Market Data

April 6, 2018

SMU Report: Next Recession Not Yet on the Horizon

Written by Peter Wright

Economists consider recessions to be a necessary evil to clear out distortions that have arisen in the economy. At Steel Market Update, we track several leading indicators of economic activity. Viewed individually, they offer limited insight on economic expansion or contraction. Viewed collectively, they give subscribers a composite view of present and future business activity.

On March 30, The Heisenberg, a currencies, macro, commodities, geopolitics analyst, wrote: “Low unemployment in the U.S. (and other places like Japan, the UK and Germany) and strong growth momentum at such an advanced stage in the economic cycle would normally already be associated with higher wages and, consequently, higher inflation and tighter monetary policy. It is because of the lack of inflation that some of these variables can appear stretched without ringing alarm bells for equity investors. Put another way, it is very unlikely that without core inflation rising much, policy rates will rise sufficiently in the U.S. or elsewhere to invert yield curves and/or force a recession in the near future.”

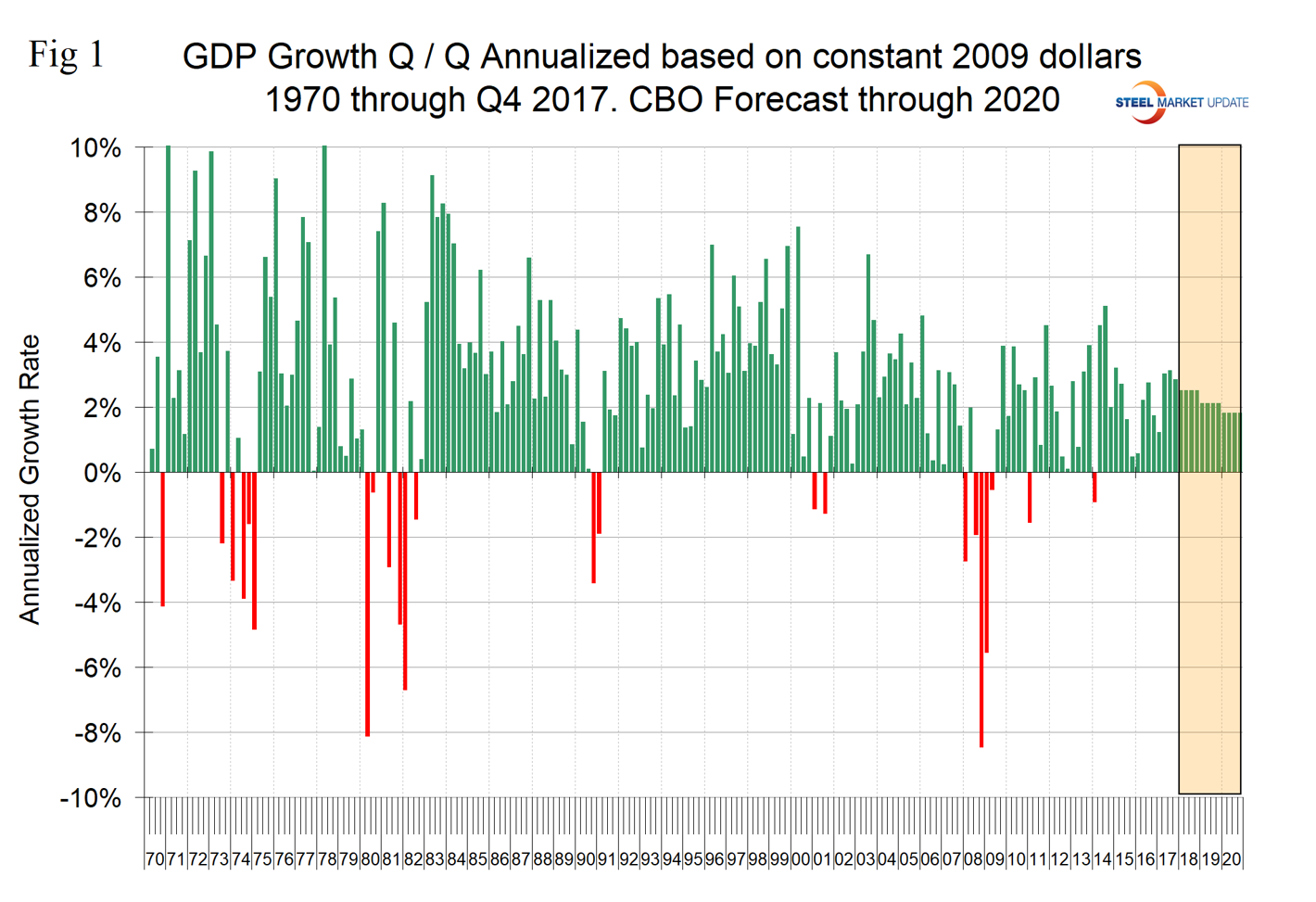

Figure 1 provides a history of U.S. recessions since 1970. Recessions occurred in 1974, 1980, 1981, 1990, 2001 and 2008. In Q4 2017, the latest data, the BEA reported the growth of GDP to be 2.87 percent.

