Analysis

April 24, 2018

Existing Home Availability Tight and Costly

Written by Sandy Williams

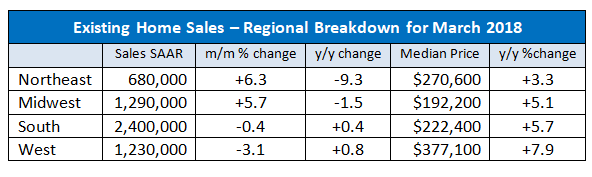

Existing home sales in March rose 1.1 percent to a seasonally adjusted annual rate of 5.60 million. Tight inventory and affordability have kept sales 1.2 percent below year-ago levels, according to the National Association of Realtors.

“Robust gains last month in the Northeast and Midwest – a reversal from the weather-impacted declines seen in February – helped overall sales activity rise to its strongest pace since last November at 5.72 million,” said NAR Chief Economist Lawrence Yun. “The unwelcoming news is that while the healthy economy is generating sustained interest in buying a home this spring, sales are lagging year-ago levels because supply is woefully low and home prices keep climbing above what some would-be buyers can afford.”

Inventory at the end of March was 1.67 million existing homes for sale, an increase of 5.7 percent from February but still 7.2 percent lower than the 2017 level. Inventory levels have fallen year-over-year for 34 consecutive months, said NAR. March inventory stands at a 3.5-month supply at the current sales pace.

While availability is falling, pricing continues to rise. The median existing home price for all types of housing rose 5.8 percent to $250,400 in March.

Single-family home sales rose a slight 0.6 percent from February to a seasonally adjusted annual rate of 4.99 million in March. Median price jumped 5.9 percent year-over-year to $252,100.

Existing condominium and co-op sales increased 5.2 percent sequentially to a seasonally adjusted annual rate of 610,000 units in March, but were still 3.2 percent below March 2017. The median existing condo price jumped 4.8 percent from last year to $236,100.