Market Data

April 19, 2018

SMU Steel Buyers Sentiment Index: Uncertainty Wearing on Attitudes?

Written by Tim Triplett

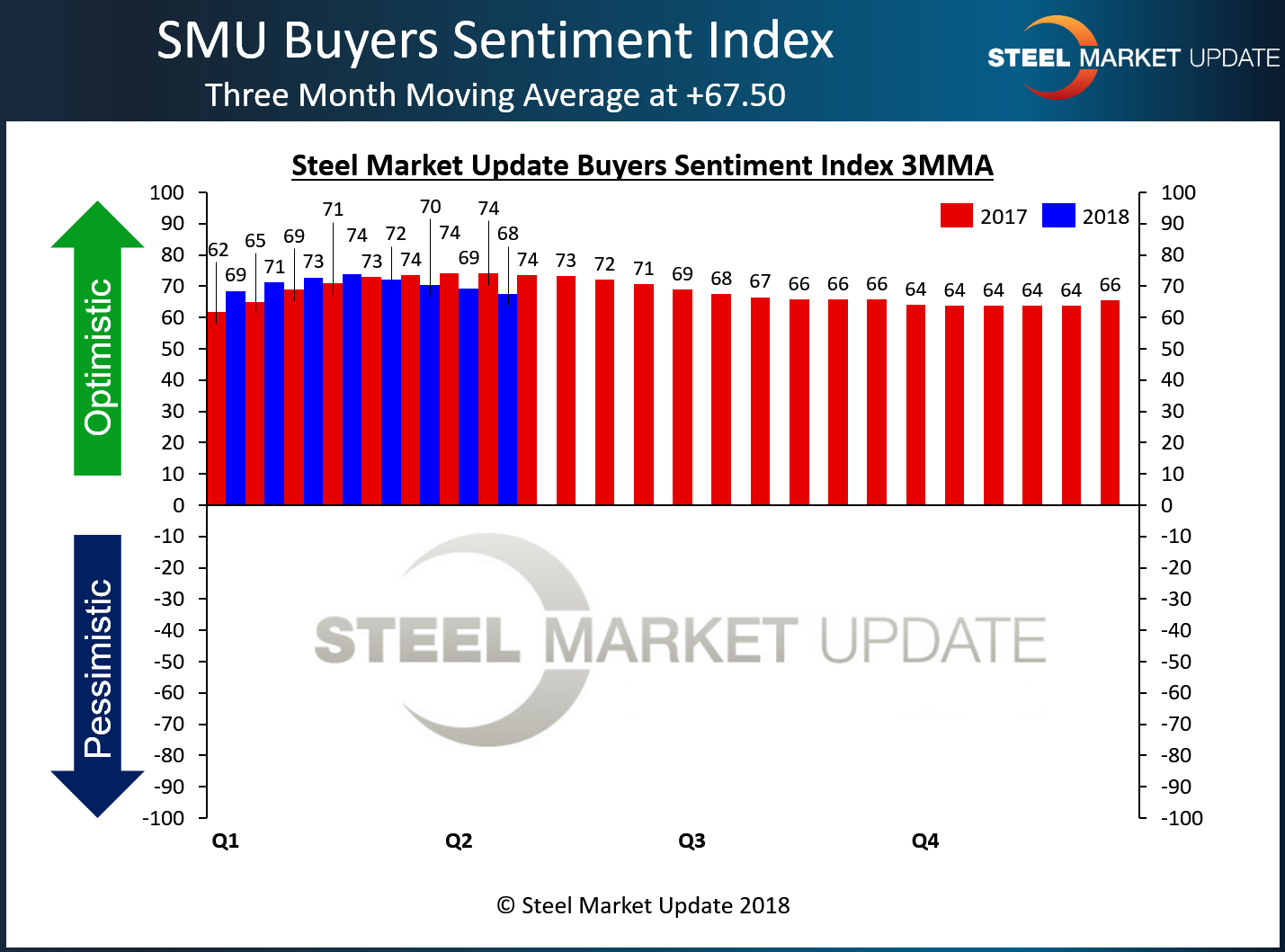

Both current and future sentiment among flat rolled steel buyers remain at optimistic levels, though buyers’ confidence appears to have seen some erosion as measured by the three-month moving averages in Steel Market Update’s Steel Buyers Sentiment Index. The index is designed to measure changes in buyers’ attitudes, which offers insight into their likely decision-making. Customer resistance to high steel prices and uncertainty over Trump administration trade actions may be taking a toll on buyers’ emotions.

Current sentiment, measured as a single data point, was at +68, up from +66 last month. Measured as a three-month moving average, which helps even out the highs and lows, the Current Sentiment 3MMA registered +67.50, down from +69.17 two weeks ago. The current 3MMA is at the lowest level seen since mid-December 2017 when it hit +65.50. The graphic below clearly shows the seasonal trend that we tend to see with our Sentiment Index has been broken. We are seeing an erosion in optimism during what is normally the most optimistic point during the calendar year. This is one of the reasons why SMU adjusted our Price Momentum Indicator to Neutral this afternoon.

Future Steel Buyers Sentiment Index

SMU’s questionnaire also asked steel buyers to assess their company’s chances for success three to six months down the road. Future Sentiment indexed as a single data point moved up eight points to +65. However, the three-month moving average for Future Sentiment continued an erosion that began in early February, dipping to +61.33 from +63.33 two weeks ago. The Future 3MMA is at the lowest level seen since mid-November 2016 when it was +60.17.

As illustrated by the graphic below, Future Sentiment is trending well below year-ago levels, at least partially due to the unsure political climate. As we noted above, the break in the seasonal trend that we see for Future Sentiment is even more dramatic than what we noted above. This is not a good sign for future demand and probalby prices…

What Respondents are Saying

Buyers report that demand is still strong despite the high steel prices, though they appear less confident it will remain that way. Below is a sampling of their comments:

- “Business demand still seems strong, but is it artificial due to increased costs or true demand? Maybe some of both.”

- “Service center business is not getting any easier and there is massive resistance to current price levels by 95 percent of the OEMs.”

- “We’re wondering how many customers bought extra for the second quarter that will carry them well into the third quarter. And, at recent spot prices and higher borrowing rates, how will service centers react to carrying extra inventory?”

- “We’re concerned too aggressive price increases on metal will create a mini-recession in building, construction and manufacturing.”

- “It depends on how the tariffs affect our business. If all are put into effect, will it cause a big slowdown in our orders?”

- “The increased cost of steel suddenly narrows the pricing gap for my steel panel versus polymer panels. Polymer will grow, while steel will see losses.”

- “In time, the companies that get my product through distributors will endlessly shop other sources for lower prices. Quality loses out to price.”

- “The good news: Steel is becoming easier to find with domestic suppliers. The bad news: Steel is becoming easier to find with domestic suppliers. That being said, mills are doing everything they can to avoid any indication of ‘holes,’ and conditions are still relatively tight.”

- “There’s strong demand especially in the oil-related sector. We continue to have strong sales starting the second quarter.”

- “Quoting is strong. We’re passing on the increases like everyone else.”

- “Additional quotas are inevitable.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 34 percent were manufacturers and 53 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.