Market Data

March 22, 2018

MSCI Data Shows February Shipments Above the Seasonal Norm

Written by Peter Wright

Service center shipments in February were stronger than the seasonal norm, according to Steel Market Update’s latest analysis of Metals Service Center Institute data.

Daily shipments in February were 3.8 percent higher than in January. On average since 2009, February shipments have decreased by 0.4 percent; therefore, these latest numbers were seasonally better than the historical average for this time of year. Carbon steel shipments averaged 156,600 tons per day in February and days on hand as of the 28th totaled 46.5, which was down from 48.2 at the end of January.

Intake and Shipment

In February, total carbon steel intake at 156,950 tons per day was up from 151,760 tons in January and was 400 tons more than shipments, therefore almost exactly in balance. This was the third month of surplus after two months of deficit. Total sheet products had an intake deficit of 400 tons. Total daily carbon steel shipments increased from 150,900 tons in January to 156,600 tons in February. MSCI data has some seasonality, therefore we need to eliminate that effect before commenting in detail on an individual month’s result. Figure 1 demonstrates this seasonality and why comparing a month’s performance with the previous month can be misleading, particularly in July and the fourth quarter of the year. Typically, daily shipments decline slightly in each of the first four months of the year and bounce up in May to the highest level of any month. In the commentary below, we report year-over-year changes to eliminate seasonality and provide an undistorted view of market direction.

