Market Data

April 3, 2018

Global Manufacturing Weakens in March

Written by Sandy Williams

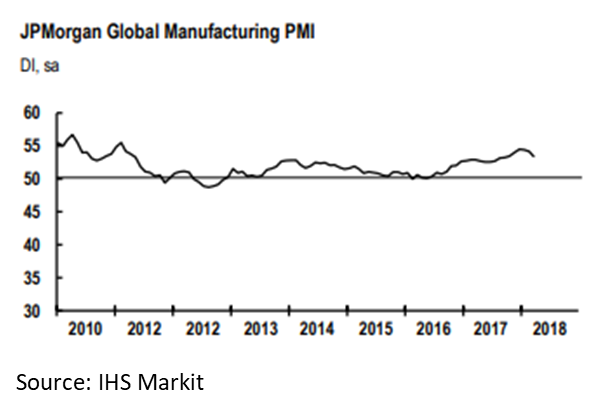

Global manufacturing growth in March slowed to its lowest level since October 2017. The J.P. Morgan Global Manufacturing PMI posted 53.4, down from 54.1 in February. Rates of expansion fell in the consumer and intermediate goods sectors, while the investment goods PMI rose to its highest level so far this year.

Manufacturing growth eased in the Eurozone, China, Japan, India, and Australia, but improved in the United States, United Kingdom, Brazil and Russia. Supply chain disruptions led to shortages of some inputs and longer vendor lead times. New export orders grew at their weakest rate in 15 months.

Manufacturing growth eased in the Eurozone, China, Japan, India, and Australia, but improved in the United States, United Kingdom, Brazil and Russia. Supply chain disruptions led to shortages of some inputs and longer vendor lead times. New export orders grew at their weakest rate in 15 months.

Manufacturing activity slowed across the Eurozone. The IHS Markit Eurozone Manufacturing PMI fell two points to 56.6 last month as new orders and production softened. The PMI decline was the biggest drop since June 2011. Raw material shortages and supply delays resulted in record lengthening of supplier delivery times.

IHS Markit Chief Economist Chris Williamson called the slowdown “inevitable” after the growth surge at the beginning of the year caused short-term capacity constraints.

“Some of the slowdown has also been attributable to temporary factors such as bad weather,” said Williamson. “However, the fact that business optimism about the coming year has slipped to a 15-month low suggests there are other factors that are now hitting factory order books. Export growth has more than halved since late last year, linked in part to the appreciation of the euro, and in some cases demand is being stymied by higher prices.”

Williamson added that the pace of growth is still robust by historical standards and PMI readings indicate steady, broad-based expansion.

China manufacturing growth improved at the weakest rate since November. The headline Caixin PMI registered 51.0 in March, down from 51.6 in February. Demand was not as strong as expected and production and new orders expanded at their softest rates in four months. Order weakness was driven by muted foreign demand. Falling employment levels combined with order expansion added to growing backlogs. Output prices rose quicker in March while input prices fell markedly, helping to sustain profits.

Russia manufacturers saw slightly stronger growth in March. The IHS Markit PMI rose to 50.6 from 50.2 in February. Production and new orders continued to grow in March, but at a slower rate. Input costs rose at the fastest pace since October, driven by higher raw material costs. Input costs were passed on to clients in higher prices. Expectations for the year remained strong with firms optimistic about product development and improved demand.

Manufacturing conditions in South Korea deteriorated in March, falling below the neutral point to 49.1 from 50.3 in February. Output and new orders both dropped sharply. New export orders declined at the strongest rate in 17 months with weaker demand noted from China, India, Japan and the U.S. Raw material prices were higher, especially for metals and oil, resulting in a moderate rise in selling prices. Firms remained optimistic regarding future output due to positive forecasts for demand, economic growth and productivity. However, confidence was at a three-month low.

Canada manufacturers continued to enjoy their 25th month of growth. The IHS Markit Canada Manufacturing PMI posted a 55.6 in March, just a smidge higher than 55.6 in February. New orders and production were up, attributed to sales from both domestic and export clients. Pressure on operating capacity caused backlogs to rise. Input buying climbed at its steepest rate since April 2011. Raw material inventories grew at notable rates due to production demand and efforts to mitigate risks from higher prices and supply chain pressure.

“Intense supply chain pressures and sharply rising raw material costs have been key headwinds for Canadian manufacturing companies so far this year,” said IHS Markit Associate Director Tim Moore. “The latest survey indicated that input price inflation was the highest for around four years, reflecting strong cost pressures for end users of steel and chemicals in particular.”

New orders hit a four-month high in Mexico in March. Export orders recovered from February’s contraction as manufacturers expanded into new markets and international demand improved. Production rose modestly along with an increase in employment levels, although mostly for temporary positions. Input costs were higher for energy, fuel and gas. Raw materials costs jumped, partly in response to peso depreciation, causing selling prices to elevate. Despite a strong month, the future outlook was at a 14-month low for manufacturers who cited concerns over inflationary pressures, finances and upcoming elections.

The IHS Markit U.S. Manufacturing PMI indicated the strongest improvement in business conditions since March 2015. The PMI rose to 55.6 from 55.3 in February. Strong demand both domestically and abroad drove increased production.

“Companies cited rising demand at home and abroad plus recent government policy announcements as helping shore up confidence in terms of their future production levels,” said Williamson. “However, recent tariff announcements were already reported to have added to inflationary pressures, and also led to the stockpiling of goods expected to rise further in price in coming months. Input cost inflation consequently hit the highest since 2012. Increased costs were often passed on to customers, meaning prices charged for goods at the factory gate showed the steepest rise in over four years.”