Market Data

April 10, 2018

SMU Market Trends: Is Demand Moderating?

Written by Tim Triplett

“Compared to one month ago, demand is declining, but to a more normal level,” commented one respondent to Steel Market Update’s market trends questionnaire last week, expressing a common view. There has been a surge in demand in recent weeks due to the Section 232 tariff decision by President Trump. Many buyers have been buying for future needs, which will ultimately come back to bite into future demand.

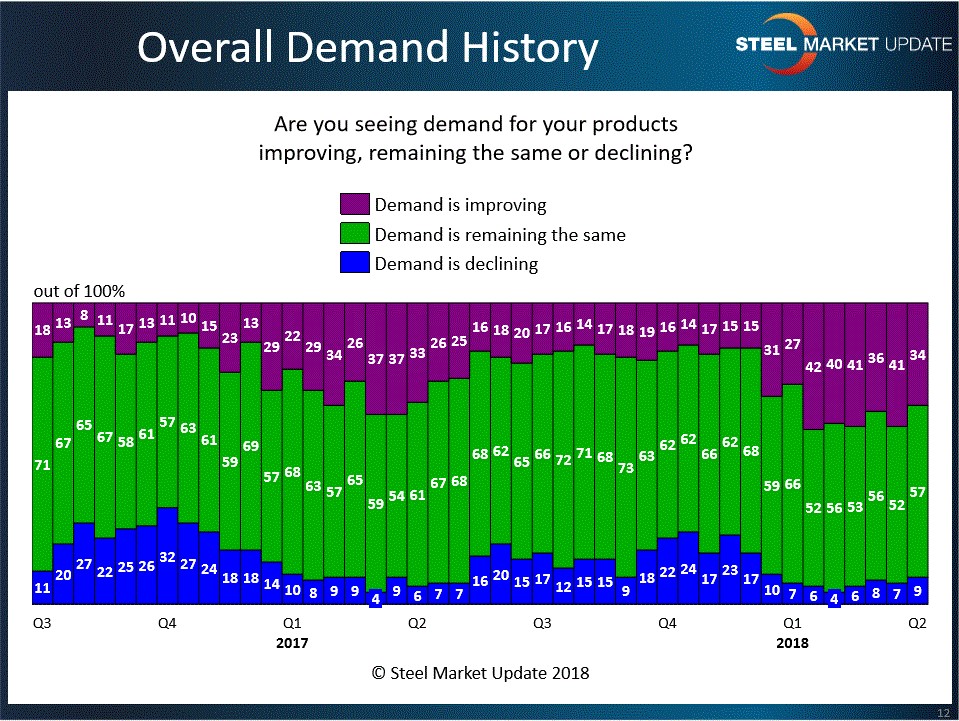

Demand for flat rolled steel products remained surprisingly stable in the first quarter (see chart), despite the rapidly rising prices and uncertainty on the trade front. Since January, on average, 39 percent of steel executives have reported improving demand, while another 54 percent reported stable demand for their products. Only 7 percent saw demand declining.

Comparing demand responses that we received for first-quarter 2018 versus that of one year ago, we are seeing buyers and sellers of steel as being more bullish by reporting demand as “improving” at greater levels this year than last. What we will need to watch from here is if demand will pull back as we move deeper into the second and third quarters as it has done in the past (see graphic below)?

The latest data from SMU’s early April query shows fewer (34 percent) reporting improving demand, and more (9 percent) reporting weakening demand. This could be a normal seasonal shift as the market enters the second quarter or it could signal that the high steel prices are facing resistance from buyers. We’ll be watching closely to see if demand continues to moderate as the quarter progresses.

Other comments from respondents reflect concerns about product availability and “panic buying” today that may hurt demand tomorrow:

• “We have just had an incredible month thanks to the panic and customers buying ahead. The next two months will be another thing, I’m afraid.”

• “We are getting into construction season and more buyers are realizing the pricing realities and supply constraint.”

• “There has been some increased interest based on domestic restrictions on quantity, but overall demand is steady. Sourcing is not.”

• “Hedge buying will mean a slowdown later in normal heavy demand months, we fear.”

• “The buyers of foreign steel are scrambling for product.”

• “Much higher steel prices have forced us to raise prices quickly and as a result our backlog is starting to drop quickly.”

• “Importers of finished goods are taking market share now that domestic producers are paying a huge premium for raw materials.”