Analysis

February 1, 2018

CAR Forecast: Mild Recession, Changes in Steel Use

Written by Sandy Williams

The automotive industry downturn is slight, especially considering the past two years have been record years, said Bernard Swiecki, Senior Automotive Analyst at the Center for Automotive Research, during a presentation Jan. 25 at the regional meeting of the Association of Steel Distributors.

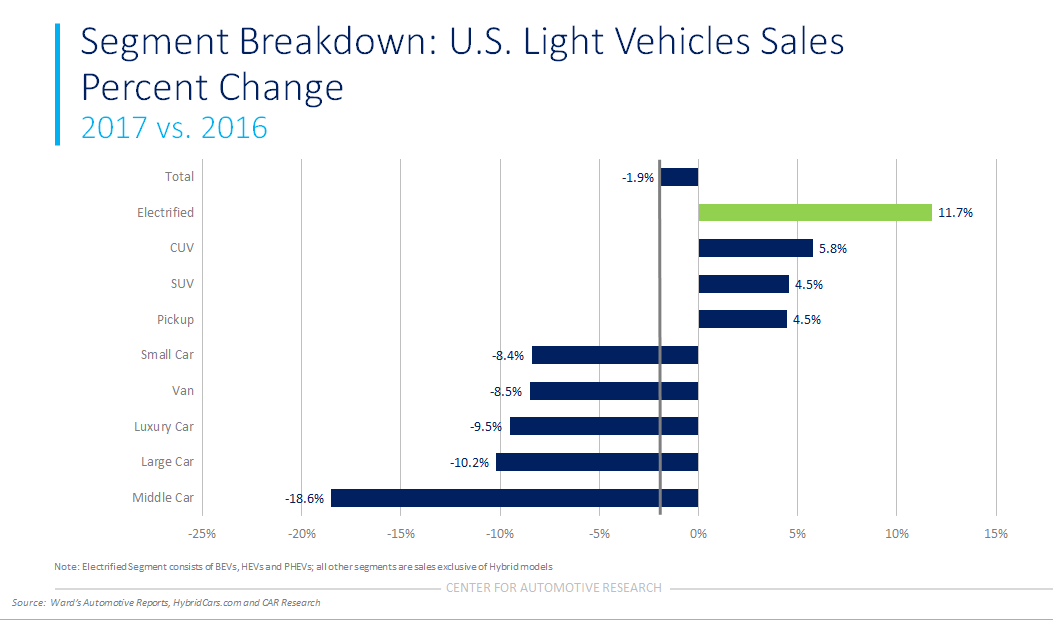

Total light vehicle sales slipped 1.8 percent in 2017, but the trend for subcategories in the industry is more important, said Swiecki. Sales of sedans fell 11 percent, but sales of higher profit pickup trucks increased 4.5 percent. CUVs dominated one-third of the market. The cross-over utility vehicle, built on a passenger car frame, is the vehicle of choice followed by SUVs and light pickup trucks. Sales of larger vehicles are supported by lower fuel costs and a robust economy.

Electrified vehicles, including conventional hybrids, plug-in hybrids, and pure battery are 3.3 percent of the market. They are the fastest growing segment in America at 11 percent, although since it is a very small portion, a few units make a big percentage change. Electric vehicles that plug-in are selling best, but low gas prices are impeding sales.

