data

May 30, 2018

No Clouds on the Horizon for U.S. Manufacturing

Written by Peter Wright

Manufacturing activity in the U.S. remains robust and economic indicators continue to point to a strong 2018, according to Steel Market Update’s latest analysis.

This report summarizes seven data sources that describe the state of manufacturing in the United States. We have reported on most of these separately in our Steel Market Update publications, and therefore will be brief in this summary. We don’t expect these data sources to all point in the same direction. Our intent in summarizing them in one document is to provide a consensus of the state of this critical steel consuming sector. Based on American Iron and Steel Institute estimates of steel mill shipments by market classification, almost 50 percent of the steel consumed in the U.S. is manufacturing-oriented. This breaks down to about 27 percent in ground transportation including infrastructure, 9 percent in machinery and equipment, 5 percent in appliances, 4 percent in defense and about 4 percent in containers.

The Industrial Production Index: Figure 1 shows the IP index since January 2007 with the year-over-year growth. The three-month moving average (3MMA) of the year-over-year growth of industrial production is shown by the brown bars in Figure 1. January 2017 was the first month of positive growth in the 3MMA since August 2015. Growth has steadily improved since September 2017. Manufacturing capacity utilization improved from 74.48 percent in January last year to 75.64 percent in April 2018, also on a 3MMA basis.

New Orders for Durable Goods: The U.S. Census Bureau announced last Thursday that new orders for manufactured durable goods in April increased by 1.1 percent on a 3MMA basis month over month and were up by 8.1 percent year over year. Figure 2 shows the 3MMA of monthly orders for durable goods since January 2010 and that the percent change year over year was the highest since September 2014.

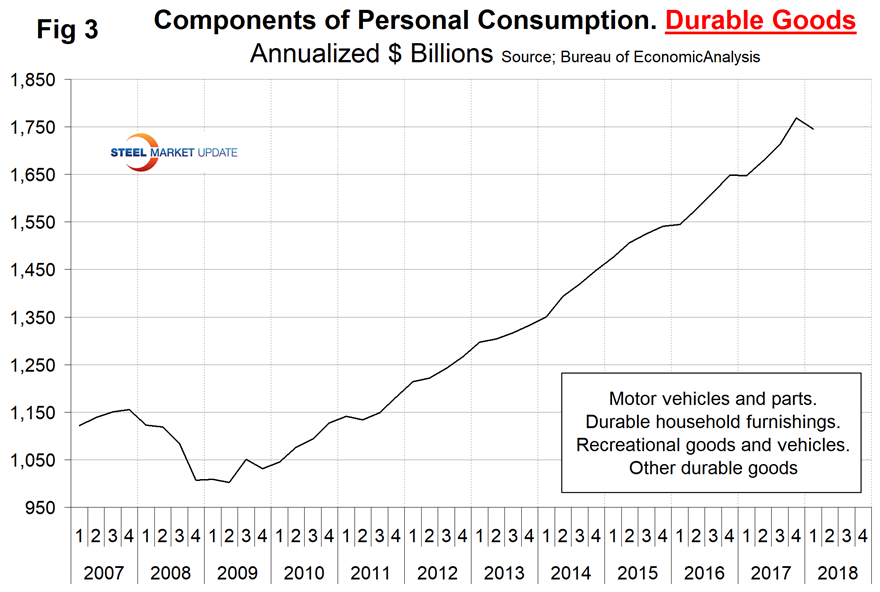

The Durable Goods Portion of GDP: The first estimate of Q1 2018 GDP came in at 2.30 percent annualized growth, which was down from 2.86 percent in Q4 2017. A subcomponent of the quarterly data is durable goods, which is part of the personal consumption calculation. It therefore contains no military hardware or civil aircraft data. This is shown in Figure 3 and, presumably because of the exclusions just mentioned, looks nothing like Figure 2. The durable goods portion of GDP declined in Q1 2018, but the long-term trend is still very positive.

