Market Segment

February 1, 2018

ArcelorMittal NAFTA Results Weaker in Q4

Written by Sandy Williams

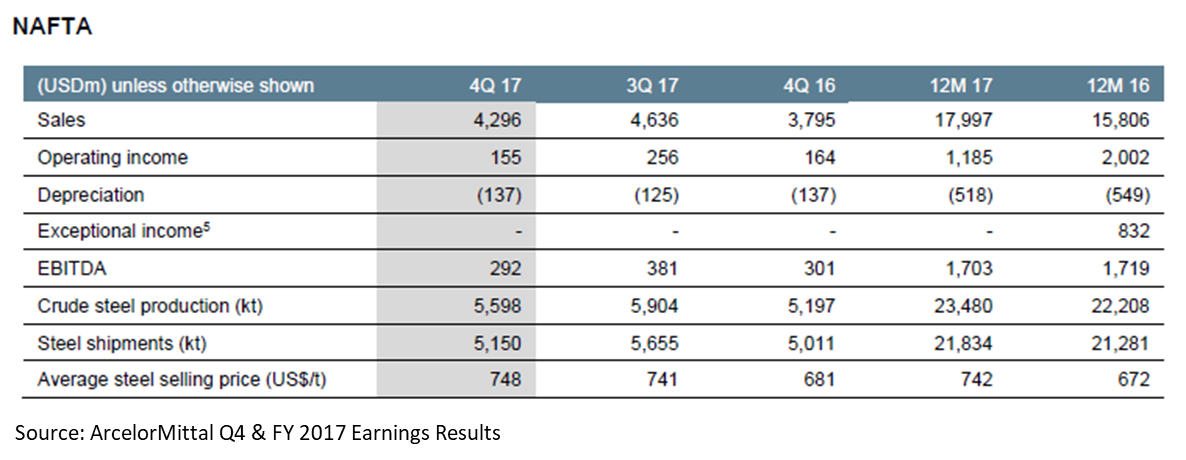

ArcelorMittal’s NAFTA segment saw crude steel production decrease 5.2 percent to 5.6 million metric tons in the fourth quarter due to operational issues in Mexico, planned maintenance at Dofasco, and a slower U.S. market.

Steel shipments declined 8.9 percent to 4.2 million metric tons, primarily driven by lower volumes in flat and long products. Sales of $4.3 billion dropped 7.3 percent with higher average steel selling prices partly offsetting lower shipment volumes. The average steel selling price increased 0.8 percent to $748 per ton in the fourth quarter and averaged $742 per ton for the year. Long products drove the higher prices with the average selling price up 1.5 percent.

The “footprint optimization” project at Indiana Harbor was completed last year with the closure of its 84-inch hot strip mill (HSM) and idling of the No. 2 steel shop. Benefits were realized in 2017 following the startup of the new caster at the No. 3 steel shop in late 2016. Restoration of the 80-inch hot strip mill and finishing line is expected to be completed in 2018.

The installation at Burns Harbor of two walking beam furnaces will improve hot rolling quality and productivity while reducing energy consumption, the company said. The project is scheduled for completion in 2021.

Automotive qualifications are continuing at Calvert. Capacity utilization increased 10 percent in 2017.

Construction has commenced at the $1 billion hot strip mill in Lazaro Cardenas, Mexico. The project is expected to be completed in 2020.

The company also recently announced it will invest in furnace replacements at its Quebec wire rod and bar facilities, which will be completed by the first half of 2020.

ArcelorMittal expects favorable steel growth in the U.S., with apparent steel consumption up in the range of 1.5 to 2.5 percent in 2018. Stronger demand is anticipated in machinery and construction, as well as pipe and tube.

ArcelorMittal overall saw total shipments in the fourth quarter drop 3.3 percent to 12.0 million metric tons, primarily due to lower shipments in the NAFTA segment. Sales in Q4 totaled $17.7 billion compared to $17.6 billion in the third quarter. Net income for the fourth quarter was $125 million compared to $117 million in Q3 2017 and $14 million in Q4 2016.

During the earnings call, Chairman and CEO Lakshmi Mittal said he is encouraged by the 115 million tons of capacity reductions completed by China and lower exports in 2017. However, ArcelorMittal believes China’s steel capacity was underestimated and 150 million tons still remains to be shut down. Hopefully, China can moderate production to demand or exports may increase again, said Mittal.

Outages at the Mexican and Canadian operations in the fourth quarter cost the company $15 million to $20 million and 200,000 metric ton in lost shipments. CFO Aditya Mittal expects NAFTA shipments and price margins to increase in the first quarter.

Answering questions on the automotive market volume, Aditya Mittal said ArcelorMittal has more exposure to passenger vehicles, which have been a declining segment of the automotive market. The company is making strides in advanced high-strength steels for automotive and believes it will be able to take advantage of the growth in electric battery vehicles.

Regarding electric vehicles, he said, “Historically, we are using all aluminum, but now we’re using the combination of primarily steel. And these are advanced high-strength steels, exactly the strength and specialty of ArcelorMittal.”

“The engagement we have with our auto customers, traditional and nontraditional, leaves us confident that steel will continue to be an important material for vehicles through electrification and beyond,” said ArcelorMittal in its slide presentation. “Factors like safety will continue to be important, and here steel has a strong competitive advantage, combined with flexibility and cost.”

Lakshmi Mittal said the U.S. tax reform has no significant impact on ArcelorMittal in 2018. “The major impact is, hopefully, it will spur more investment in the U.S., more consumers. I read about the tax bonuses, so I hope they will buy more cars.”

Mittal was asked if the NAFTA renegotiations will affect the company’s investments in the Mexican sheet business. “We believe that our Mexican investment was planned much before these NAFTA negotiations begin,” he said.” And we clearly believe that in view of our flats’ really competitive situation in terms of price, cost and quality, converting those slabs into high-value products through downstream investment was the right decision, irrespective of the NAFTA conclusion.”