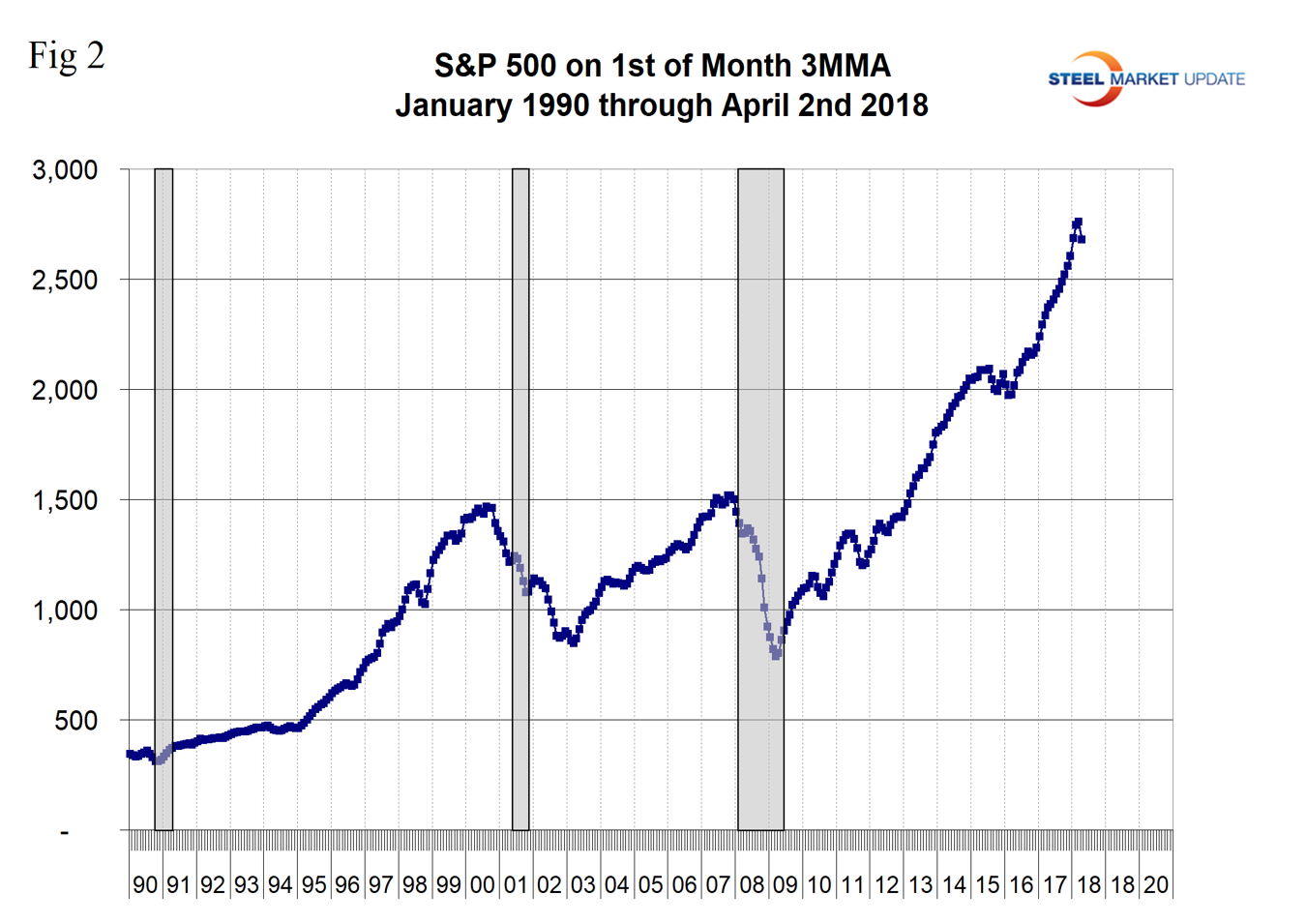

Figure 2 shows the three-month moving average of the S&P 500 on the first day of each month from January 1990 through April 2018. The stock market did predict the recession of 2001, but failed in 2008.

