Prices

March 13, 2018

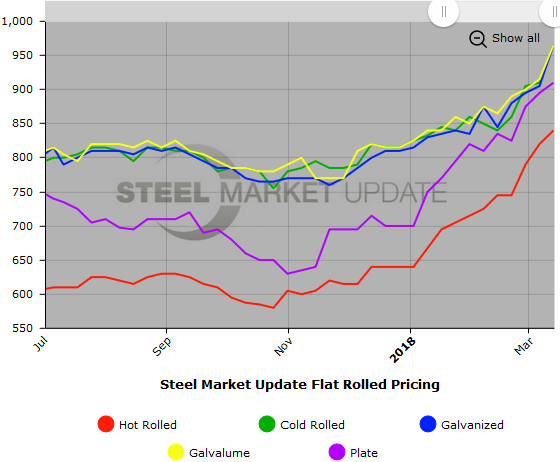

SMU Price Ranges & Indices: Supply Concerns Push Prices Higher

Written by John Packard

Flat rolled sheet prices, as well as plate prices, surged this week as steel mills moved to allocation or totally withdraw from the market pending further examination of the Section 232 ruling and how it will impact each mill’s ability to produce sheet and plate products. SMU is hearing of offers on hot rolled as high as $900 per ton ($45.00/cwt), but we have not yet heard of a transaction at that price level. We are also gathering intelligence suggesting some mills have taken coated steel base prices (galvanized and Galvalume) into the the low $50s (prior to extras). Not everyone is a believer in a possible shortage caused by the blockage of foreign steel. However, there appear to be more believers than doubters, and that is showing up in the price ranges SMU is reporting this evening on hot rolled, cold rolled, galvanized, Galvalume and plate steels.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $800-$880 per ton ($40.00/cwt-$44.00/cwt) with an average of $840 per ton ($42.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end rose $40 per ton. Our overall average is up $20 compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Hot Rolled Lead Times: 4-8 weeks

Cold Rolled Coil: SMU price range is $920-$1,010 per ton ($46.00/cwt-$50.50/cwt) with an average of $965 per ton ($48.25/cwt) FOB mill, east of the Rockies. The lower end of our range rose $40 per ton compared to last week, while the upper end jumped $70 per ton. Our overall average is up $55 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Cold Rolled Lead Times: 5-10 weeks

Galvanized Coil: SMU base price range is $46.00/cwt-$50.50/cwt ($920-$1,010 per ton) with an average of $48.25/cwt ($965 per ton) FOB mill, east of the Rockies. The lower end of our range rose $50 per ton compared to one week ago, while the upper end rose $70 per ton. Our overall average is up $60 compared to last week. Our price momentum on galvanized steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,006-$1,096 per net ton with an average of $1,051 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-12 weeks

Galvalume Coil: SMU base price range is $46.00/cwt-$50.50/cwt ($920-$1,010 per ton) with an average of $48.25/cwt ($965 per ton) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end rose $60 per ton. Our overall average is up $50 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,211-$1,301 per net ton with an average of $1,256 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

Plate: SMU price range is $870-$950 per ton ($43.50/cwt-$47.50/cwt) with an average of $910 per ton ($45.50/cwt) FOB delivered. The lower end of our range remained the same compared to one week ago, while the upper end increased $30 per ton. Our overall average is up $15 per ton compared to last week. Our price momentum on plate steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Plate Lead Times: 6-10+ weeks (Note: June not open at most mills)

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.