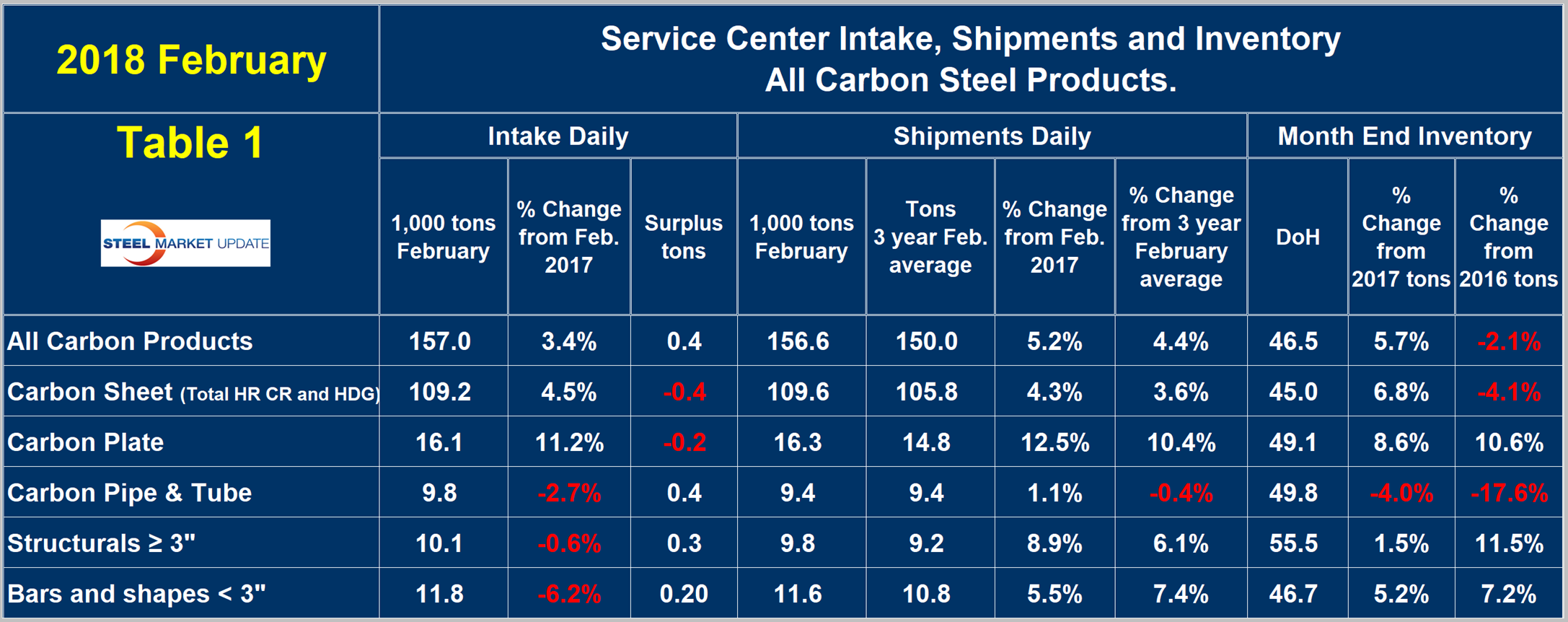

Table 1 shows the performance by product in February compared to the same month last year, along with the average daily shipments for this and the two previous months of February. We then calculate the percentage change between February 2018 and February 2017 and compare it with the most recent three-year February average. February this year was up by 5.2 percent from February 2017 and up by 4.4 percent from the three-year February average. The fact that the year-over-year growth comparison is better than the three-year comparison suggests that momentum is positive.