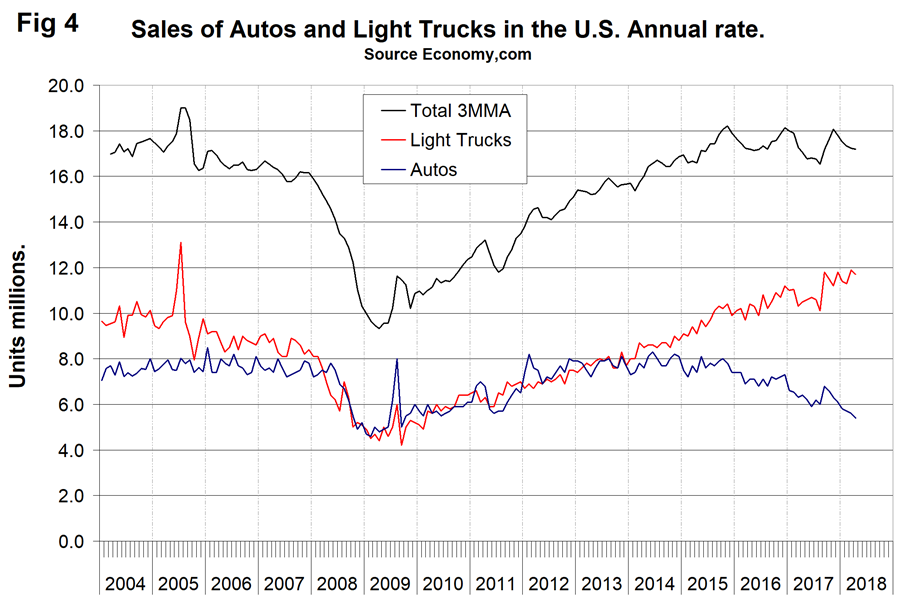

Light Vehicle Production in NAFTA: Our past reports have included auto assembly data for the U.S., Canada and Mexico, but that source has dried up, so until we find a replacement we are reporting on U.S. auto sales. Another complication is that effective in April 2018 GM no longer reported their sales results. Automobile sales have trended down slightly in the last 2½ years but in April rose by 1.2 percent year over year. Sales are still strong on a historical basis (Figure 4). Consumers’ preference for light trucks, which includes SUVs and crossovers, is still increasing.

Manufacturing Employment: Manufacturing employment plummeted during the recession and gradually improved from the spring of 2010 through 2014. Growth was flat in 2015 and declined slightly in 2016 when 23,000 jobs were lost during the year. There was a turnaround in 2017, and in the nine months from August 2017 through April 2018, 231,000 jobs were created in manufacturing (Figure 5). The motor vehicles and parts subcomponent of manufacturing employment had a net gain of 31,000 in the same time frame.

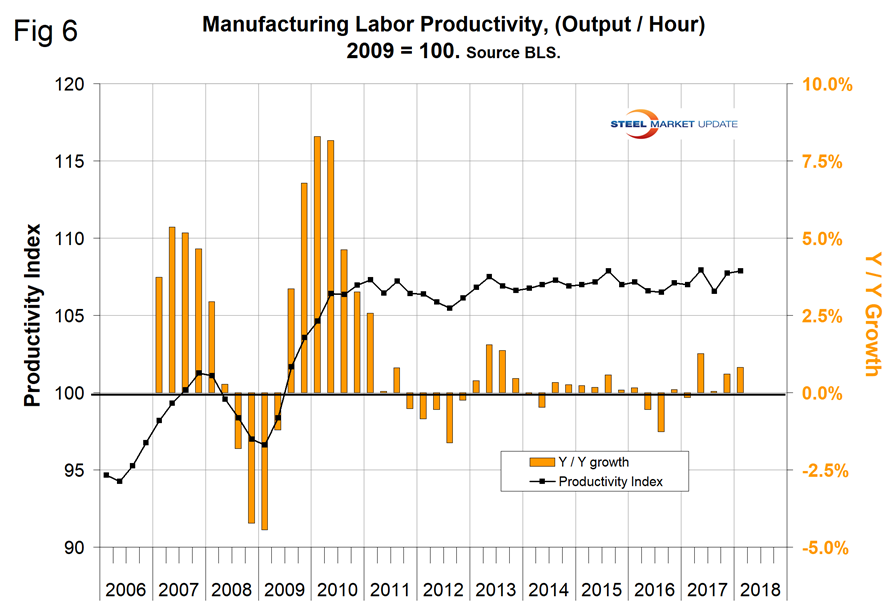

Manufacturing Productivity: The Bureau of Labor Statistics reported that in Q1 2018 manufacturing productivity improved by 0.8 percent year over year (Figure 6). Productivity growth was erratic in 2017, but there has been a gradual improvement for three years.