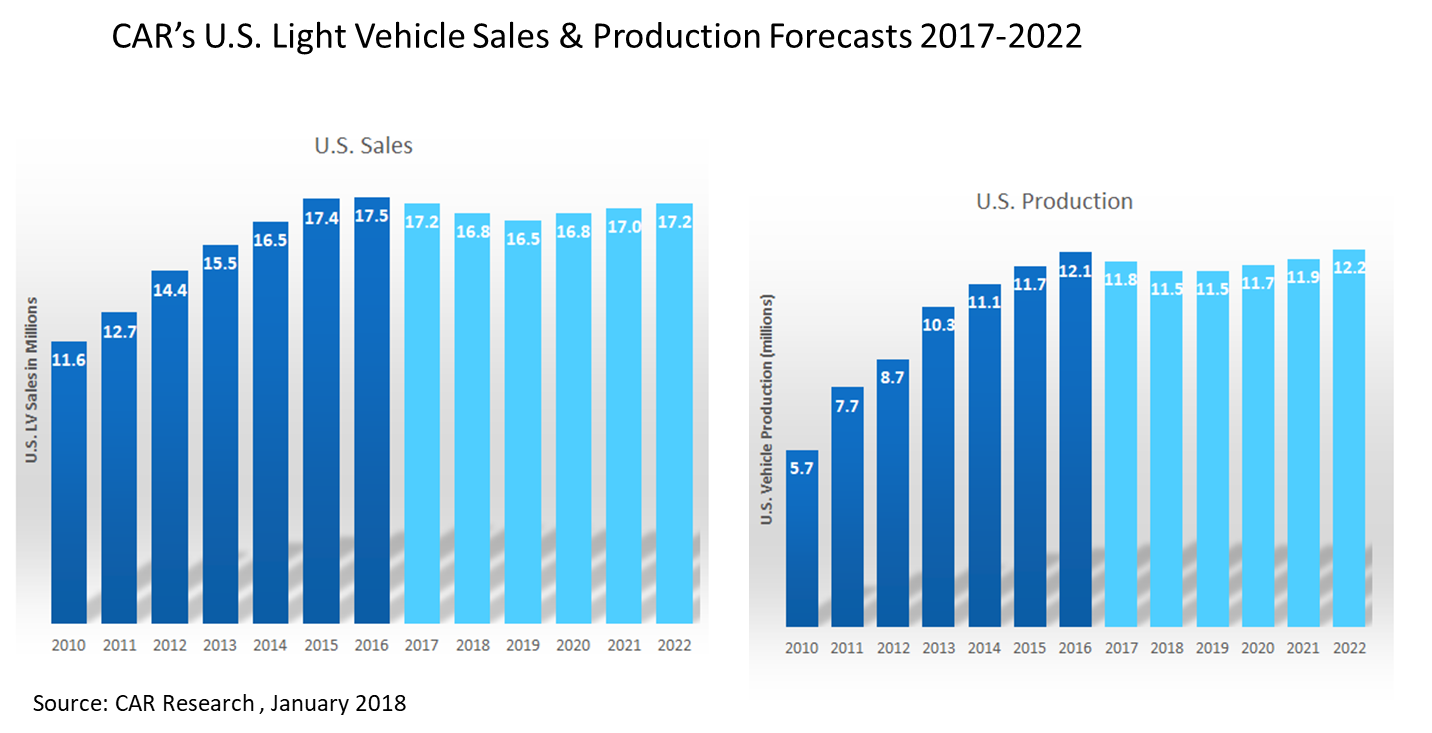

CAR’s forecast for U.S. automotive sales bottoms out in 2019 at 16.5 million units. During the last recession, from peak to trough, the industry lost about 7 million units. Comparing that to the 2019 forecast, which predicts a downturn in the economy, only about 1 million units will be lost during this next mild recession, roughly the equivalent of four assembly plants spread across the industry. “If that is the drop, you are doing okay,” said Swiecki. Production of vehicles is following a similar path as sales.

Positive indicators in the forecast include a strong labor market with low unemployment and underemployment. Growing wages are supporting record transaction values in auto sales, as are a rising stock market and personal net worth.

On the negative side, subprime loans are a growing problem. Loan defaults and vehicle repossessions are at an all-time high. Increased restrictions and rising credit interest rates are making it hard for consumers to get credit. Three more interest rate hikes are expected this year, which will be problematic for car buyers, said Swiecki.