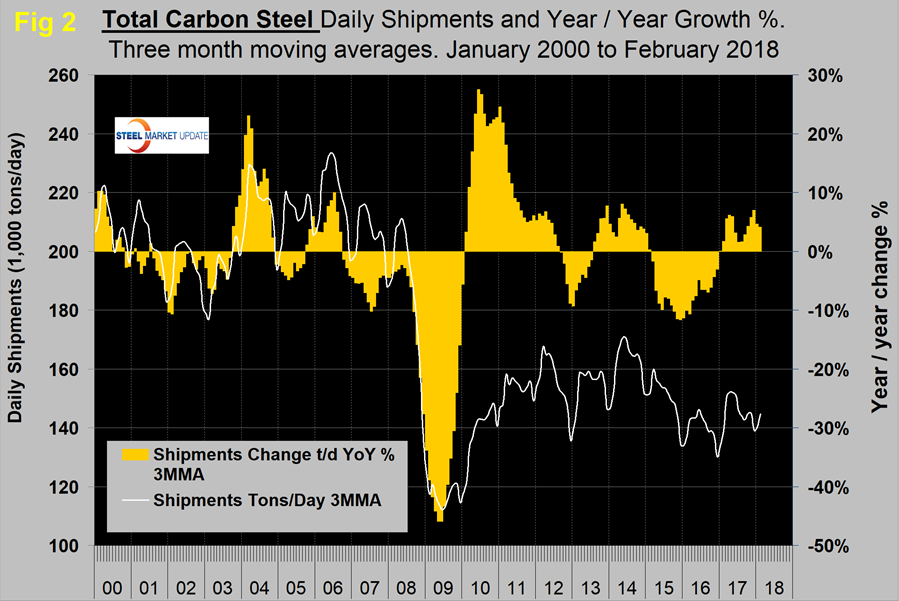

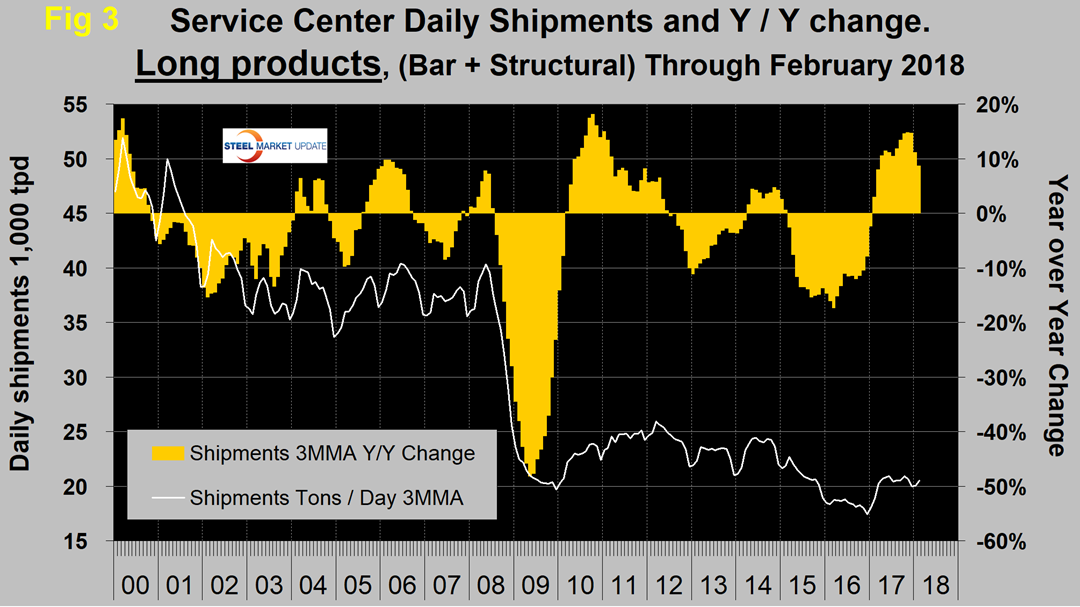

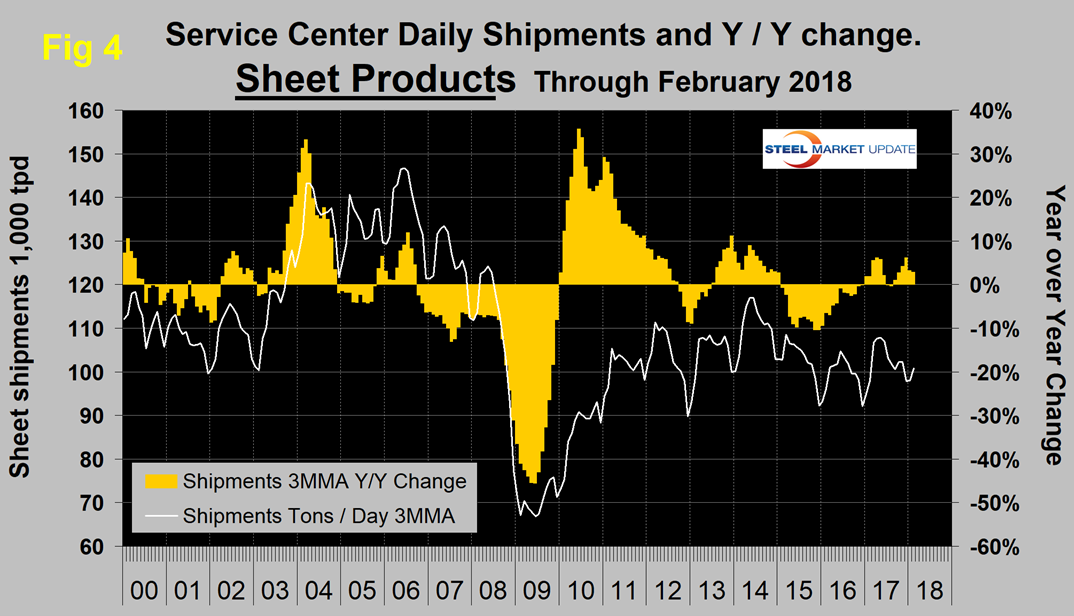

Shipments of all individual products were up from February last year. Figure 2 shows the long-term trend of daily carbon steel shipments since 2000 as three-month moving averages (3MMA). The quickest way to size up the market is the brown bars in Figures 2-6, which show the percentage year-over-year change in shipments by product.

Figure 3 shows monthly long product shipments from service centers as a 3MMA with year-over-year change. Growth has been strong since March last year and in positive double digits every month from April last year through January this year. In February, growth was 8.7 percent.

