Market Data

February 27, 2018

SMU Market Trends: Flat Roll Demand on the Increase

Written by Tim Triplett

Flat rolled steel prices have been on the rise since October. Judging by steel demand, that trend is likely to continue.

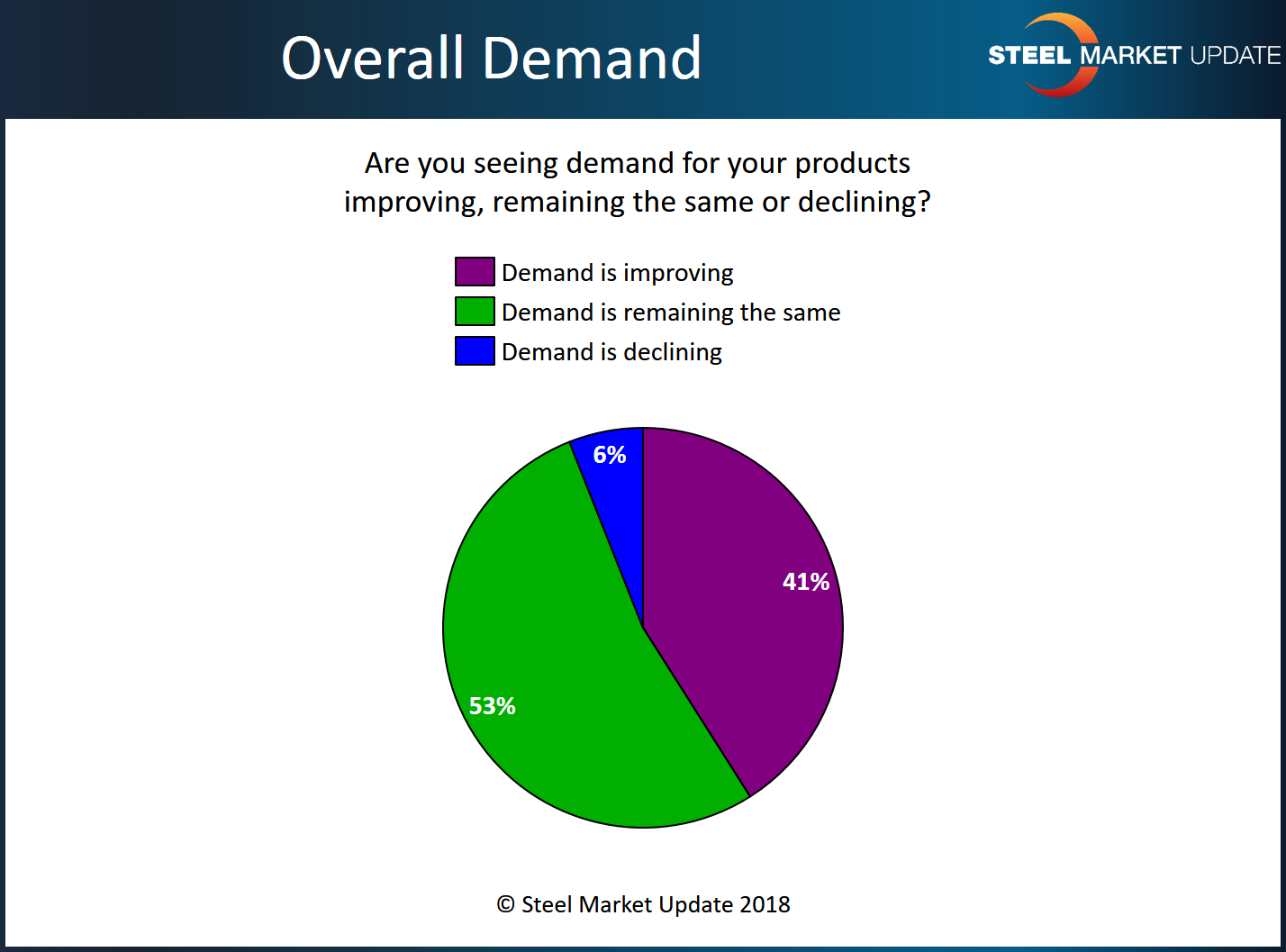

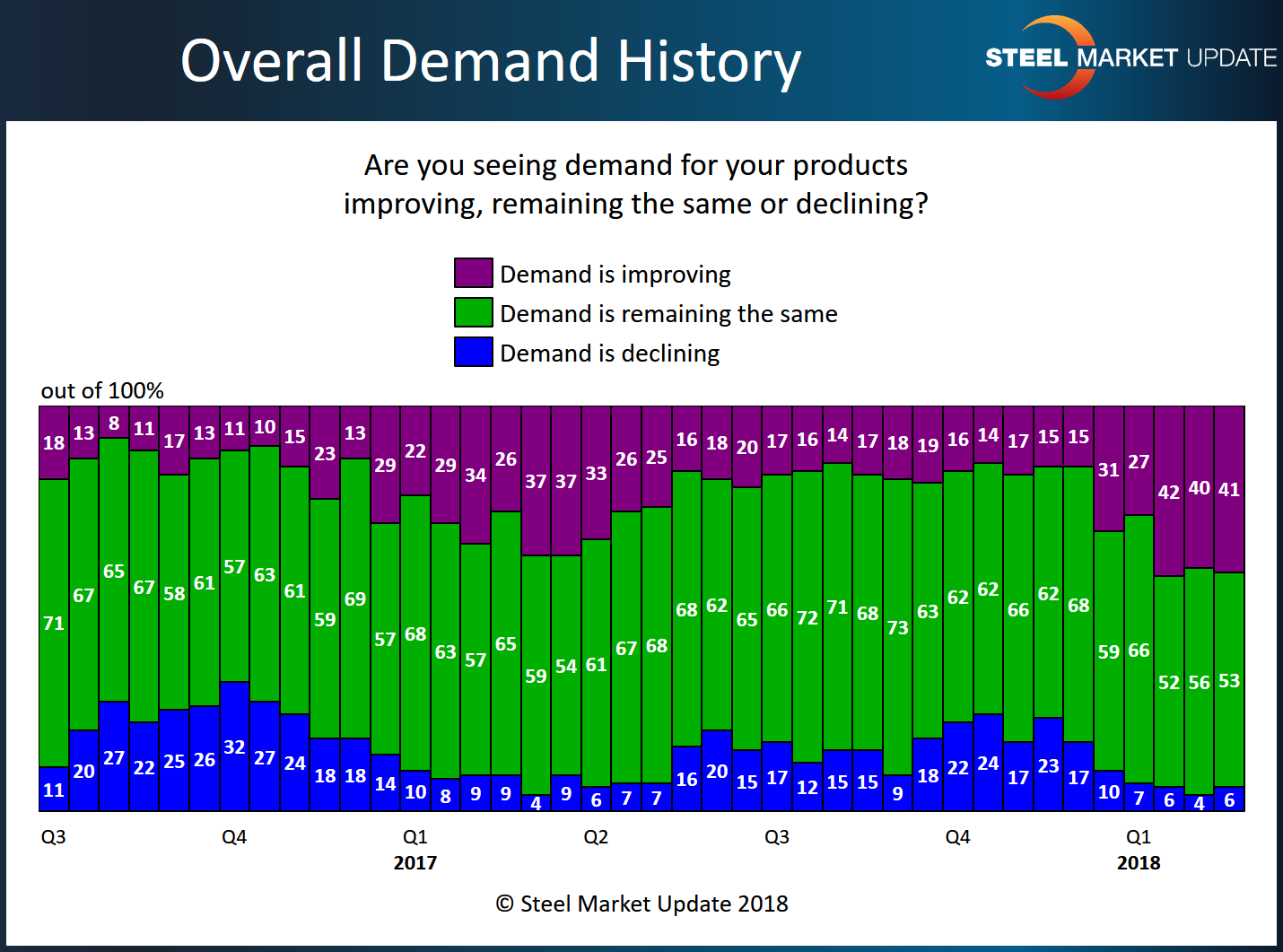

About 41 percent of all the respondents to last week’s Steel Market Update market trends questionnaire reported improving demand for their products. Another 53 percent said demand remained the same. Only 6 percent felt demand was declining.

Thirty-four percent of the service center executives responding to the questionnaire reported that their manufacturing customers are increasing orders, while 58 percent said OEMs are maintaining order flows. Only 8 percent said OEM customers are reducing orders.

