Market Data

March 15, 2018

Distributors Supporting Higher Steel Spot Prices

Written by John Packard

Last week, Steel Market Update conducted an analysis of the flat rolled steel market trends. We reached out to 640 individuals representing more than 600 manufacturers, steel service centers and wholesalers, steel mills and toll processors and asked dozens of questions related to flat rolled and plate steel usage.

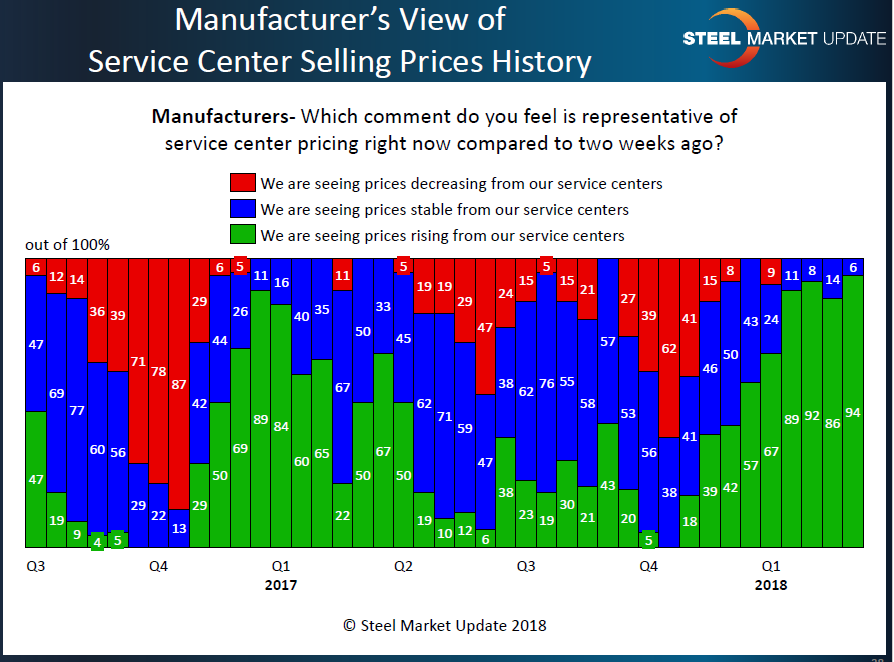

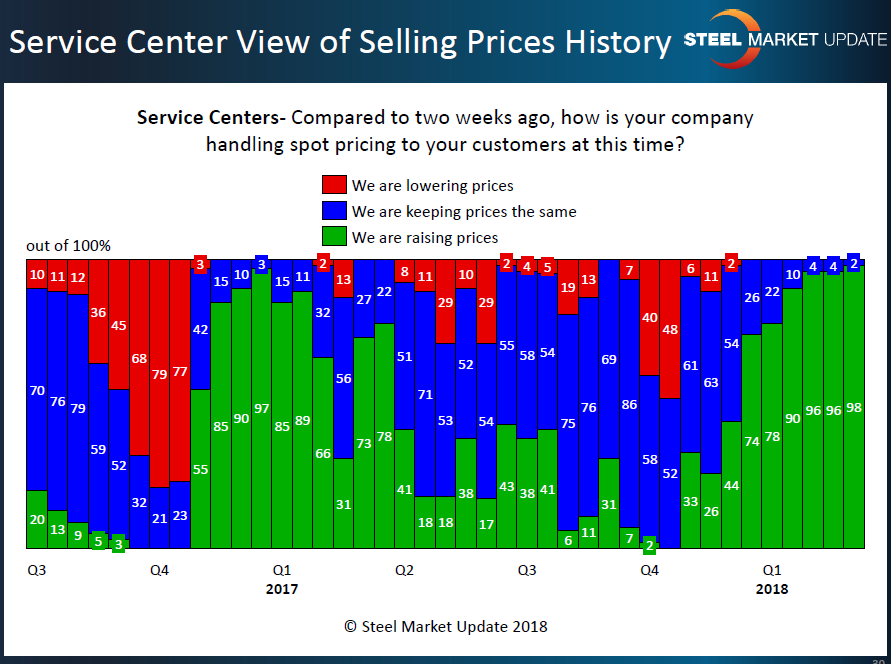

One of the key areas of our inquiry was what steel service centers are doing regarding spot prices to their customers. Specifically, we asked both manufacturing companies and distributors whether service centers were raising, lowering or keeping spot prices the same as two weeks ago (the last time we inquired).

Going back to mid-fourth quarter 2017, there has been a building wave of support for higher spot prices by steel distributors to their customers. This support is related to price increases being collected and, in SMU’s opinion, the mills’ ability to collect these price increases in part due to the support provided by the service centers.

Flat rolled and plate steel service centers are almost universally asking for higher spot pricing from their customers. The percentage of manufacturing companies reporting that their service center suppliers were raising prices increased from 86 percent in mid-February to 94 percent this past week.

We saw 98 percent of the service centers responding to our questionnaire reporting their company as raising spot prices to their customers.

With the president announcing tariffs against foreign steel, there is no question that in the short-term steel distributors will continue to ask for higher spot pricing. The expectation is for prices to remain high and move even higher, which would mean that this “up” market cycle could extend for some time to come. For this reason, we are keeping our SMU Price Momentum Indicator pointing toward higher steel prices over the next 30-60 days.