Market Data

February 11, 2018

SMU Analysis: What Does AISI Production Data Say About Unused Capacity?

Written by Tim Triplett

Steel Market Update was contacted this week by an analyst who questioned the accuracy of the American Iron and Steel Institute data published by SMU. He wondered how AISI calculates its weekly mill capacity utilization rates and whether their calculations account for idled furnace capacity. A close look at the AISI data shows the domestic steel industry has a lot of unused capacity.

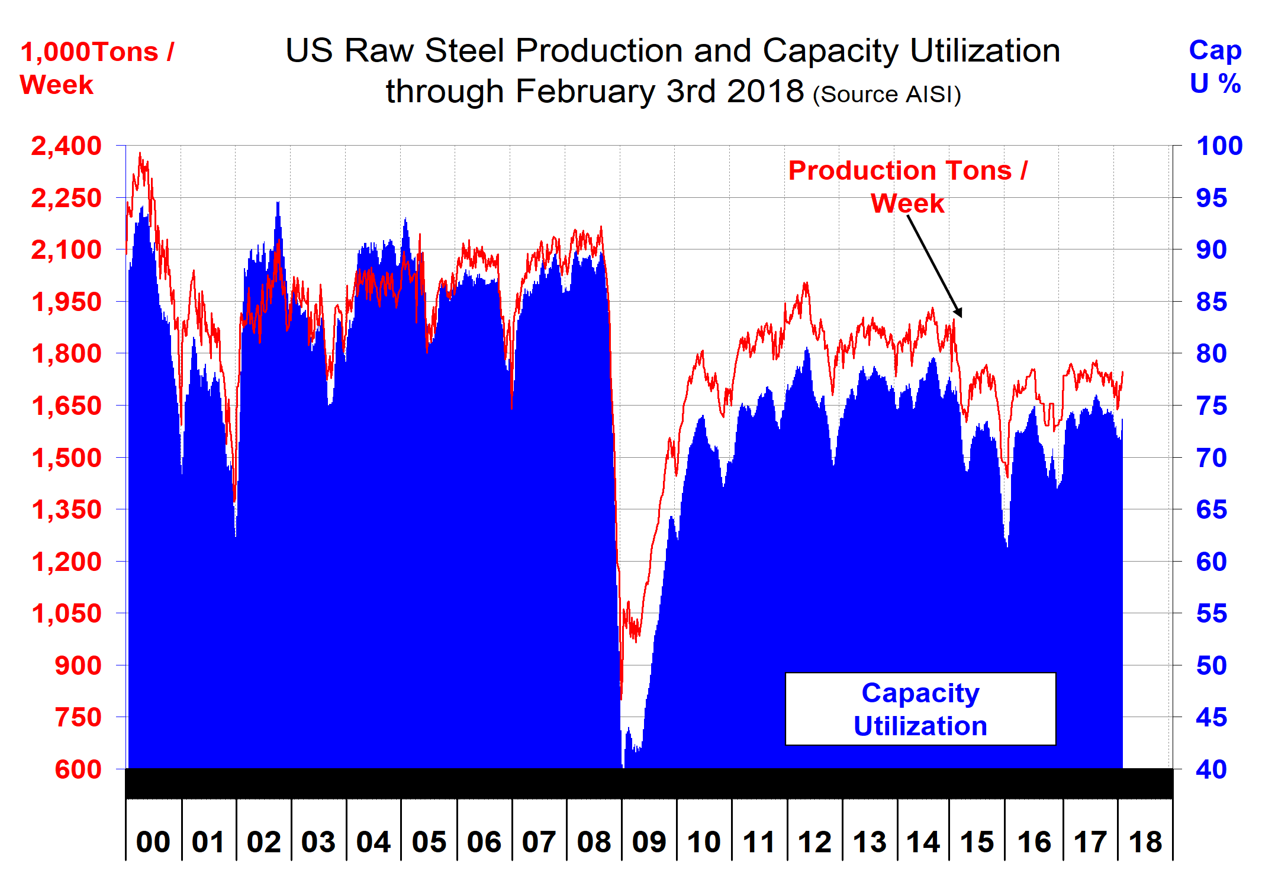

AISI reported raw steel production of 1.747 million tons for the week ending Feb. 3 at 75 percent capacity utilization. Doing the math, that suggests the industry could theoretically produce 2.33 million tons per week at 100 percent capacity or more than 121 million tons per year. Last year, the industry produced about 90 million tons. SMU’s analysis shows that AISI data does reflect mill capacity additions and closures.

Capacity utilization has ranged between 70 and 75 percent for the last two years and hasn’t been above 80 percent, what would be considered full production, since before the market crash in 2008.

