Market Data

January 30, 2018

Consumer Confidence at a Level Not Seen Since 2000

Written by Peter Wright

Consumer confidence dipped slightly in December, but recovered in January and remains at an extremely high level, according to The Conference Board’s January Consumer Confidence Survey. The composite value of consumer confidence in January was 125.4, up from 123.1 in December. Last July, the composite reached 120 for the first time since November 2000 and has been above that level ever since. The three-month moving average (3MMA) decreased from 126.0 in December to 125.7 in January, which was 18.3 points higher than in January last year. Consumer confidence is a driver of consumer spending, which is the largest component of GDP and ultimately drives a large portion of steel consumption.

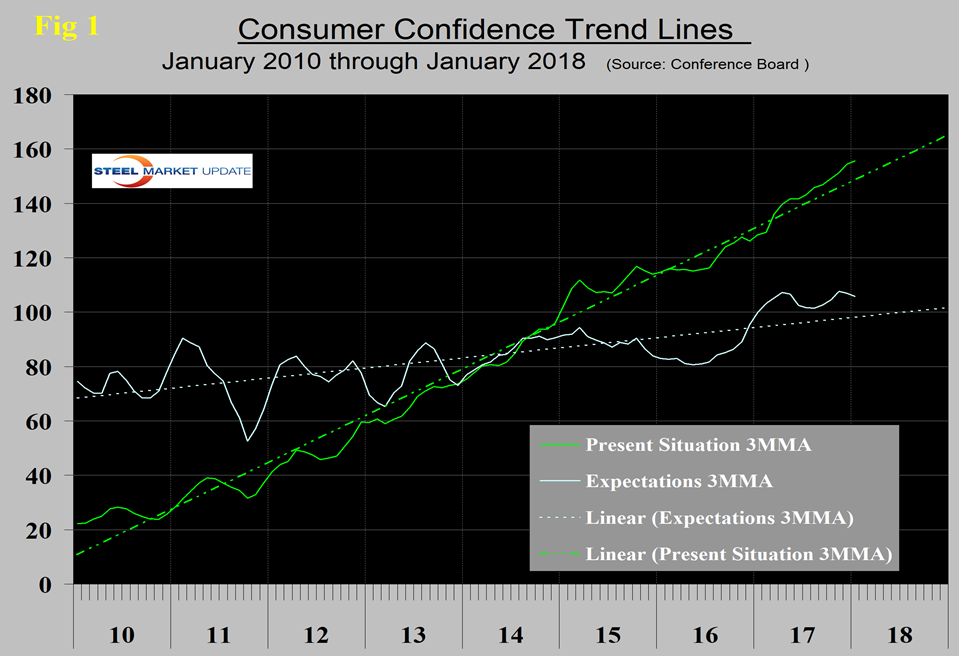

In January, the 3MMA of the composite decreased by 0.27 points to 125.7 points. We prefer to smooth the data with a moving average because of monthly volatility, which in the case of consumer confidence has been quite extreme since the beginning of 2016. The composite index is made up of two sub-indexes. These are the consumer’s view of the present situation and his or her expectations for the future. Both are now above their eight-year trend line (Figure 1).

