Market Data

February 8, 2018

SMU Market Trends: Negotiations Tighten on Hot Roll, Galvanized

Written by Tim Triplett

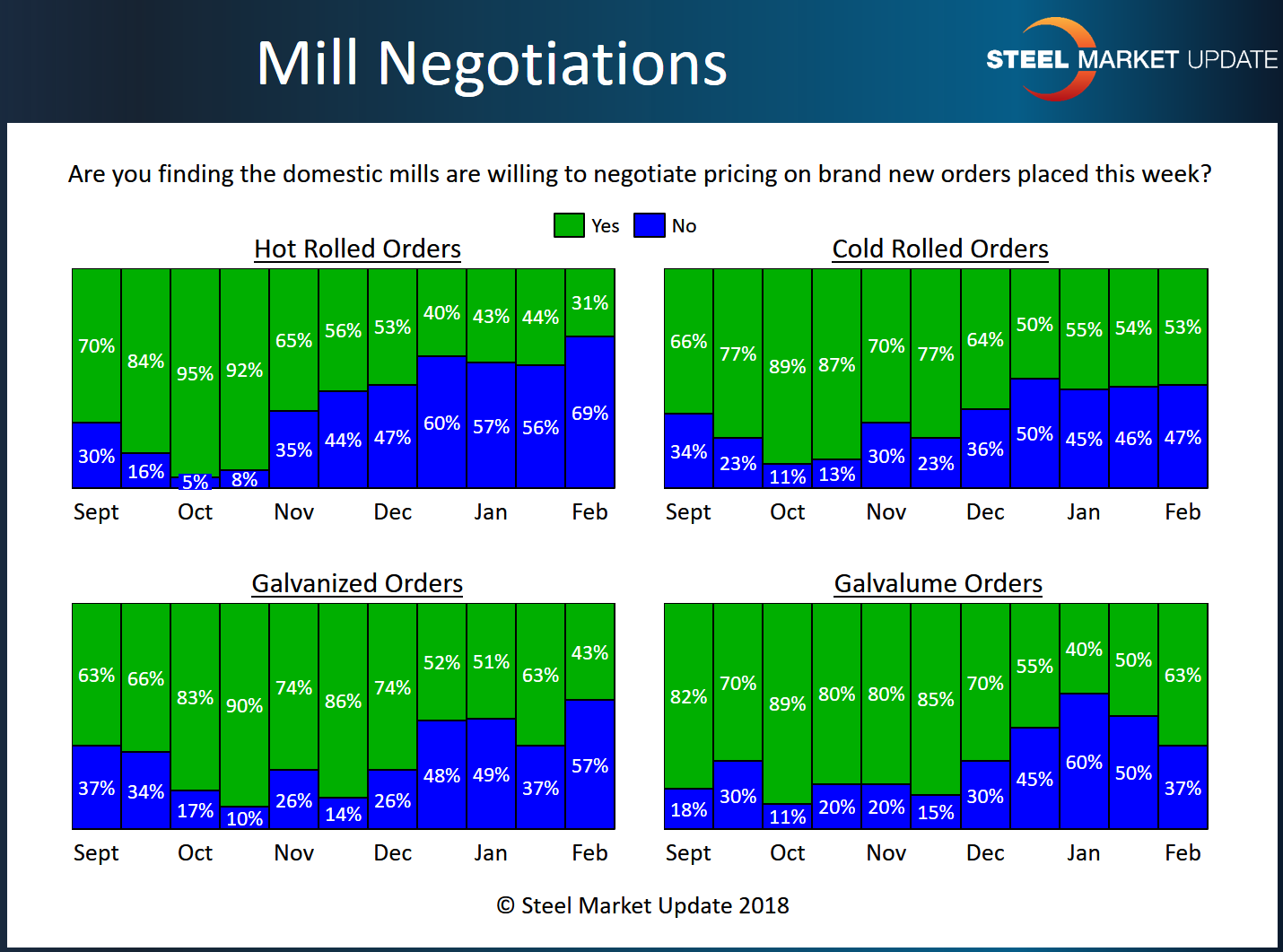

Suppliers of hot roll and galvanized products are less willing to talk price than they were in mid-January, reported steel buyers, as the mills seek to collect their latest price increases. Cold roll negotiations are unchanged, and Galvalume talks may have loosened a bit.

Overall, about 40 percent of respondents to Steel Market Update’s latest market trends questionnaire reported that mill order books are firm and there’s no negotiating on price. The other 60 percent said they have found some mills willing to negotiate to varying degrees.

By market segment, 69 percent of SMU respondents said the mills are holding firm on hot rolled steel orders, while only 31 percent have found mills willing to negotiate. That compares to 56 percent holding the line and 44 percent open to price negotiations in mid-January.

Like hot roll, talks in the galvanized sector between mills and buyers have gotten more contentious. Fifty-seven percent of buyers said the mills are standing firm on galvanized prices today, up from just 37 percent who said the mills were holding the line on coated products in mid-January.

In the cold roll segment, there has been little change in negotiations over the past few weeks. A slim majority (53 percent) said they have found some mills willing to talk price, while nearly the same number (47 percent) reported mill prices as non-negotiable.

Talks have loosened a bit in the Galvalume market, where 63 percent of buyers reported mills willing to dicker on price. Three weeks ago, it was a 50-50 proposition whether Galvalume suppliers would have any flexibility on price.

Following are some buyers’ comments about current negotiations:

• “The mills put on their tough faces this month.”

• “In the entire country, we only see one coating mill willing to negotiate.”

• “We feel order books are firm, but there is still some negotiation in competitive situations.”

• “The mills are trying hard to hold the line and establish a new price floor both for contract and spot prices, as well as to take advantage of the tight supply situation that they are promoting. However, there is some room in pricing depending on the mill, product and volume.”

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.