Market Data

January 31, 2018

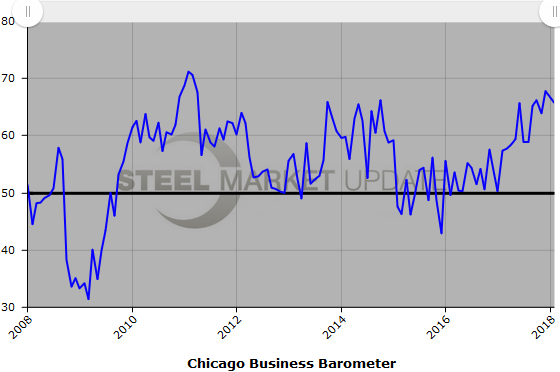

Chicago Business Barometer Retreats in January

Written by Sandy Williams

The Chicago Business Barometer retreated 2.1 points in January to 65.7, but remained an encouraging start for 2018. The barometer was 28.3 percent higher than the January 2016 reading and above the average of 63.7 in the second half of 2017.

New orders and output slowed in January. Orders were at a five-month low accompanied by a decline in production. The slowdown allowed firms to catch up on backlogs, dropping the index reading for order backlogs to its lowest level since May.

Supplier delivery times were longer and inventories were marginally lower after the three-year high in December.

More firms expressed their intention to add employees, pushing the employment indicator to a near six-year high and over the 60 mark.

Factory gate prices rose and firms reported higher prices for steel, wood and resin.

In a special question, survey participants were asked how tax reform would impact their businesses and the economy. Most, 63.5 percent, said reform would benefit both companies and the economy, while 11.5 percent said it would benefit business but may not be in the best interest of the country.

Jamie Satchi, economist at MNI Indicators, said that although the survey metrics were somewhat softer in January, business sentiment remains robust. “This was the best January result in seven years, capped off by the Employment indicator rising to its highest level in almost six years,” said Satchi. “Still, inflationary pressures remain elevated and show no signs of abating, something that should be at the forefront of the Fed’s mind.”

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.