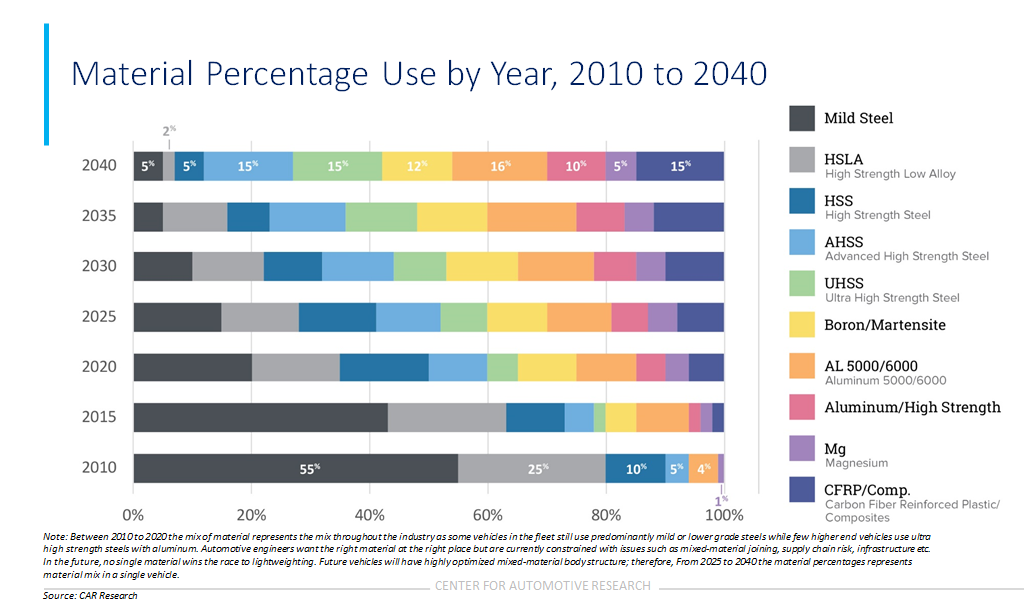

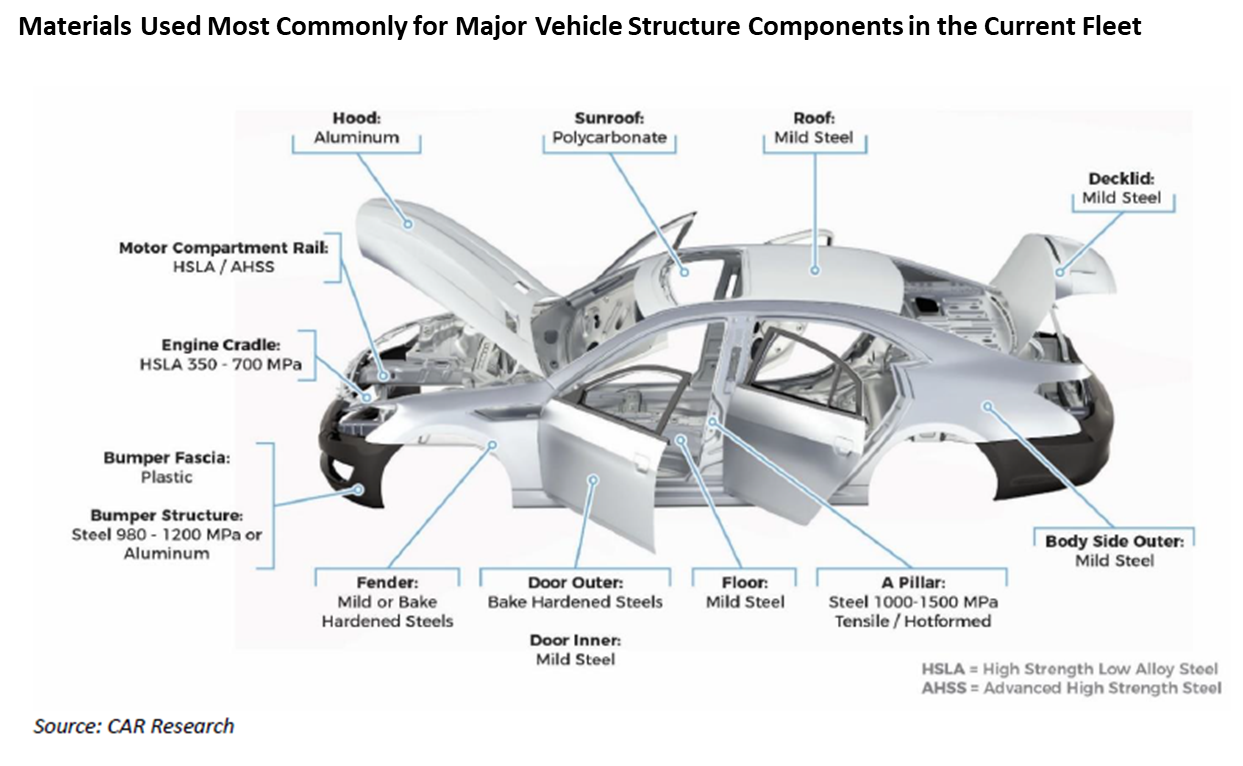

Material Mix to Change in Future Vehicles

Moving on to automotive materials, steel is still the predominant choice with aluminum making entry way on closures, Swiecki said. The primary joining method is resistance spot welding with some adhesives. For 2020, more high-strength and ultra-high-strength steel is expected along with more aluminum closures, much of which is already being pulled through in 2018. Although the GM pickup doesn’t use aluminum in its bed like the Ford F-150, the truck is expected to become more aluminum-intensive with aluminum replacing steel in doors, tailgate and hood, he said, citing one vehicle example. More carbon fiber and adhesives are in the forecast.

In 2025-2030, the trend will continue with more carbon fiber showing up in truck beds and adhesives becoming the joining technology of the future. While still in its infancy, 3-D printing of parts has big expectations, said Swiecki.

By 2020, mild steel in vehicles will have fallen by two thirds, and by 2040 mild steel will total only 5 percent of the composition of an average vehicle, according to CAR forecasts. High-strength, advanced high-strength and ultra-high-strength steel percentages will account for a total of 35 percent of material use by 2040. The rest will be a combination of aluminum and composite material (see chart below), CAR predicts.

During a brief question and answer period, ASD members wanted to know how millennials using Uber and ridesharing may affect future automotive sales. Although millennials initially showed an aversion to purchasing vehicles, partly due to college debt, they are getting older, marrying, moving to the suburbs and becoming more like their parents. As children are added into the equation, owning a vehicle becomes more attractive, Swiecki said.

Fully autonomous cars are currently used in tightly controlled and measured environments and those that will be able to travel anywhere are too far in the future to predict, he said. Shared vehicles, whether autonomous or not, will have increased use and wear out quicker resulting in faster replacement. The average age of a car on the road today is 12 years, but that may decrease going forward.

Commercial fleets may benefit from the new tax bill, said Swiecki. Amortization can be written off sooner and extra savings could encourage purchase of assets including automobiles.

For individuals, the tax savings per year may not allow the purchase of additional cars, but may spur consumers to purchase more options or a more expensive vehicle.