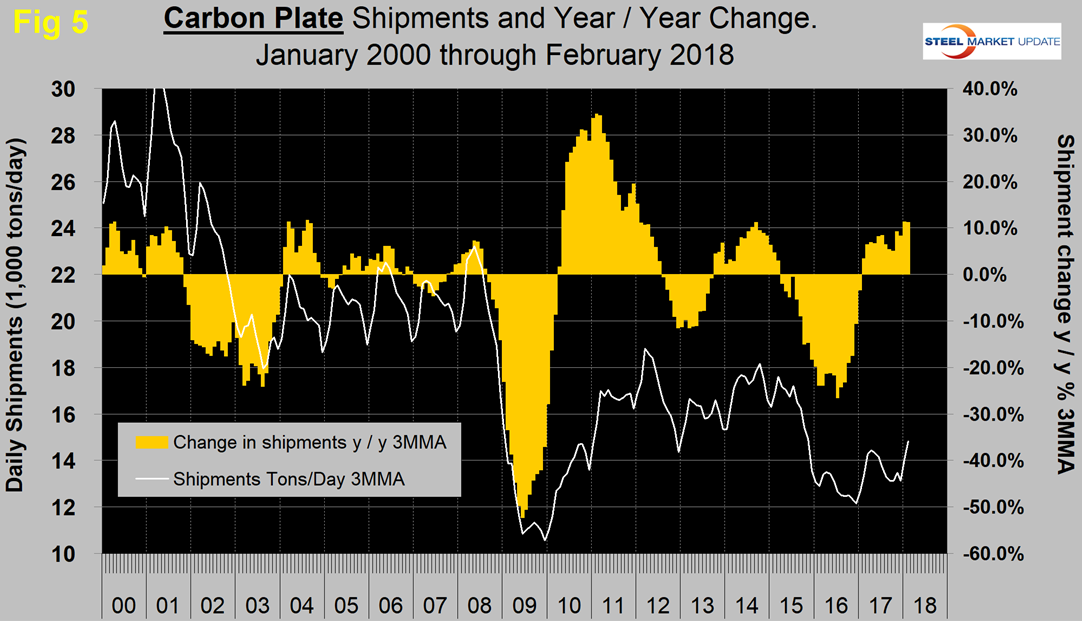

Figures 4, 5 and 6 show the 3MMA of daily shipments and the year-over-year growth for sheet, plate and tubular goods, respectively. Plate performed much worse than sheet in 2015 and 2016. This year, plate has begun to close the gap. Pipe and tube have performed very poorly since early 2015, which coincided with the decline in rig count. The rig count has doubled from where it was this time last year, but so far this has not translated into year-over-year shipment growth of pipe and tube from service centers.

In 2006 and 2007, the mills and service centers were operating at maximum capacity. Figure 7 takes the monthly shipments by product and indexes them to the average for 2006 and 2007 to measure the extent to which shipments of each product have recovered. Each year, all products experience the December collapse and January pickup. In February, the total of carbon steel products was 73.8 percent of the average monthly shipping rate that occurred in 2006 and 2007. Structurals were 55.2 percent and bar was 57.7 percent. Sheet was at 83.7 percent, plate at 77.6 percent and tubulars at 65.7 percent.

