Market Data

May 6, 2018

SMU Steel Buyers Sentiment Index: Troubling Signs...

Written by John Packard

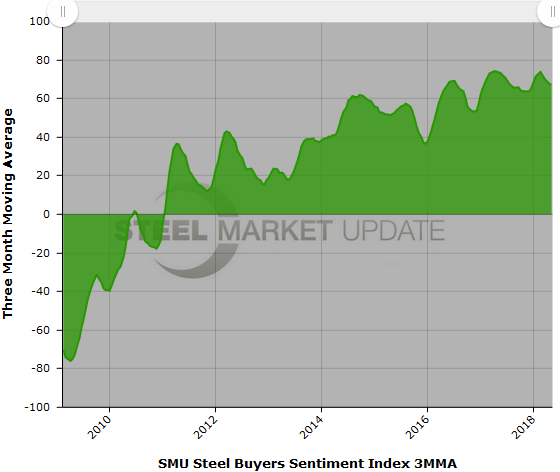

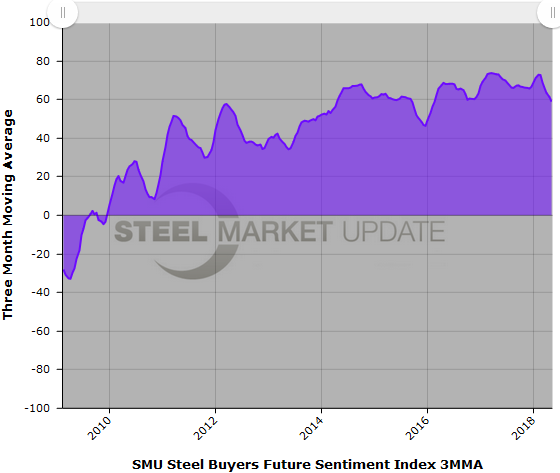

Since November 2008 Steel Market Update has been measuring how buyers and sellers of flat rolled steel felt about their company’s ability to be successful in both the existing (current) as well as future (3-6 months into the future) market conditions. The result is our nationally known SMU Steel Buyers Sentiment Index which we believe to be a forward-looking index for the flat rolled steel communities. It is that “forward-looking” part of our index that is providing some concerns as we review the past few months results.

Buyers and sellers of flat rolled steel felt a little better about their company’s ability to be success this week compared to what we reporting as single data points over the past two months. The industry continues to be well within the optimistic portion of our range with the single data point measuring Current Sentiment at +73 and Future Sentiment at +62 this week.

Both of our indices (Current and Future Sentiment) reach record highs for a single data point in mid-January with Current Sentiment reaching +78 out of a possible +100 and, Future Sentiment came in at +77 also out of a possible +100 high, the most optimistic reading possible for our index.

Steel Market Update prefers to utilize our 3-month moving average as a truer gauge of the trend and to recognize changes in the trend as they develop. In mid-January, when the single data points for each index had reached their historical peak, the 3-month moving average was indicating a rising trend. However, first our Future Sentiment broke the trend in mid-February 2018. Current Sentiment followed two weeks later in early March. Since then both the Current and Future Sentiment 3-month moving averages have been in decline – indicating buyers and sellers of steel are becoming less optimistic than earlier this year.

The Current Sentiment 3-month moving average has dropped from a high of +73.83 to +67.17, a concern to SMU but still well within the upper optimistic range for our index.

Future Steel Buyers Sentiment Index

The one that is more concerning to us is the forward-looking Future Sentiment Index which has dropped from a high of +72.83 down to +58.83. We should all be warned that there may be some negatives ahead (one to two quarters ahead).

What Respondents are Saying

Here is what our respondents had to say while answering our questions about the current market environment affecting Current Sentiment:

“99% contractual business, so not too concerned about down-side risk, but the risk of falling prices is always scary, right. It’s never a gradual, slow fall.”

“Demand remains strong but too much uncertainty and cost shift makes the future unclear.”

“Seems like some of our customers are slowing down. Some say their customers want to wait until prices correct.”

“Unsure of effect of tariffs.”

“People bought heavy first quarter waiting for prices to fall in 3rd quarter.”

“Business continues to be good but our margins are shrinking. Our customers are starting see cheaper material on the market and are starting to beat us up.”

“PLATE demand remains fairly strong.”

Here are the comments made from those responding to questions about future business conditions and Future Sentiment:

“With energy strengthening and section 232 still undetermined, there is a significant prop under the market. It won’t begin to soften until worldwide options can be presented to the US market in a traditional way, offering substantial savings to domestic prices.”

“Three months is okay but end of year is not clear.”

“In steel trading, there is no visibility re the future, so no idea how things will go for us.”

“Remain concerned about the potential of falling steel prices.”

“Not sure what the mills will do be smart or radical?”

“Cloudy We need to know if the temporary exemptions will become permanent If not i’m sure the steel mills will be laying in wait to raise prices.”

“Infrastructure – Wind – Rail – Marine outlook all pointing positive for foreseeable future.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 40 percent were manufacturers and 46 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.