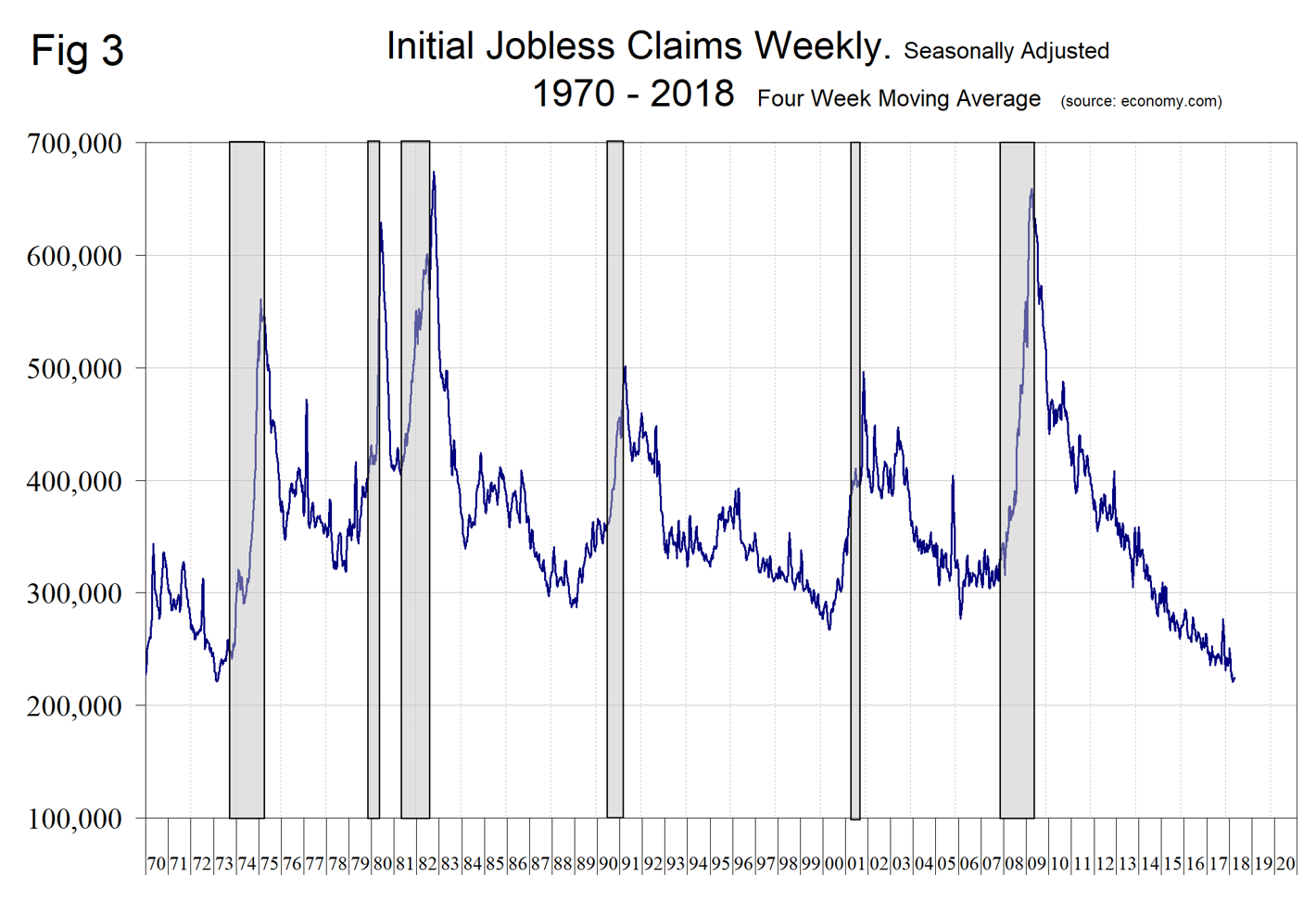

Figure 3 records new weekly claims for unemployment compensation. This indicator failed to predict the 1981 and 2008 recessions. It had a lead of over a year on the other four.