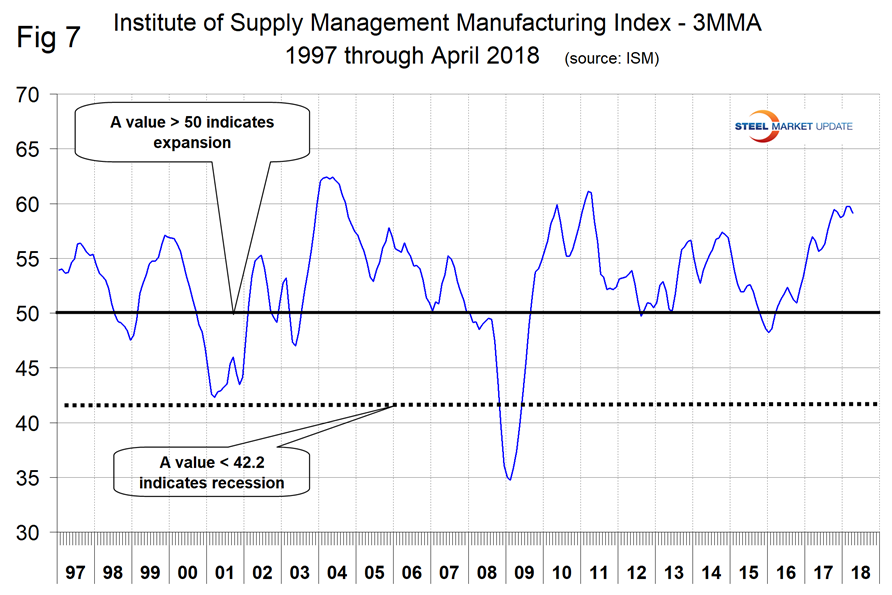

The ISM Manufacturing Index: The Institute for Supply Management’s Manufacturing Index is a diffusion index. ISM states: “Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change and the scope of change. An index value above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates the opposite.” Figure 7 shows the 3MMA of the ISM index from January 1997 through April 2018 with an improving trend since January 2016. In April, the 3MMA of the index at 59.13 was down by 0.6 from March but still historically high.

On March 22, the Manufacturers Alliance for Productivity and Innovation summarized as follows: “U.S. manufacturing demand and profitability are accelerating. Catalyzed by meaningful improvement in the outlook for capital spending, and for export growth, the MAPI Foundation currently projects that U.S. manufacturing growth will average 2.8 percent between 2018 and 2021, nearly double the 1.5 percent average growth rate that we projected in our November 2017 report.”

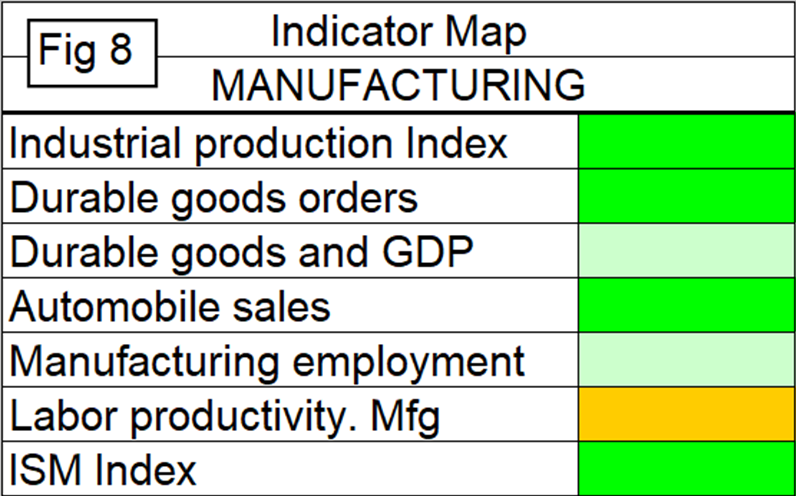

SMU Comment: This month, we have introduced an indicator map for manufacturing that is shown as Figure 8. There are no clouds on the horizon. The weakest indicator of the seven is the increase in labor productivity, which we find surprising considering all we read about artificial intelligence and automation.