Prices

March 28, 2018

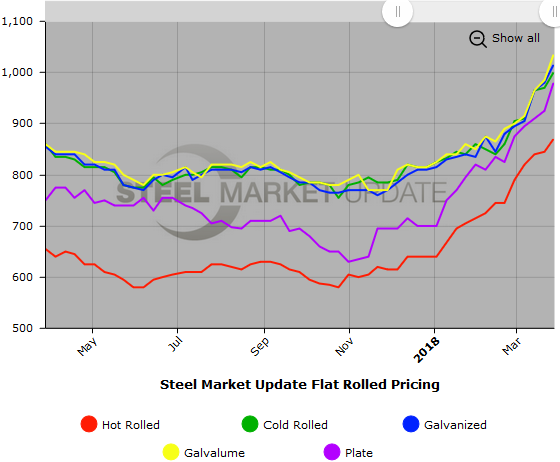

SMU Price Ranges & Indices: Prices Have Not Yet Peaked

Written by John Packard

Flat rolled and plate steel prices moved higher over the past seven days. Steel buyers reported the domestic and Canadian steel mills as being “firm” with their price offers. Even so, steel buyers advised Steel Market Update that even with many mills allocating tonnage or, working on a controlled order entry basis, that they were able to get enough tonnage to satisfy their business.

We are hearing of foreign tons beginning to be offered with the 25 percent tariff included. Many of the buyers reported products such as coated steels as being “competitive” with domestic numbers while other products were less competitive depending on where the buyer sits geographically (freight considerations).

The question being asked is what will happen with prices over the short term (2nd Quarter)? Will hot rolled prices reach or exceed $900 per ton?

One of the largest domestic service centers told SMU in an email today, “Q2 is going to be very tight. Shortages look possible. Expect H2 to stabilize and come down modestly from Q2 peaks. Mills don’t seem to want to push prices too much further. We don’t see HRC breaching $900. [This is] all based on expectation for only modest demand growth. If demand surges unexpectedly shortages will persist into H2.”

On a different subject a trading company sent us a note regarding the quotas being negotiated and how it might affect the HVAC community (light gauge galvanized buyers for duct and furnace pipe applications), “Get ready for a world of quotas…Going to be a killer for the HVAC guys….”

SMU will report more on pricing, demand and supply in the coming days. We have been gathering a lot of data from steel buyers over the past few days and we have more to report. Stay tuned.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $840-$900 per ton ($42.00/cwt-$45.00/cwt) with an average of $870 per ton ($43.50/cwt) FOB mill, east of the Rockies. The lower end of our range rose $10 per ton compared to one week ago, while the upper end increased by $40 per ton. Our overall average is up $25 compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Hot Rolled Lead Times: 3-8 weeks

Cold Rolled Coil: SMU price range is $970-$1,030 per ton ($48.50/cwt-$51.50/cwt) with an average of $1,000 per ton ($50.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end rose $20 per ton. Our overall average is up $30 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Cold Rolled Lead Times: 5-9 weeks

Galvanized Coil: SMU base price range is $48.50/cwt-$53.00/cwt ($970-$1,060 per ton) with an average of $50.75/cwt ($1,015 per ton) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to one week ago, while the upper end jumped $50 per ton. Our overall average is up $35 compared to last week. Our price momentum on galvanized steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,056-$1,146 per net ton with an average of $1,101 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-11 weeks

Galvalume Coil: SMU base price range is $50.50/cwt-$53.00/cwt ($1,010-$1,060 per ton) with an average of $51.75/cwt ($1,035 per ton) FOB mill, east of the Rockies. The lower end of our range jumped $70 per ton compared to last week, while the upper end rose $30 per ton. Our overall average is up $50 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,301-$1,351 per net ton with an average of $1,326 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-9 weeks

Plate: SMU price range is $950-$1,010 per ton ($47.50/cwt-$50.50/cwt) with an average of $980 per ton ($49.00/cwt) FOB delivered. The lower end of our range increased $50 per ton compared to one week ago, while the upper end rose $60 per ton. Our overall average is up $55 per ton compared to last week. Our price momentum on plate steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Plate Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.