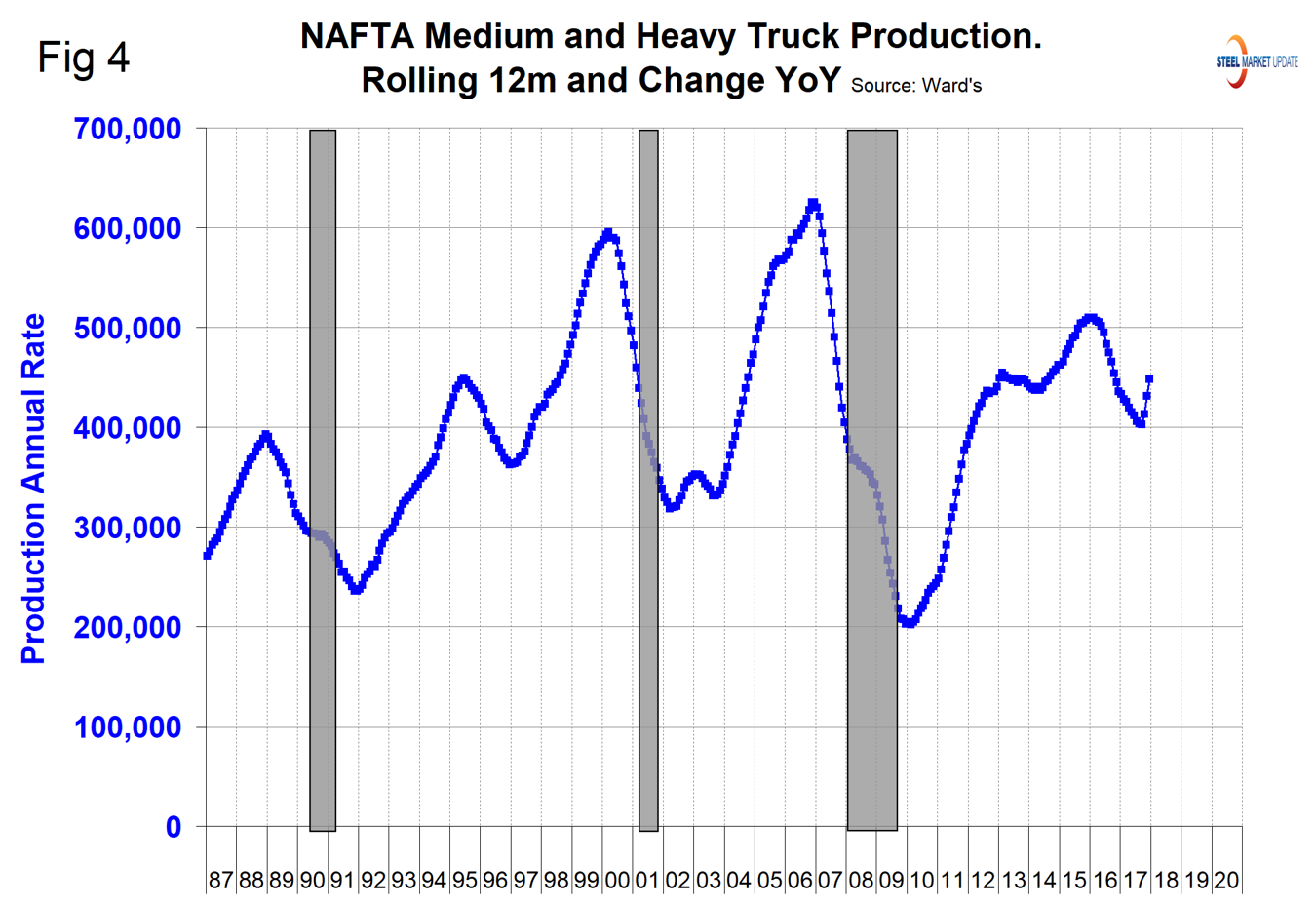

Figure 4 shows monthly assemblies of medium and heavy trucks in NAFTA. Evidently, the auto companies’ economists have a good read on future business activity. They correctly anticipated and acted in advance of the 1990, 2001 and 2008 recessions. They were nervous in 1995 and 2016, which turned out to be false alarms. This illustrates our belief that we need to be cognizant of all these indicators simultaneously to get the best view of the future.

