Market Data

February 8, 2018

SMU Market Trends: Flat Roll Lead Times Extending

Written by Tim Triplett

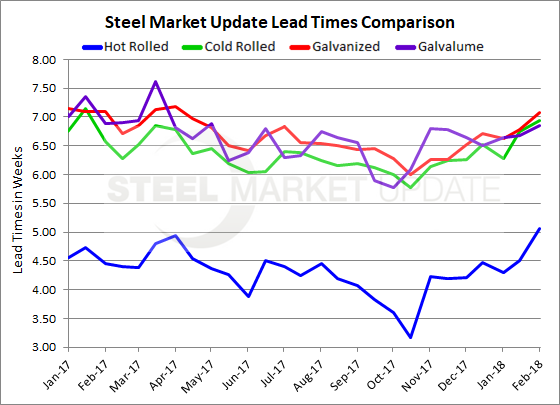

Mill lead times on flat roll continue to extend as buyers order steel ahead of further price increases. The latest data from Steel Market Update’s market trends questionnaire indicates that the average lead time for hot roll has now topped five weeks, while lead times for cold roll, galvanized and Galvalume are now approximately seven weeks.

One of the key indicators tracked by SMU, lead times reflect the activity at the mills and the order levels they are seeing from their customers. Lead times have been lengthening steadily since November through four rounds of mill price increases, reflecting buoyant demand as 2018 gets off to a strong start.

Hot rolled lead times now average 5.07 weeks, up from 4.50 weeks in mid-January, and at the highest level since June 2016.

Cold-rolled lead times average 6.93 weeks, a jump from 6.27 weeks a month ago, and at their longest since January 2017.

Galvanized lead times moved up to 7.08 weeks from 6.63 weeks one month ago. The galv lead time was at 6.0 weeks in mid-October, and thus has moved out by a full week over the past three and a half months. Galvalume lead times, at 6.86 weeks are up slightly from 6.64 weeks one month ago.

Overall, 55 percent of steel buyers reported that mill lead times are extending, while another 42 percent consider lead times normal for this time of year. Only 3 percent of respondents said lead times are shorter than expected. “Some mills are way behind. Most mills are shipping late,” commented one buyer.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.