Plate

April 24, 2018

SMU Price Ranges & Indices: Plates Spinning as are Steel Prices

Written by John Packard

“Too many plates spinning right now to try and peg a price direction. The wrong tweet at the wrong time could throw all your planning out the window,” said one manufacturing company to Steel Market Update earlier today, explaining his take on the market. Steel buyers are seeing stability in most products with the possible exception of plate, and there is a debate within the community about that, as well.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $840-$900 per ton ($42.00/cwt-$45.00/cwt) with an average of $870 per ton ($43.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end declined $20 per ton. Our overall average is down $10 compared to last week. Our price momentum on hot rolled steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Hot Rolled Lead Times: 4-9 weeks

Cold Rolled Coil: SMU price range is $990-$1,040 per ton ($49.50/cwt-$52.00/cwt) with an average of $1,015 per ton ($50.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end rose $20 per ton. Our overall average is up $10 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Cold Rolled Lead Times: 5-10 weeks

Galvanized Coil: SMU base price range is $48.00/cwt-$53.00/cwt ($960-$1,060 per ton) with an average of $50.50/cwt ($1,010 per ton) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to one week ago, while the upper end rose $20 per ton. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,046-$1,146 per net ton with an average of $1,096 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-12 weeks

Galvalume Coil: SMU base price range is $50.00/cwt-$53.00/cwt ($1,000-$1,060 per ton) with an average of $51.50/cwt ($1,030 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end rose $20 per ton. Our overall average is up $10 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,291-$1,351 per net ton with an average of $1,321 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-12 weeks

Plate: SMU price range is $930-$1,030 per ton ($46.50/cwt-$51.50/cwt) with an average of $980 per ton ($49.00/cwt) FOB delivered. The lower end of our range declined $10 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is unchanged compared to last week. Our price momentum on plate steel is pointing to Higher indicating prices are expected to rise over the next 30-60 days. SMU Note: Because of controlled order entry and with not all the mills booking the same months, we are getting wide pricing spreads.

Plate Lead Times: “Allocation” 5-9 weeks

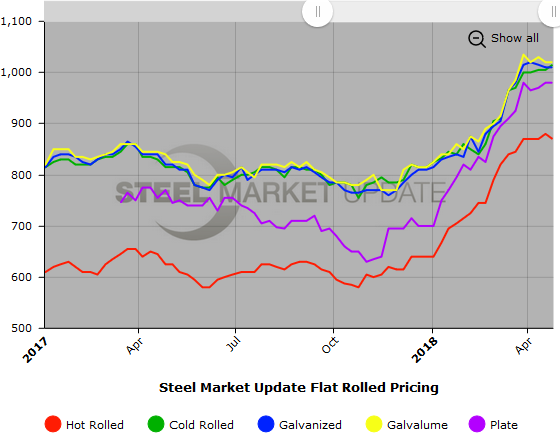

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.