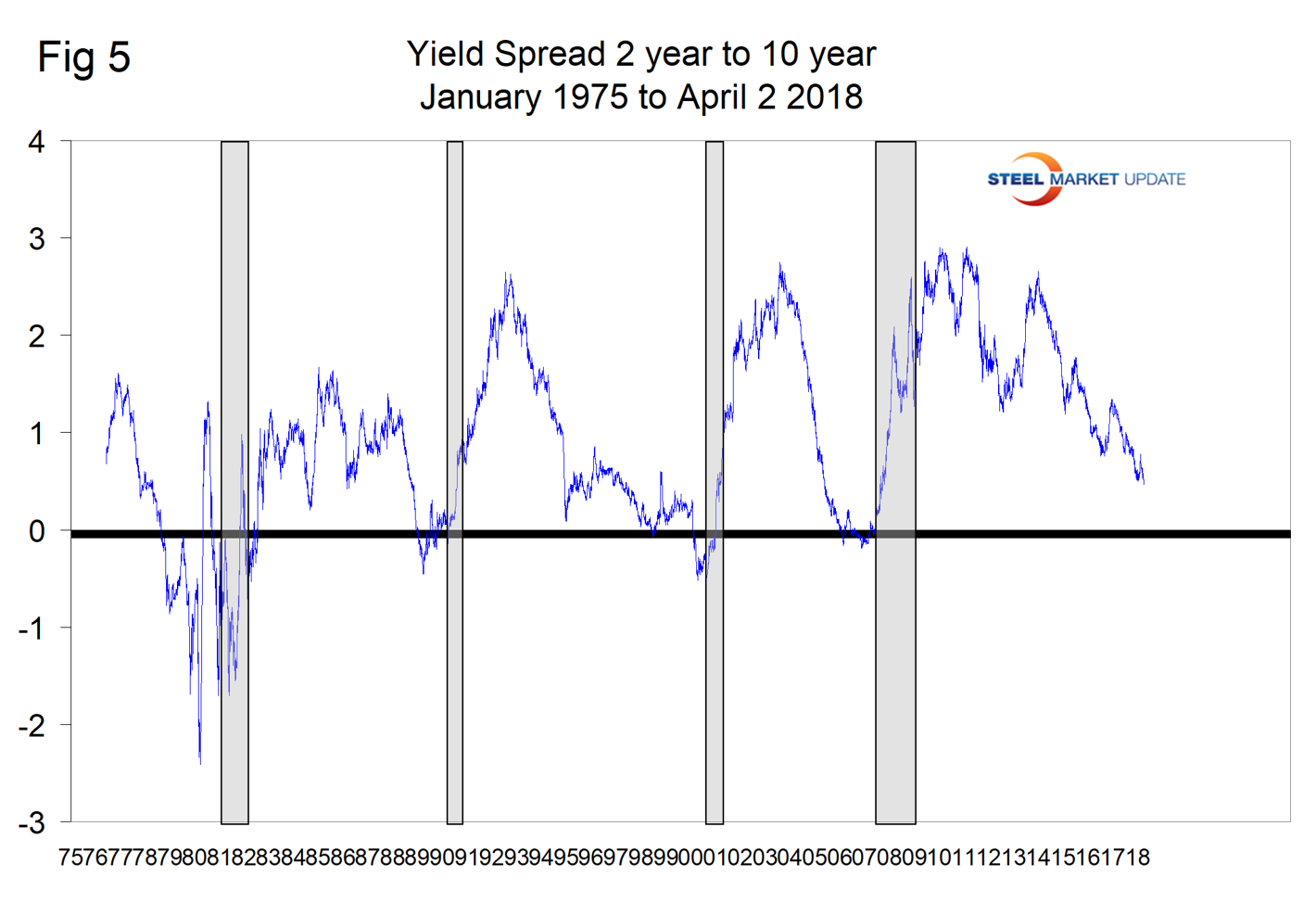

Figure 5 is the well-known yield spread and shows a negative or “inverted” yield curve to be a sign of imminent recession. The treasury spread is developed by subtracting a shorter-term from a longer-term treasury yield. Ten-year interest rates minus two-year interest rates, for example. This has been one of the most accurate and longstanding leading indicators for growth and inflation. A spread that is increasing is a sign of higher growth and inflation as bank lending becomes more profitable (borrow short and lend long) and loan growth is expected to accelerate. A declining or contracting yield spread foreshadows lower growth and inflation due to contractions in bank loan growth due to reduced profitability. The current forecast predicts lower growth and inflation will materialize toward the end of this calendar year and, more specifically, the first several months of next year. That thesis has been unfolding as the yield curve, measured several different ways, is contracting. A negative spread anticipated all five of the recessions since 1975.

