Market Segment

January 30, 2018

Nucor Delivers Best Yearly Results Since 2008

Written by Sandy Williams

In its year-end 2017 financial report, Nucor delivered its highest annual earnings since 2008. Consolidated net sales increased 25 percent to $20.25 billion, compared with $16.21 billion for fiscal 2016. Shipments to outside customers during 2017 totaled 26,492,000 tons, an increase of 9 percent from fiscal 2016. Average sales price per ton increased 15 percent.

The company reported net earnings of $383.9 million for fourth-quarter 2017, which included a $175.2 million federal tax benefit from legislation enacted during the quarter. Consolidated net sales fell 2 percent to $5.09 billion, but were 29 percent higher than the same quarter a year ago.

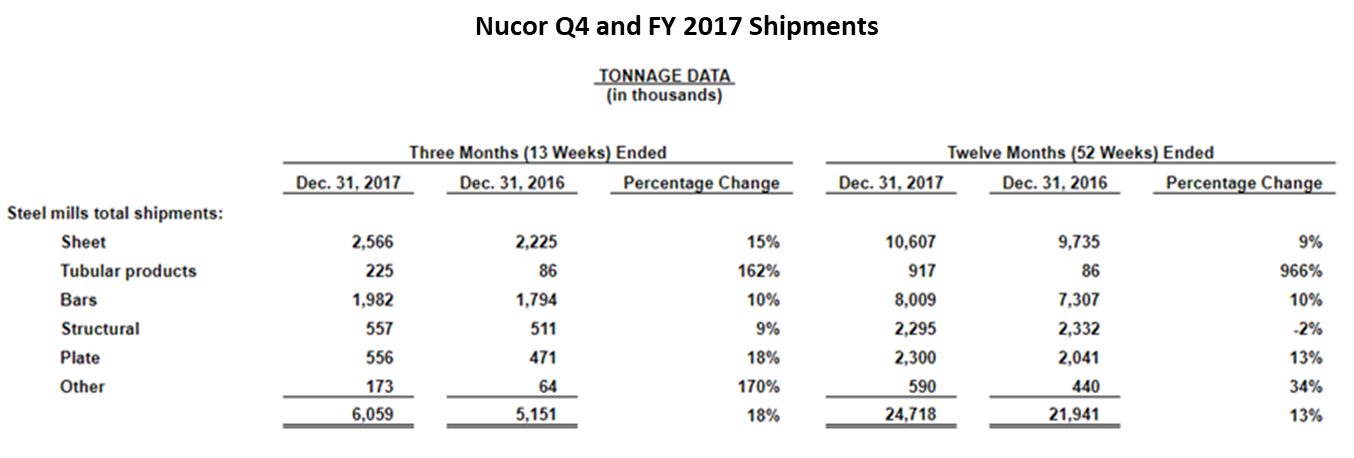

Nucor’s fourth-quarter shipments totaled 6,542,000 tons, down 1 percent from Q3 and 13 percent higher than Q4 2016. Steel mill shipments decreased 2 percent from Q3 and 18 percent from Q4 2016. Fourth-quarter downstream steel products shipments to outside customers decreased 3 percent from the third quarter of 2017 but increased 13 percent from the fourth quarter of 2016. Average sales price per ton was comparable with the third quarter.

Shipments to the automotive market in Q4 totaled 1.5 million tons, 1.2 million tons of which were sheet products.

Nucor has two major bar mill investments under way. A full-range merchant bar quality (MBQ) mill will be constructed at its existing steel mill located in Bourbonnais, Ill. The mill will have an annual capacity of approximately 500,000 tons, cost $180 million and take two years to complete. The project will allow Nucor to fully optimize the melt capacity and infrastructure at the existing bar mill, the company said. The mill is located in an area of plentiful scrap supply and enhances Nucor’s commercial footprint in the central United States.

Nucor will also build a 350,000-ton rebar micro mill east of Kansas City in Sedalia, Mo., at a cost about $250 million. Startup is anticipated in 2019 pending regulatory approvals and state and local incentives. The mill will provide rebar to the Kansas City, upper Midwestern and Plains markets that are currently supplied from outside the region. The location takes advantage of the region’s abundant scrap provided by Nucor’s scrap business, The David J. Joseph Company.

Nucor is expanding its product offerings with a specialty 500,000-ton capacity cold rolling facility at its Arkansas sheet mill that will be able to produce 2,000 megapascal steel. A 72-inch hot band galvanizing line is being built at the Gallatin Kentucky mill and will be the lightest hot weld galvanizing line in North America. The Kentucky line will have an annual capacity of 500,000 tons. Both projects are scheduled for start-up in the first half of 2019.

Start-up of the Nucor/JFE galvanizing facility in Mexico is expected late in the second half of 2019. Nucor will provide half of the substrate required from its sheet mills. The project will expand Nucor’s automotive presence in Mexico and the global automotive market.

The performance of the Louisiana DRI mill was deemed unacceptable by Nucor, prompting an intensive review of processes and equipment. Nucor hopes to have an analysis ready to share by mid-2018. Utilizing DRI from its own plant will become more important as prime scrap becomes less available, the company said. Some scrap is lost when manufacturers move offshore, and the quality deteriorates when scrap is used over and over again. Currently, Nucor uses 15-20 percent pig iron, 20-30 percent DRI, and the rest prime and obsolete scrap.

CEO John Ferriola said that customers are more optimistic about the market than they have been in a long time and are seeking larger steel volume commitments. Nucor says it is in prime position to benefit from an infrastructure bill when it is eventually passed by Congress.

The electrode shortage continues, but because of its long-term contracts with suppliers, Nucor will not be impacted by higher electrode prices until later in the year.

During the earnings call, Ferriola was asked if many EAF mills can make the lightweight high-strength steels that the automotive market requires. Ferriola said he cannot speak for other minimills, but claimed Nucor Hickman’s special cold mill can produce ultra-high-strength steel very efficiently.

Asked about truck availability, Joe Stratman, Chief Digital Officer, said the company is not immune to supply and demand issues in the transportation sector. Logistics is a major cost issue, as well as a customer service issue. Nucor’s Memphis logistic center works to coordinate activities across the Nucor enterprise. The company owns 200 trucks and has 100 dedicated contract trucks at its disposal. Additionally, Nucor sources from over 1,000 trucking companies in its geographical region. “We can allow our companies a lot of reload or next load opportunities; 20-25 percent of those who drop their load reload at another facility,” he said.

Nucor also has 2,700 rail cars that handle scrap and steel, as well as barge contracts that transport 15 percent of tonnage by water.