Analysis

February 8, 2018

Dodge Construction Index Dips 5.1% in January

Written by Sandy Williams

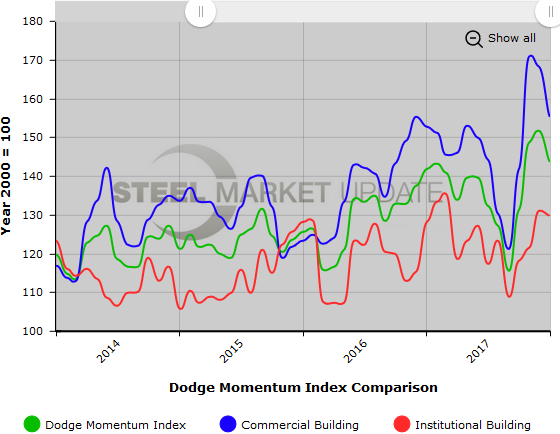

The Dodge Momentum Index fell 5.1 percent in January to 143.7 from December’s revised score of 151.5. On a year-over-year basis, the index gained 7.7 percent.

The Dodge Momentum Index, published by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which has been shown to lead construction spending for nonresidential buildings by a full year.

The commercial construction component dragged down the index in January with a drop of 7.8 percent. The institutional planning component inched down 0.9 percent.

“The fourth quarter of 2017 was particularly strong for the Momentum Index, and January’s retreat returns it to a more sustainable level,” wrote Dodge Data & Analytics. The 7.7 percent gain in the year-over-year index, said Dodge, suggests that nonresidential construction should continue to post moderate gains in 2018.

Five projects with a value of $100 million or more entered the planning stage in January. The leading commercial project was a $200 million office building in Boston. The leading institutional project was a $440 million water park in Branson, Mo.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.