Analysis

March 12, 2018

Final Thoughts

Written by John Packard

Mexico, Canada, Australia … (Europe, Russia, Turkey?) … which will be the next countries to negotiate directly with President Trump, who appears to be less interested in building steel jobs than getting trade concessions (or personal acknowledgement) out of many of our allies.

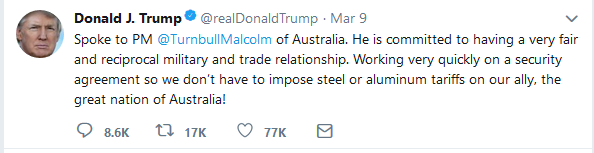

With President Trump, you need to review his Twitter account should you miss an excluded country or negotiation position:

In a more recent Tweet, President Trump has suggested that Wilbur Ross is negotiating with Europe so they can be excluded from the steel and aluminum tariffs.

So, my question is: At what point does the Section 232 tariff become irrelevant?

And, what will happen to steel prices once there is more supply than demand? Could we see another 2008-type destruction of steel prices? I think, yes, since the prices are not running up due to true cost fundamentals and will need to reset once supply is back in balance (or steel buyers no longer fear running out of steel and begin cancelling their double-orders).

Key countries to watch when it comes to exclusions: Russia and Brazil (slabs), South Korea (OCTG and line pipe), Taiwan (Galvalume), Japan and Germany (automotive steels), South Africa and India (light-gauge galvanized).

Here is something from a large service center that I have also heard directly from end users: the mills are already destroying their core customer base. “Biggest immediate impact of 232 is extremely concerned customers. Having multiple conference calls, emails, etc., to educate customers on what’s happening. Interestingly, already hearing of strong interest by companies to immediately research viability to source metal parts/components/segments in Mexico and Canada. Yes, that’s right-Canada. These are 2 closest countries and therefore simplest supply chains to consider. There’s an overwhelming feeling of incredulity about the mills’ raising prices without impunity in sync with developments. In this vein, one mill source confided that they think HR goes to $900+, but they’re trying to move up each week so as to not look like they are taking advantage of the situation. I assured him it was too late for that…”

A comment about our upcoming SMU Steel Summit Conference. Steel Market Update DOES NOT use any company to sell hotel rooms. If you are contacted and told rooms are scarce or some other scare tactic, hang up. Do NOT purchase any rooms through anyone other than going to the links provided on our website. We currently have plenty of rooms available for the Aug. 27-29 conference.

If you are making early airfare arrangements for our conference, you will want to arrive by late morning on Monday, Aug. 27, and you do not want to leave until approximately 5 PM ET on Wednesday, Aug. 29. We will book a significant speaker for the end of the conference.

I welcome your comments. You can reach me at: John@SteelMarketUpdate.com.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, Publisher