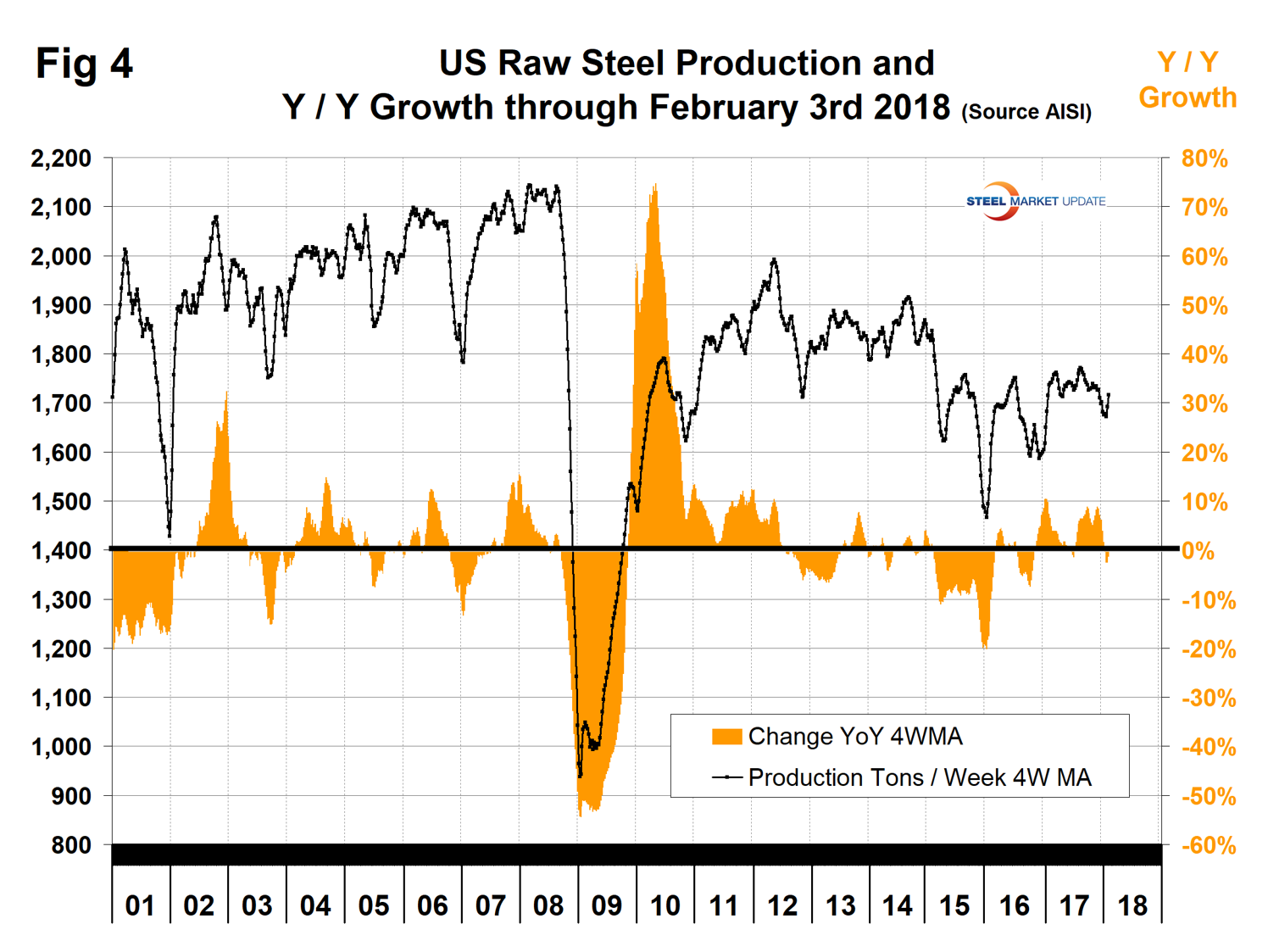

Raw steel production grew by single digits in 2017 but has ticked slightly downward in the first five weeks of 2018.

SMU estimates that sheet mills are running at about 78.5 percent capacity and the long product mills at about 71 percent. Mills could never run at 100 percent capacity for a sustained period if for no other reason than maintenance shutdowns and unplanned outages. Also, the mills do not run just one product that maximizes their rolling capacities. Assuming 90 percent of capacity is the best run rate possible over the long term, domestic capacity totals about 109 million tons, which indicates the mills have roughly 20 million tons of extra capacity at their disposal. In that 20 million tons there are two flat rolled mills with idled blast furnaces that are still counted by AISI as being available. They are USS Granite City (2 blast furnaces) and AK Steel Ashland (1 furnace).

Will the mills keep a tight rein on the steel supply in 2018 or will some break ranks and try to tap into that unused capacity to capitalize on higher steel prices? In SMU’s opinion, the mills have managed supply quite well and are reaping the fruits of their labors with hot rolled prices above $700 per ton. So, the question really is: At what price does it make sense for U.S. Steel or AK Steel (or both) to bring back online blast furnaces?