Prices

May 29, 2018

SMU Price Ranges & Indices: Prices Barely Move as U.S. Celebrates Holiday

Written by John Packard

There was little movement in flat rolled steel prices over the past seven days most likely due to the Memorial Day holiday weekend. Steel buyers returned to their offices after the long holiday weekend and advised Steel Market Update of what they are seeing out of the domestic steel mills. Last week, we saw a push, especially by hot rolled mills, to move prices higher. Since then, the pressure appears to have subsided. Even so, steel buyers are well aware of the expiration date for country tariff exclusions, especially those of Canada and Mexico, our closest neighbors and trading partners.

SMU continues to reference flat rolled price momentum as being Neutral, while plate price momentum continues to be for Higher prices over the next 30 days. We will have more on this as the week progresses.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $860-$920 per ton ($43.00/cwt-$46.00/cwt) with an average of $890 per ton ($44.50/cwt) FOB mill, east of the Rockies. The lower end of our range fell $20 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $10 per ton compared to last week. Our price momentum on hot rolled steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Hot Rolled Lead Times: 4-8 weeks

Cold Rolled Coil: SMU price range is $980-$1,030 per ton ($49.00/cwt-$51.50/cwt) with an average of $1,005 per ton ($50.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on cold rolled steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU base price range is $48.50/cwt-$52.50/cwt ($970-$1,050 per ton) with an average of $50.50/cwt ($1,010 per ton) FOB mill, east of the Rockies. The lower end of our range fell $10 per ton compared to one week ago, while the upper end rose $10 per ton. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,056-$1,136 per net ton with an average of $1,096 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-12 weeks

Galvalume Coil: SMU base price range is $50.50/cwt-$52.50/cwt ($1,010-$1,050 per ton) with an average of $51.50/cwt ($1,030 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,301-$1,341 per net ton with an average of $1,321 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-10 weeks

Plate: SMU price range is $925-$1,000 per ton ($46.25/cwt-$50.00/cwt) with an average of $962.50 per ton ($48.125/cwt) FOB delivered. The lower end of our range fell $35 per ton compared to one week ago, while the upper end declined $20 per ton. Our overall average is down $27.50 compared to last week. Our price momentum on plate steel is pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Plate Lead Times: 5-8 weeks, allocation/controlled order entry

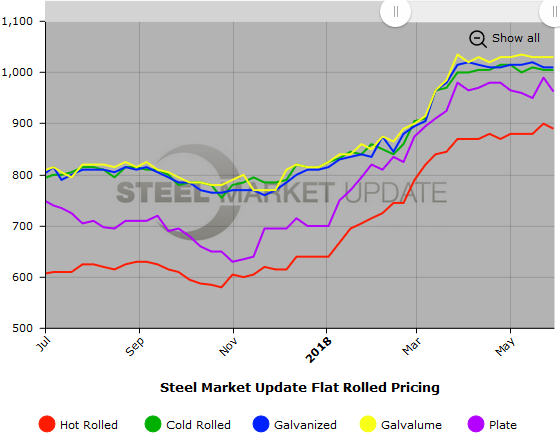

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.