Market Data

February 8, 2018

SMU Steel Buyers Sentiment Index: Optimism Near Record Highs

Written by Tim Triplett

Current and future sentiment among flat rolled steel buyers remains at or near record highs, according to the latest Steel Market Update Steel Buyers Sentiment Index. The index measures changes in buyers’ optimism levels, which offers insight into their likely decision-making. Three out of four respondents to SMU’s flat rolled market trends questionnaire this week said their company’s chances for success in the current market environment are good, if not excellent. The other 25 percent feel their prospects are fair. None had a negative outlook.

Current sentiment, measured as a single data point, averaged +75 this week, down just a tick from +78 in mid-January, which was an all-time high for the index.

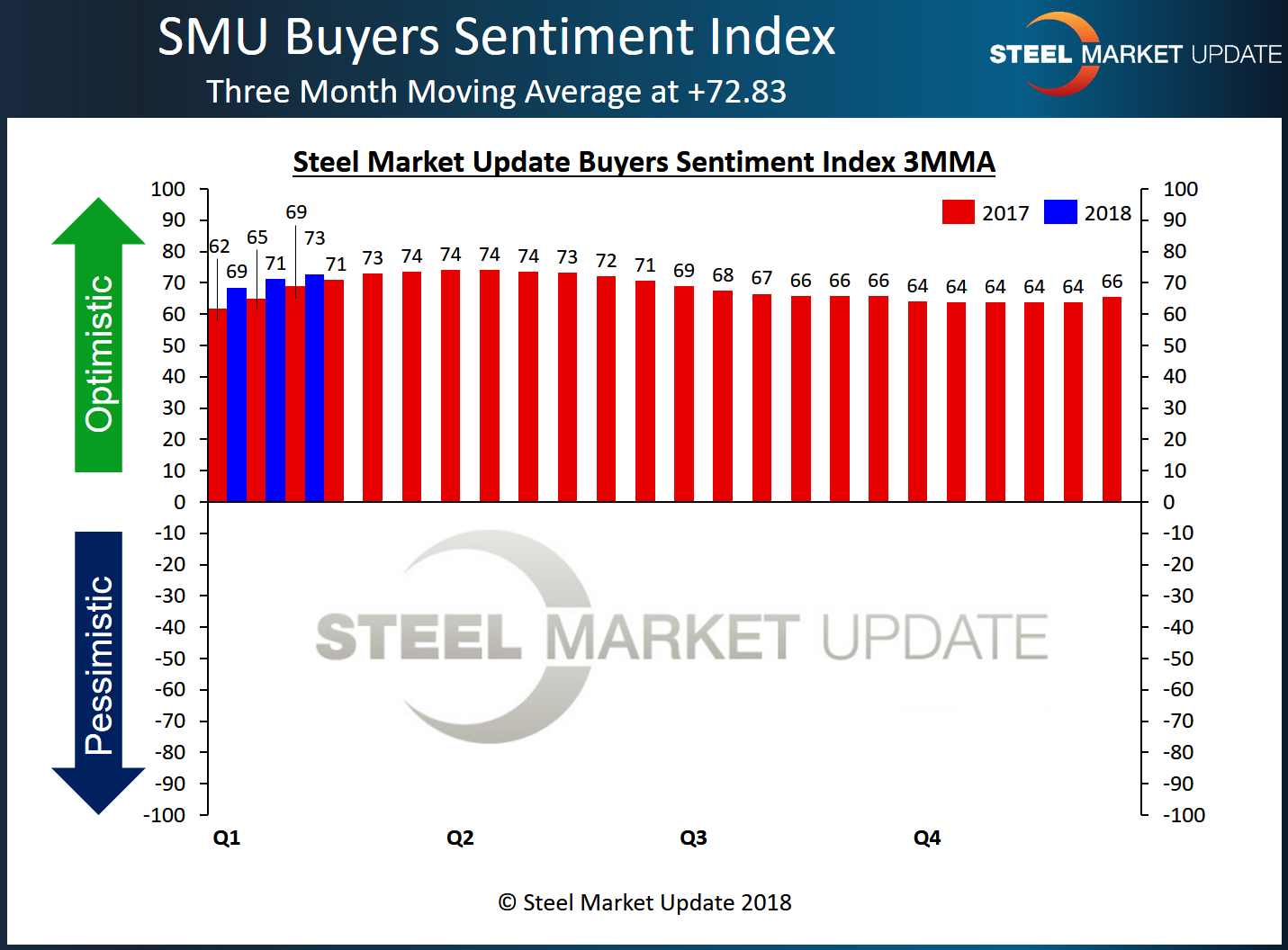

Looking at the data based on a three-month moving average (3MMA), which smooths out the ups and downs and provides a truer picture of the trend, the Current Sentiment 3MMA is at +72.83, up a bit from + 71.33 in mid-January and at its highest level since mid-June.

As you can see by the graphic below, sentiment normally improves at this time of year. However, we are coming into the New Year at the highest (most optimistic) levels we have seen since we first began measuring sentiment in 2008. Steel Market Update expects our Sentiment Index to track on a similar path as what we saw in 2017 (red bars in the graph below) barring any “black swan” event.

