Analysis

March 7, 2018

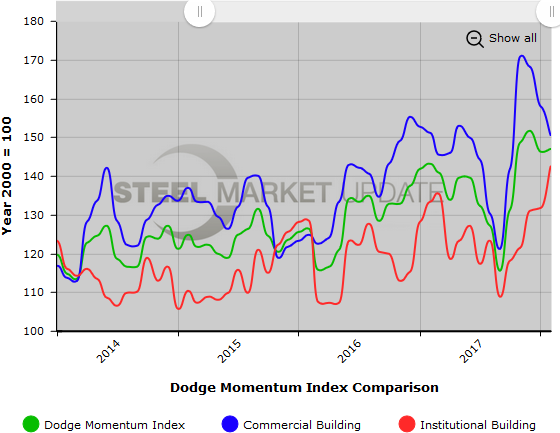

Dodge Momentum Index Tepid in February

Written by Sandy Williams

The Dodge Momentum Index, a monthly forecast of nonresidential construction, increased just 0.5 percent in February. The marginal increase was due to an 8.2 percent rise in the institutional component that was offset by a 4.8 percent contraction in the commercial component.

Dodge says that although the commercial component has declined for two months straight, it should not be taken as an “outright decline in construction activity.” Instead, commercial construction is expected to ease in 2018 as more vacancies appear at offices and warehouses.

Institutional building construction has been supported by state and local bonds issued for schools and other institutional buildings.

In February, 16 projects each with a value of $100 million or more entered planning. The $450 million MSG Sphere Arena in Las Vegas and the $412 million St. Jude’s Children’s Hospital Research Center in Memphis led the institutional sector. Leading commercial projects were the $280 million first phase of the Sentinel Data Center in Sterling, Va., and a $150 million mixed-use project in San Jose, Calif.

The Dodge Momentum Index, published by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which has been shown to lead construction spending for nonresidential buildings by a full year.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.