Prices

March 18, 2018

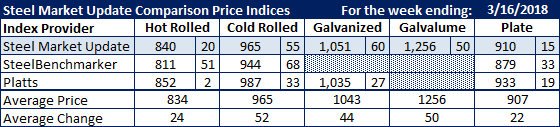

Comparison Price Indices: Steel Prices Keep Moving Higher

Written by John Packard

We saw another surge in flat rolled and plate steel prices last week as steel buyers deal with closed order books, allocation and uncertainty. With the Section 232 tariffs set to go into effect on Friday of this week (March 23) buyers are scrambling to make sure they are covered. This has allowed the steel mills to unilaterally take prices up without any official price increase announcements.

Benchmark hot rolled was up $20 per ton, according to our own HRC index average. SMU has HRC averaging $840 per ton ($42.00/cwt base), and we are hearing of HRC offers as high as $900 per ton ($45.00/cwt). Platts average is higher than ours at $852 per ton. SteelBenchmarker, which reports prices twice during the month, came in up $51 per ton to $811 per ton.

Cold rolled prices were up double digits on all three indexes with Platts at $987 per ton, SMU at $965 per ton and SteelBenchmarker at $944 per ton.

Galvanized averages also rose for .060” G90 with SMU up $60 per ton to $1,051 per ton and Platts up $27 to $1,035 per ton.

Galvalume .0142” AZ50, Grade 80 was also up big to $1,256 per ton. This is up $50 compared to where we saw the numbers just one week prior.

Plate numbers also were up last week. SSAB announced a $50 per ton price increase and plate buyers were advising SMU late in the week that June prices ranged from $960 to $1,025 per ton delivered. SMU had plate at $910 per ton delivered, while Platts saw plate a little higher at $933 per ton delivered. SteelBenchmarker had their average on plate at $879 per ton, FOB the mill.

SMU Note: Galvanized prices include $86 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Midwest Mill (includes freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.