Market Segment

March 5, 2018

Ryerson Reports Strong Sales Despite Section 232 Concerns

Written by Sandy Williams

Ryerson, a processor and distributor of metals, posted sales of $3.4 billion for 2017, a 17.7 percent increase year over year due to an 11.9 percent increase in the average selling price and a 5.1 percent gain in volume. Net income was $17.1 million for the year.

Gross margins decreased to 17.3 percent in 2017 compared to 20 percent in 2016. Margin compression in 2017 was driven by elevated import levels, pricing volatility and well supplied markets. Warehousing delivery, selling, and general and administrative expenses also jumped in 2017, increasing 8.3 percent year over year to $36.1 million

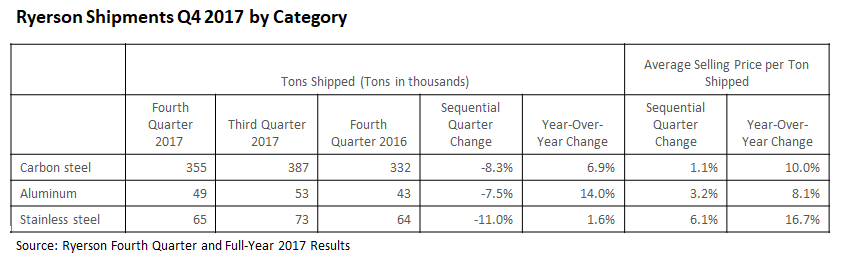

Net income for Ryerson in the fourth quarter was zero after a one-time income tax benefit of $3.4 million offset a loss of $3.4 million for the company. Revenue for the quarter totaled $810.6 million, up 18.8 percent from the year-ago period. The average selling price per ton increased 11.3 percent to $1,725 per ton. Shipments increased 6.8 percent to 470,000 tons.

Ryerson estimates its effective tax rate for full-year 2018 to be in the range of 26-27 percent.

Ryerson expects positive demand conditions for most of its key end markets for the first half of 2018. Construction equipment, HVAC, and the oil and gas sector are growing. Some weakness was noted in consumer durable equipment sectors such as automotive, home appliance and electronics. Aluminum and nickel prices are trending higher and should support and stabilize average industry selling prices. Margins are expected to expand in the first quarter of 2018 compared to fourth-quarter 2017.

Ryerson expects an “upward bias on pricing conditions for metal products in the U.S. for at least the first half of 2018” due to the expected enactment of tariffs on steel and aluminum under Section 232.

Commented President and CEO Eddie Lehner, “Ryerson is well positioned to realize the upside of a strong manufacturing economy provided one thing that has been missing the past nine years, and that is duration, duration and duration. It is an important perspective to look back on the past nine years and realize that demand in the industry is still well below industry averages of the past 25 years and commodity prices have just recovered to levels in place during 2014.”

“It is easy to fall into the trap of headline instant karma. However, we have learned by hard knocks to not get comfortable, as the policy retaining wall that is restraining massive overcapacity is still forming. The key going forward is to track very closely the duration and sustainability of these conditions, while ensuring availability, service and quality to our customers.”

Regarding the impending Section 232 tariffs, Lehner said customers are mostly concerned with availability and continuity of supply.

Kevin Richardson, President, Southeast Region, added that it is still a fluid situation. “We are starting to see an impact on the spot market in terms of anticipation of something happening in tight supply and pricing going up.”

He added, “Right now we’re just weeding through the confusion and committing to communicating in real time as we get updates.”

“I think people are really looking to take care of the next quarter first,” said Lehner. After the next 90 days, they will be looking at whether import flow will be restored or not.

“We’re hearing that folks are starting to think through strategies of at what level they could import over the tariff, at what time are traders going to come back into the market or are traders going to stay out of the market and who is taking the risk of any potential tariffs and duties,” said Lehner.

Regarding reported steel shortages, Lehner said they have received reports that “depots are being cleaned out and people are buying ahead, maybe in excess of even their current demand.” Such buying is likely to result in longer-lead times, and greater pricing pressure in the spot market.

The recent tax reform has been an incentive for long-term capital expense investments by Ryerson’s customers. Ryerson’s executives agree that there is a theme building to automate in the face of a tight labor market in the industrial sector, and for smaller businesses to consolidate.

Mike Burbach, President, Northwest Region, said, “When you take the tax reforms, on top of improving sentiment that started before the tax law change, it really has put a perfect storm together. Activity levels and the attitudes from our customers in virtually every sector are more bullish today than 12 months ago.”

Generational turnover and tight labor conditions are creating opportunities for investment, said Lehner. “I think our customers are going to have to invest in technology. And I think there is opportunity for people coming into the industry to have great careers, because we skipped a generation and a half, effectively. And so you need to combine making investments in equipment and technology with recruiting a new generation of people to come into the industry.”