Product

May 17, 2018

SMU Steel Buyers Sentiment Index: Concerns Still Exist

Written by John Packard

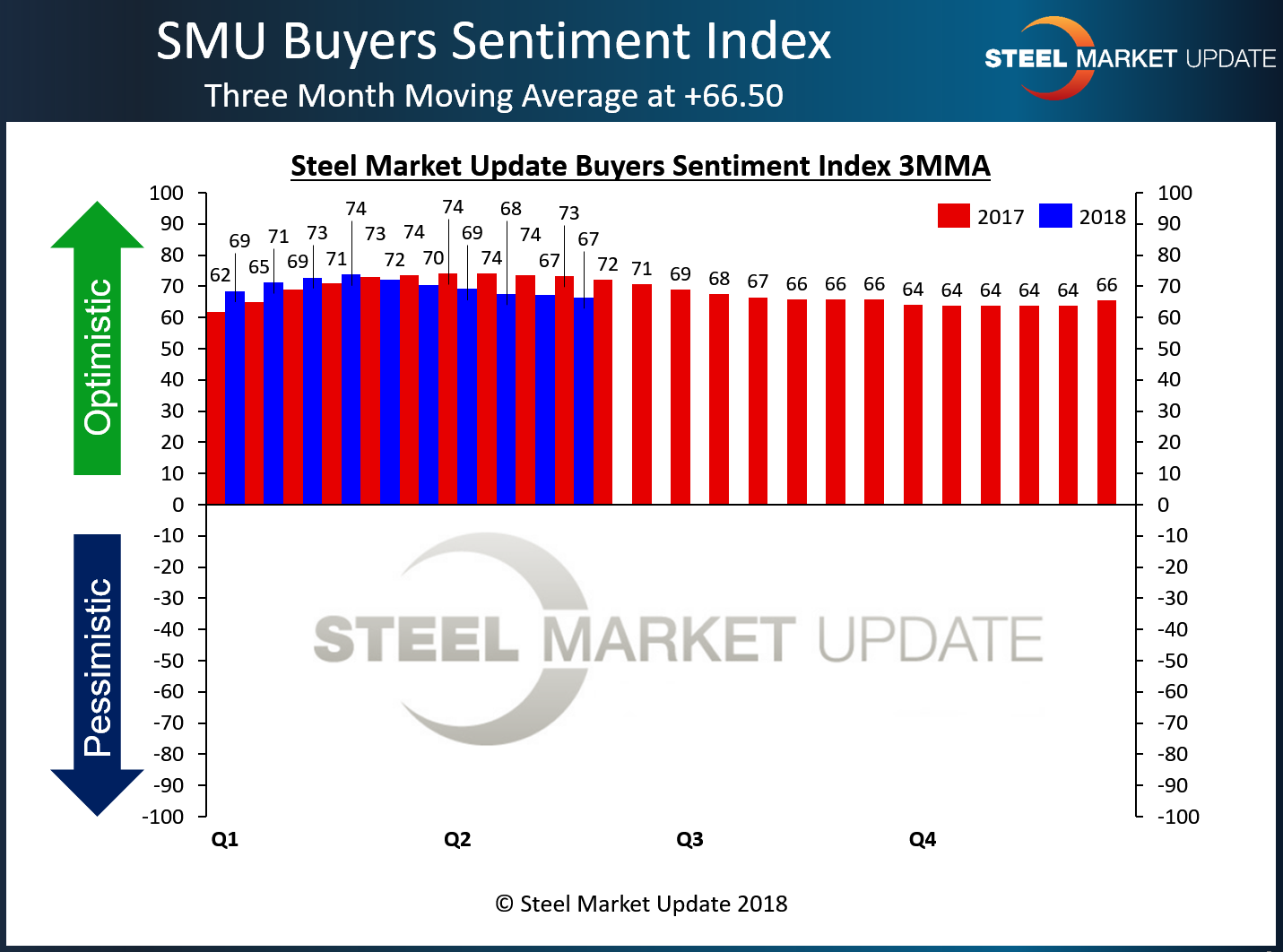

Despite all the uncertainty on the trade front, demand has stayed strong, and buyers and sellers of flat rolled steel remain optimistic about their chances for success in current and near-term market conditions. The SMU Steel Buyers Sentiment Index, which measures how buyers and sellers of flat rolled and plate steels feel about their companies’ ability to be successful both now and three to six months into the future, was modestly higher this week. However, when looking at the data from a three-month moving average (3MMA), there continue to be concerns about the direction of Sentiment as both Current and Future Sentiment Indexes have been trending lower over the past couple of months.

SMU’s Steel Buyers Sentiment Index registered +67 this week out of a possible +100, down 6 points from early May. Calculated as a three-month moving average (3MMA) to smooth out the data, the index is at +67.17, the lowest reading of the year, though still at an optimistic level.