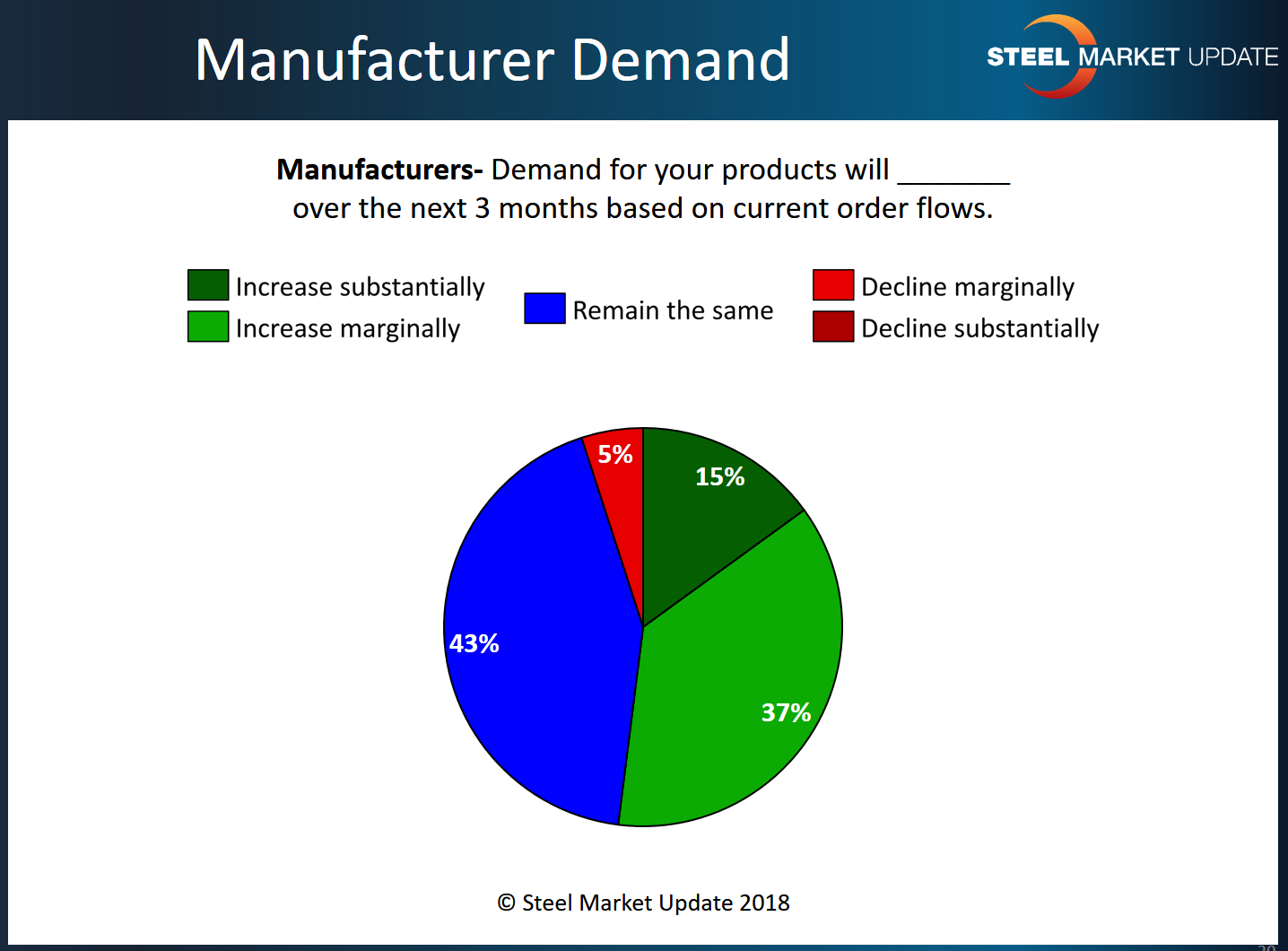

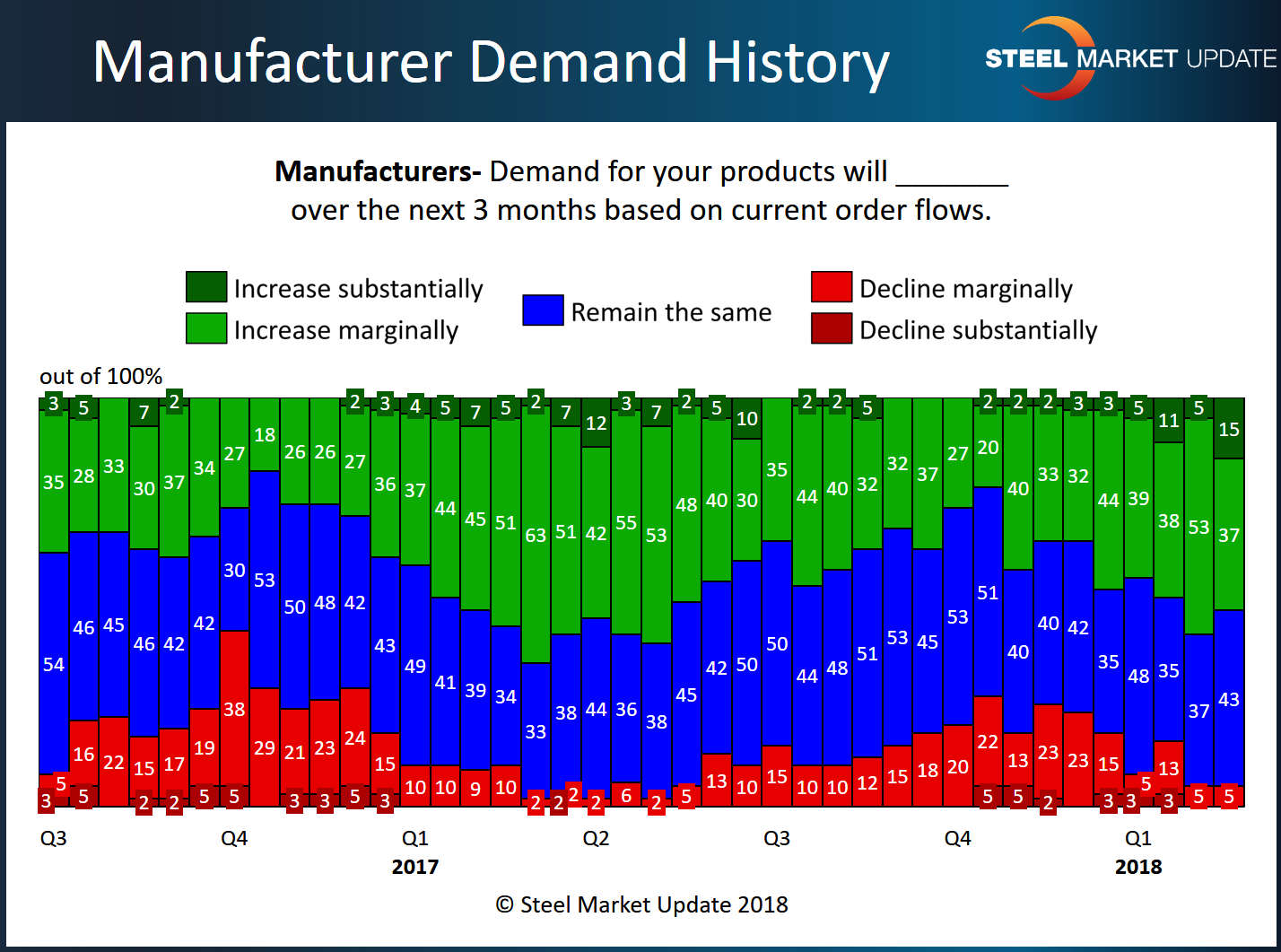

Viewing demand from the OEM perspective, 15 percent of the manufacturers responding to SMU’s questionnaire expect demand for their products to increase substantially in the next three months based on current order flows. Another 37 percent expect demand to increase marginally. Thus, the majority of manufacturers are planning for demand to increase in the coming quarter, to one degree or another. About 43 percent expect demand to remain the same in the next few months, while only 5 percent foresee a decline in demand, and then only a marginal one. Indeed, about 40 percent of manufacturers are already buying more steel than they did at this time a year ago, according to SMU data, while about 53 percent are buying the same amount.

“Demand is above normal,” observed one manufacturer. “Demand continues to slightly improve as we reach mid-February,” said a steel mill executive. But the outlook is not all rosy. “There’s too much uncertainty in the market for customers to feel confident about going long,” commented a service center exec. “We’re starting to see more customers seeking protection from import risks,” added a trader. “Our market share is lost to foreign competitors,” lamented another OEM.