Future Steel Buyers Sentiment Index

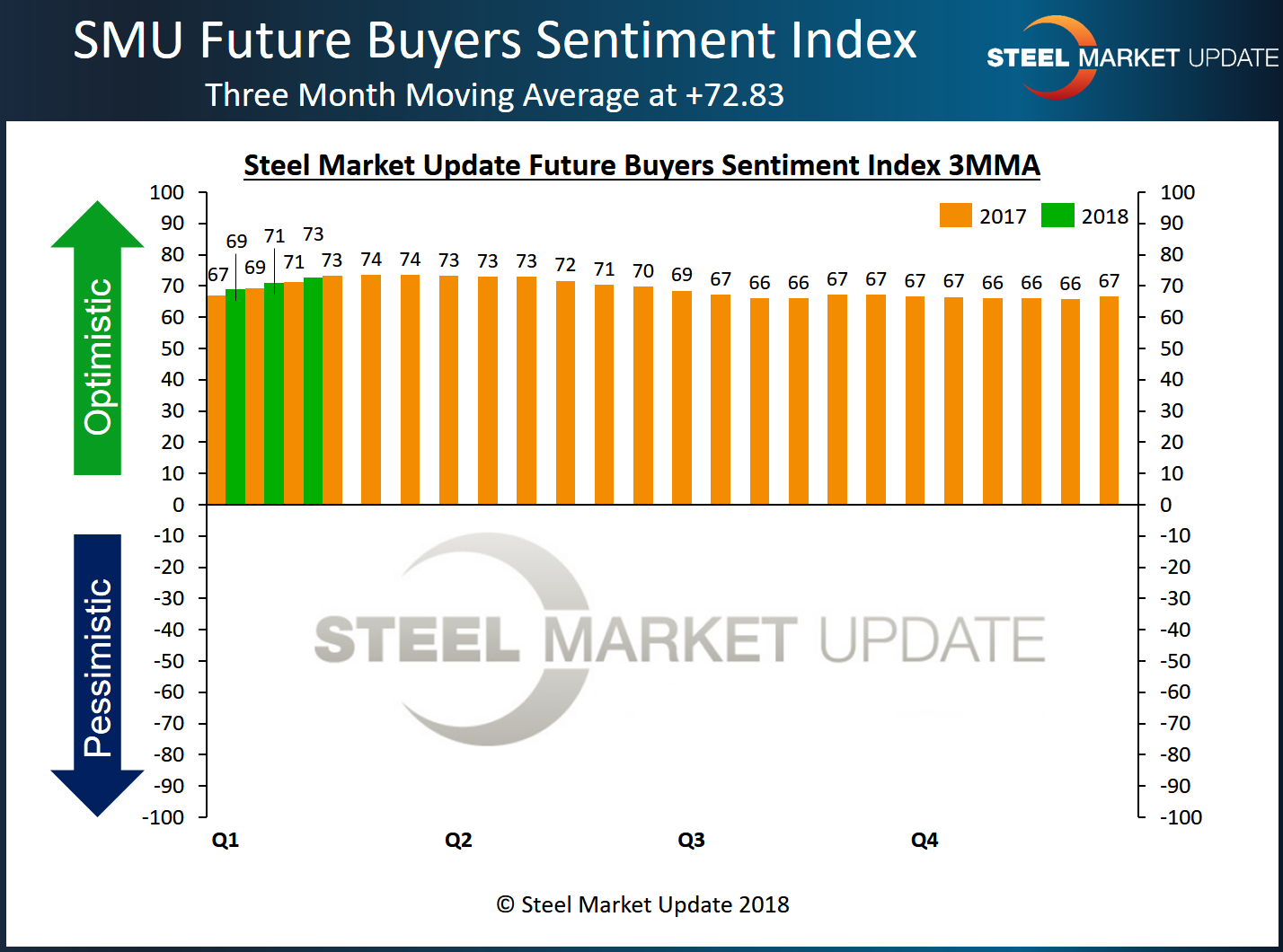

SMU asked respondents how they feel about their company’s ability to be successful three to six months in the future. SMU Future Sentiment indexed as a single data point remained at +77, the record high for the index reached three weeks ago.

As a three-month moving average, Future Sentiment matched the 3MMA for Current Sentiment at +72.83, up from +71.00 in mid-January and also the highest level since June.

What Respondents are Saying

Despite the optimistic sentiment that characterizes the market, steel buyers’ comments reveal lingering concerns about Washington and competition:

- “I’m worried about the back half of 2018.”

- “There’s still way too much uncertainty. Trade action needs to be applied or rejected. People need clarity.”

- “There are so many variables in this market, it’s like wading through alligators.”

- “Contractual business is brutally competitive, which will definitely pressure margins.”

- “There’s positive momentum. However, the distribution market is selling well under replacement cost (even at contract discounts), which makes stocking new steel precarious.”

- “If Washington gets their act together and the stock market settles down, things should move forward just fine.”

- “I’m starting to get nervous that without some Section 232 action, we could see a pricing cliff ahead.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 38 percent were manufacturers and 49 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.