Analysis

April 3, 2018

Auto Sales Surge in March

Written by Sandy Williams

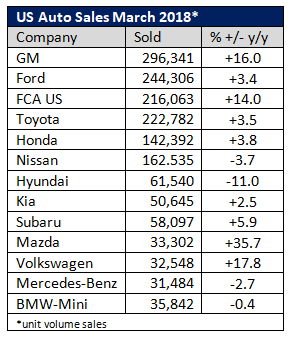

Automakers reported strong sales in March after a weak performance in February. Industry sales rose to 1.647 million units from 1.548 million last year, according to WardsAuto. The seasonally adjusted annual rate was 17.4 million, surging over last year’s rate of 16.7 million.

Mark LaNeve, Ford Vice President, U.S. Marketing, Sales and Service, said, “March represented a strong start to the spring selling season for both Ford and the industry.”

General Motors and FCA USA sales advance by double-digit percentages of 16 and 14 percent, respectively, with FCA retail sales at a 17-year high. Ford sales were up 3.5 percent for the month. Most manufacturers reported positive sales year over year, with Hyundai, notably, a lone double-digit drop at -11.0 percent. SUV purchases accounted for 43 percent of Hyundai sales.

General Motors announced it will begin reporting U.S. vehicle sales on a quarterly basis.

“Thirty days is not enough time to separate real sales trends from short-term fluctuations in a very dynamic, highly competitive market,” said Kurt McNeil, U.S. vice president, Sales Operations. “Reporting sales quarterly better aligns with our business, and the quality of information will make it easier to see how the business is performing.”