Analysis

May 7, 2018

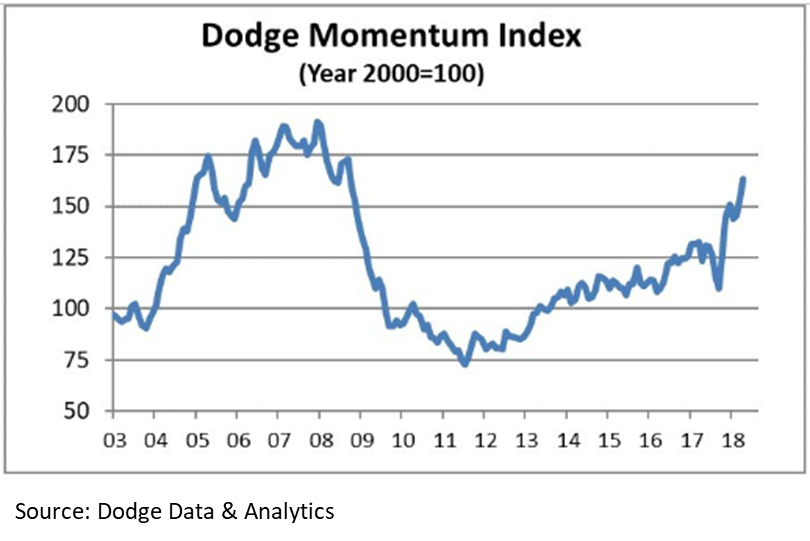

Dodge Momentum Index Higher in April

Written by Sandy Williams

The Dodge Momentum Index, a first report for nonresidential building projects in planning, jumped 6.1 percent in April to 163.0. Commercial and institutional components of the Index both rose 5.3 percent and 5.8 percent, respectively.

“Over the last two months, the commercial portion of the Momentum Index has posted the most aggressive growth, fueled by continued low vacancy rates for commercial buildings, as well as the potential benefits from the tax cuts passed in December,” said Dodge Analytics. “The gains for the institutional component, while healthy, have been more moderate, reflecting the ebb and flow of public funding for larger education and public building projects.”

There were 12 projects with a value of $100 million or more that entered the planning stage in April. Commercial planning included a $200 million office building in Boston and a $174 million building in Atlanta. The leading institutional projects were a hospital in San Luis Obispo, Calif., and a training center in Pelham, Ala.

The Momentum Index, published monthly by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.