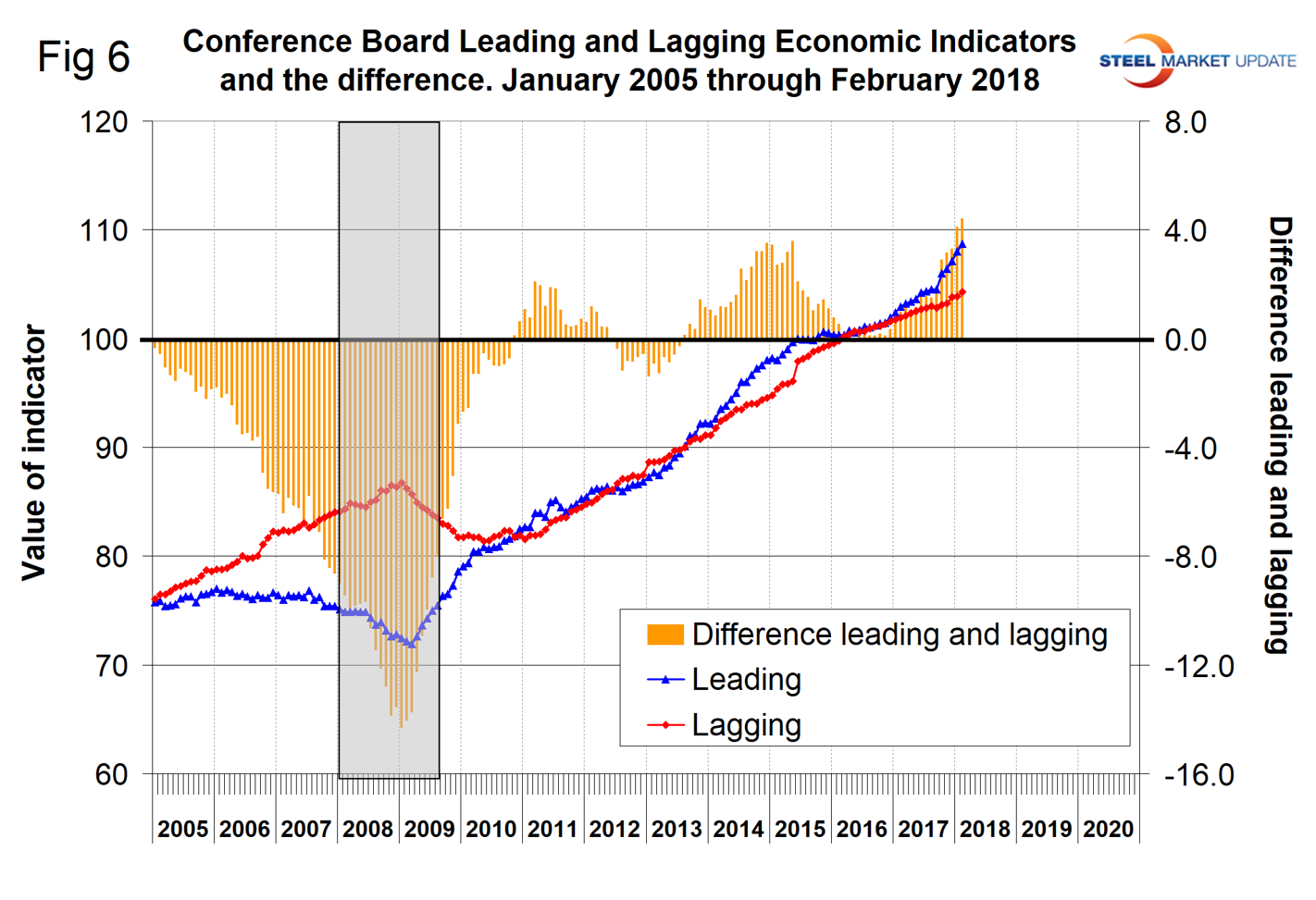

Figure 6 is the chart we like the best, though we have no history before 2008. This is The Conference Board leading and lagging economic index. We have subtracted one from the other in the rationale that if the lead is better than the lag, the situation is improving, or vice versa. The lead minus lag inverted three years in advance of the 2008 recession; certainly by 18 months before the big event it was clear something was happening. At present, this indicator is in an ascending mode.