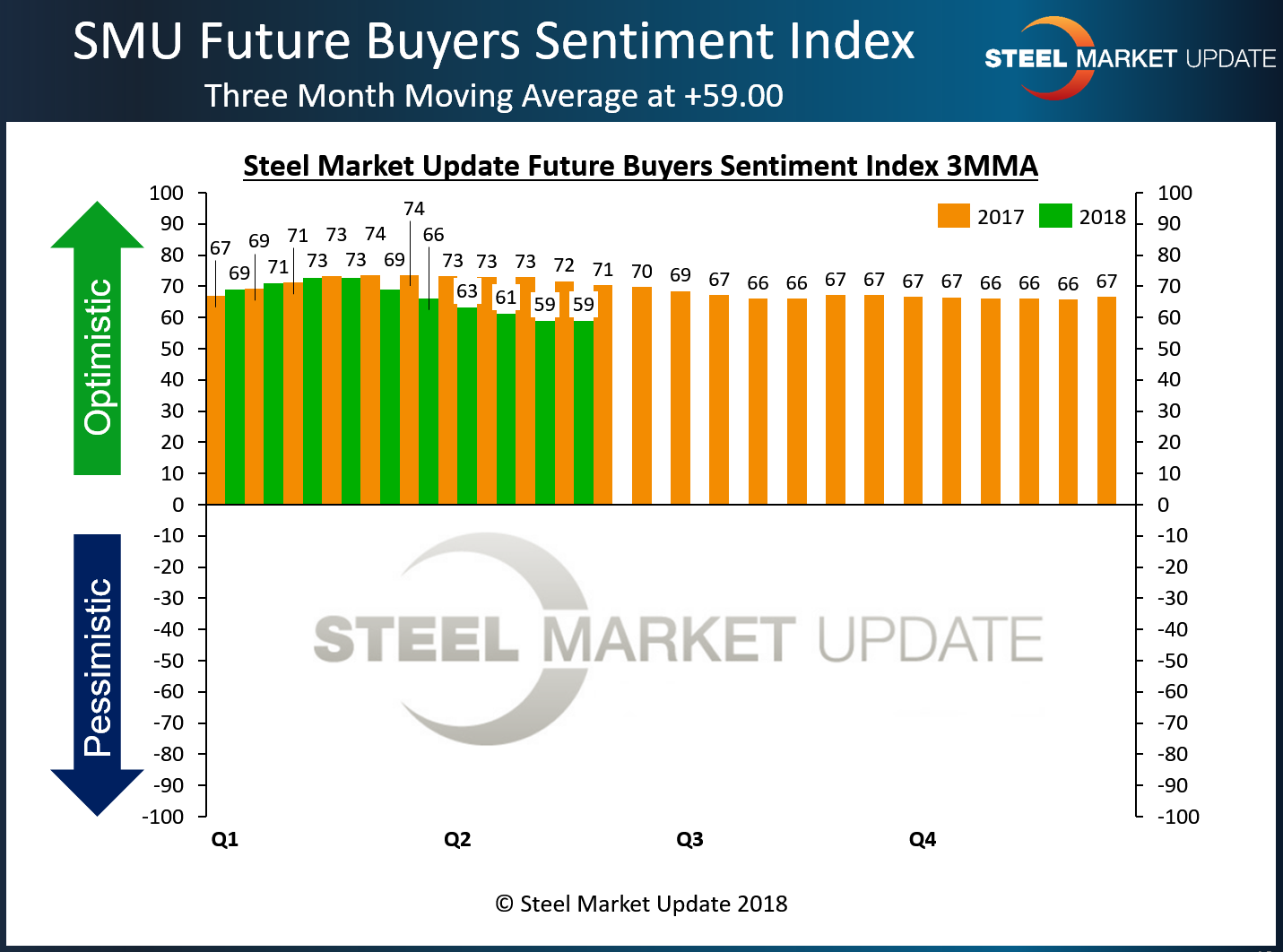

Future Steel Buyers Sentiment Index

Future Sentiment – companies’ view of their ability to be successful three to six months in the future – rose 3 points to +65. The 3MMA for Future Sentiment inched up to +59 from +58.83.

To put these figures in perspective, both Current and Future Sentiment reached record highs for a single data point in mid-January with Current Sentiment at +78 and Future Sentiment at +77 out of a possible +100. This week, the 3MMA for Future Sentiment registered its first increase since February when the index hit its peak for 2018 at 72.83.

Generally speaking, the data indicate that industry executives are slightly less optimistic than they were at the beginning of the year, which may affect decisions they make regarding purchasing, capital investment, etc.

What Respondents are Saying

• “There’s still too many unknowns relating to trade.”

• “We’re still struggling to pass on current mill pricing to final customers.”

• “Customers are moving finished products offshore, something we predicted would happen when they placed tariffs on raw material only and did not consider the manufactured products that use steel.”

• “I deal in foreign steel. There’s too much uncertainty due to trade restrictions. Pricing has gotten so high, futures are not at comfortable levels and the risk is getting higher. Customers are passing on order placement until they find more clarity. Domestic supply will improve on availability, especially on the West Coast, so customers see less risk later in the year to stay with local sourcing.”

• “With the time it takes to review, analyze and negotiate [tariff exclusions], we are probably talking next year before we see what actual pricing will be.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 36 percent were manufacturers and 50 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.