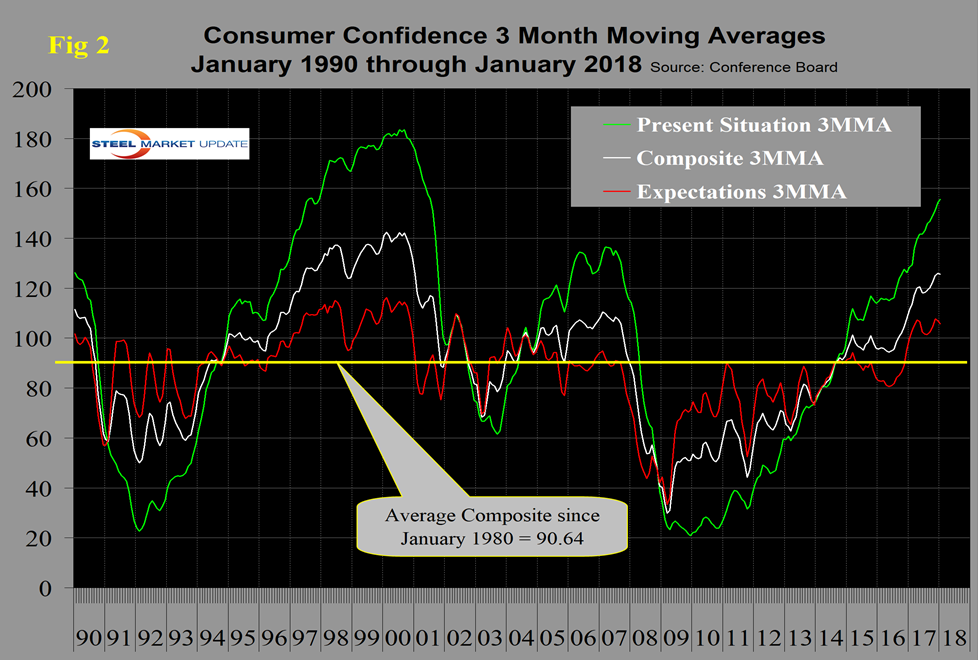

The historical pattern of the 3MMA of the composite, the view of the present situation and expectations are shown in Figure 2.