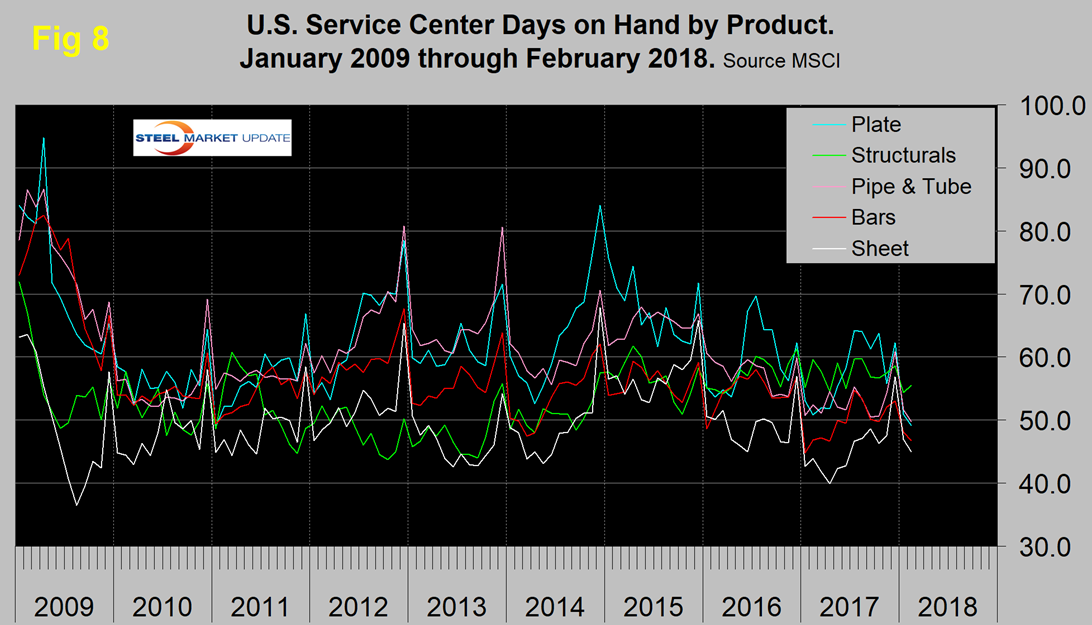

Inventories

Compared to the end of February last year, total carbon steel inventories were up from 6.9 million to 7.3 million tons, an increase of 5.7 percent, but days on hand were almost exactly the same. Compared to 2017, all products except tubular goods had an inventory tonnage increase. Figure 8 shows the days on hand (DoH) by product monthly since January 2009. Figure 9 shows both the month-end inventory and DoH since January 2008 for total sheet products. In the last three years, both the year-end spikes and the mid-year troughs of days on hand of sheet inventory tonnage have been declining.

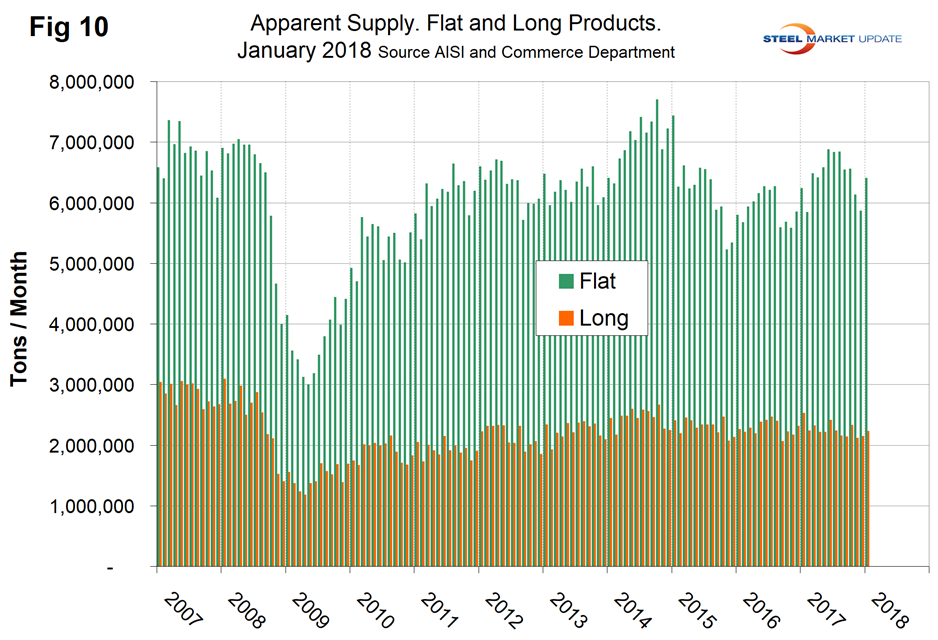

SMU Comment: In February, service center shipments improved for all products year over year, the extremes being plate up 12.5 percent and tubulars up 1.1 percent. There are differences between the MSCI data and some of our other information sources that we can’t reconcile. For example, based on AISI shipment data and USITC import data, tubular goods are doing much better than the MSCI data suggests. On the other hand, MSCI data for long products looks more believable than the AISI and import data. Figure 10 shows the total supply to the market of long and flat products based on AISI shipment and import data through January, which is the latest data available.

Notes: In this analysis, we began to report days on hand for the first time in August 2017. All previous SMU updates reported months on hand. The problem with MoH is that it is influenced by the number of shipping days, therefore another variable is introduced. In months with a high number of shipping days, monthly shipments are elevated, which reduces the numerical value of inventory divided by shipments. In months with few shipping days, the reverse is the case. This is a big deal because shipping days can be as low as 18 and as high as 23. This variable is eliminated by considering inventory divided by daily shipments.

The SMU database contains many more product-specific charts than can be shown in this brief review. For each product, we have 10-year charts for shipments, intake, inventory tonnage and months on hand, available on request.