Prices

March 11, 2018

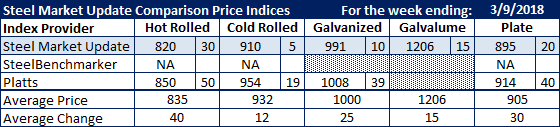

Comparison Price Indices - On Fire!

Written by John Packard

With the final announcement of Section 232 steel tariffs, we saw steel prices spike (again) with double-digit gains on most products followed by Steel Market Update. The prices referenced in the table below are through the week ending March 10, 2018.

Hot rolled prices surged with Platts recording their average as $850 per ton by the end of the week. Steel Market Update pegged our average slightly lower at $820 per ton. However, by the end of the week SMU was capturing offers out of two mills at $870 and $880 per ton ($43.50/cwt and $44.00/cwt FOB Mill). We anticipate prices on our index will rise when we begin collecting data early this week.

Cold rolled prices also rose with Platts taking their number to $954 per ton, while SMU was at $910 per ton on Tuesday based on the prices collected from our SMU survey, which began on Monday of this past week.

Galvanized .060” G90 also increased with SMU moving up $10 per ton to $991 per ton, while Platts numbers rose by $39 per ton to $1,008 (Platts only produces the GI index average once per month).

Galvalume .0142” AZ50, Grade 80 was also higher by $15 per ton to $1,206 per ton.

Plate prices rose, as well, with SMU taking our number up $20 to $895 per ton, while Platts plate number rose by $40 per ton by the end of the week to $914 per ton.

SMU Note: Galvanized prices include $86 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Midwest Mill (includes freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers, we will include them in the average. The weeks where they do not produce numbers (NA = not available), we will not include their outdated numbers in the CPI average.