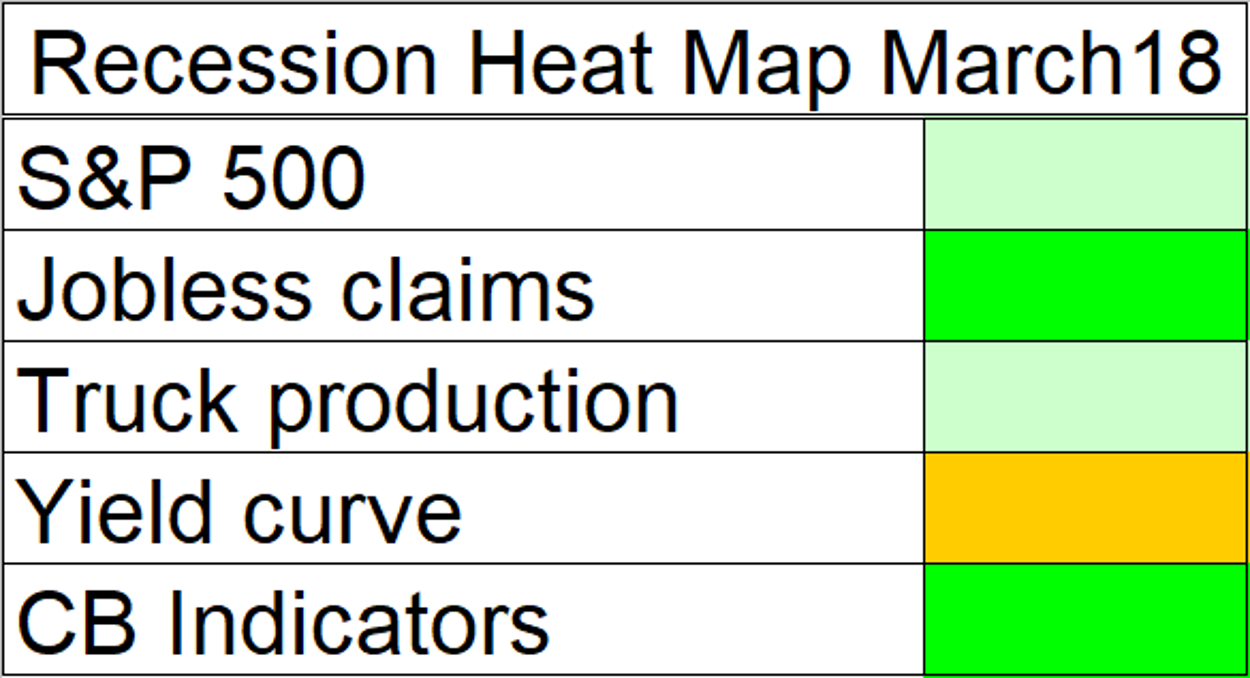

Figure 7 summarizes this data as a recession heat map.

A study of the current data shows a generally healthy U.S. economy. This is SMU’s first attempt to develop such a predictor of an economic downturn. As long as there are no causes for alarm, we will release this update every three months and continue to refine it. When we see a recession on the horizon, we will report more frequently.