Prices

April 3, 2018

China’s Poised to Disrupt the Ferrous Scrap Market

Written by Tim Triplett

China will control the global ferrous scrap market, it’s just a matter of time, says scrap expert John Harris of Aaristic Services, Inc.

China produces about half the world’s steel every year and has accumulated a scrap reservoir more than sufficient to meet its domestic steelmaking needs. There is little reason for China to import scrap, except in instances where it can supply mills near the coast with lower cost scrap purchases from ocean cargoes. Yet the Asian giant has recently upped its percentage of purchased scrap to around 9 percent from 3-5 percent in an attempt to influence the market price. “It’s not working,” said Harris. “We can definitely expect large increases in Chinese scrap exports in the near future as they perfect their logistics.”

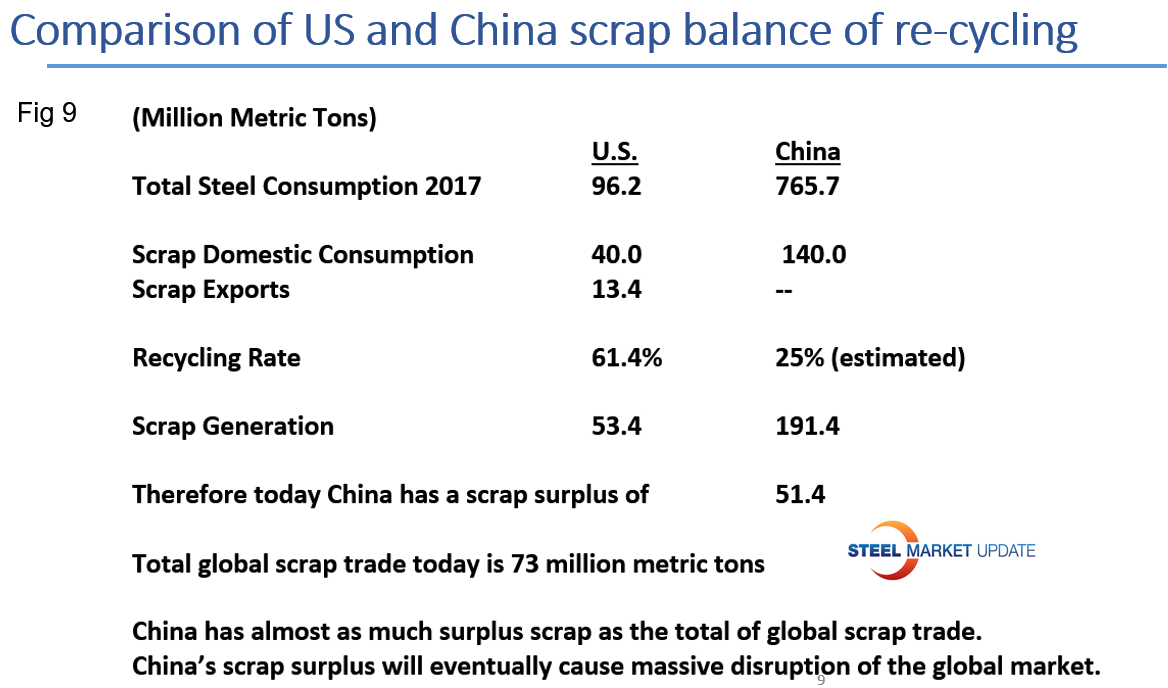

Commenting on a recent article in Steel Market Update’s Premium newsletter (“Scrap Trade: Expanding with Global GDP”), Harris said he believes Figure 9 overstated the steel and scrap consumption in the U.S. and China and he offers the following amendments (see chart below):

SMU’s Figure 4 indicated that the U.S. share of the global scrap market peaked at 36.2 percent in the third and fourth quarters of 2008 and stood at 22.2 percent in Q4 2017. SMU attributed the decline in the U.S. share to the strengthening of the U.S. dollar. Harris believes the long-term decline in U.S. market share is more a result of the China growth factor than the strong dollar.

Of Steel Market Update’s conclusion, Harris is in complete agreement: China has more surplus scrap than the total of global scrap trade, which sets the stage for an eventual massive disruption of the global scrap market.