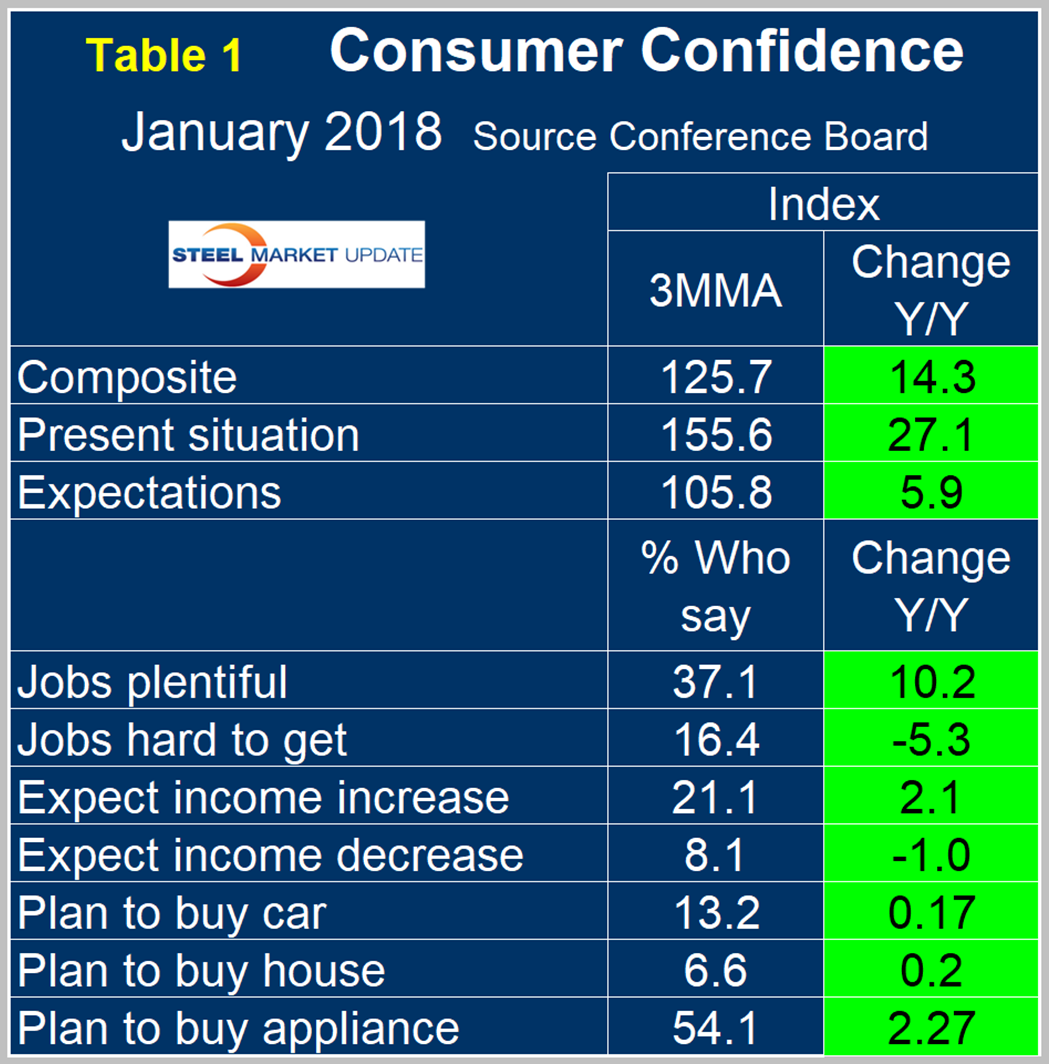

All three measures are now higher than they were at the pre-recession peak of 2007. The 3MMA of both components of the composite surged from mid-2016 until June 2017 when expectations briefly declined. Comparing January 2018 with January 2017, the 3MMA of the composite was up by 14.3, the present situation was up by 27.1 and expectations were up by 5.9 (Table 1).

All sub-indices in Table 1 were green in each of the last three months. The consumer confidence report includes encouraging data on job availability and wage expectations. It reports on the proportion of people who find that jobs are hard to get and those who believe jobs are plentiful, and it measures those who expect a wage increase or a decrease. Since January 2011, both of the employment components have steadily improved. The difference between those finding jobs plentiful and hard to get has been in positive double digits every month since February 2017 and in January 2018 reached 21.2 percent. Expectations for wage increases have been less consistent, but the differential between those expecting an increase and those expecting a decrease has been in positive double digits since January 2017. Plans to buy an automobile have had positive year-over-year growth since July 2016. In January, plans to buy a car were up by 0.2 percent. Plans to buy a house have been positive year over year for each of the last 10 months. Apart from a slight decline last September, plans to buy an appliance have had positive year-over-year year growth since August 2016.

Economy.com summarized as follows: “Consumer confidence recovered partially in January, with The Conference Board index rising 2.3 points to 125.4, up from a revised 123.1 in December. The gain was driven entirely by a bounce in consumer expectations as the labor differential rose to 21.2 from 20.3. Consumers have not been so optimistic about the labor market since 2001. However, the present situation index took a modest 1.2-point slide, as current business conditions were rated slightly less favorably. Auto purchasing plans improved to a three-month high, but home purchasing plans dropped to their lowest since June.”

SMU Comment: Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence and disposable income. The current consumer confidence report is excellent in both these respects.

The Conference Board Consumer Confidence Index Improved

The Conference Board Consumer Confidence Index® increased in January, following a decline in December. The Index now stands at 125.4 (1985=100), up from 123.1 in December. The Present Situation Index decreased slightly, from 156.5 to 155.3, while the Expectations Index increased from 100.8 last month to 105.5 this month. The cutoff date for the preliminary results was Jan. 18.

“Consumer confidence improved in January after declining in December,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions decreased slightly, but remains at historically strong levels. Expectations improved, though consumers were somewhat ambivalent about their income prospects over the coming months, perhaps the result of some uncertainty regarding the impact of the tax plan. Overall, however, consumers remain quite confident that the solid pace of growth seen in late 2017 will continue into 2018.”

Consumers’ assessment of current conditions was slightly less positive in December. Consumers’ assessment of business conditions was mixed. The percentage saying business conditions are “good” decreased slightly from 35.8 percent to 34.9 percent, while those saying business conditions are “bad” increased slightly, from 11.7 percent to 12.7 percent. Consumers’ assessment of the labor market was also mixed. The percentage of consumers claiming jobs are “plentiful” increased from 36.3 percent to 37.6 percent, while those claiming jobs are “hard to get” increased marginally, from 16.0 percent to 16.4 percent.

Consumers’ optimism about the short-term outlook improved in January, following a sharp decline in December. The percentage of consumers anticipating business conditions to improve over the next six months increased marginally, from 21.6 percent to 22.0 percent, while those expecting business conditions to worsen increased from 9.0 percent to 9.8 percent.

Consumers’ outlook for the job market was also less negative. The proportion expecting more jobs in the months ahead was virtually unchanged at 19.0 percent, while those anticipating fewer jobs declined from 15.9 percent to 11.8 percent. Regarding their short-term income prospects, the percentage of consumers expecting an improvement decreased from 22.7 percent to 20.4 percent, while the proportion expecting a decrease also declined, from 9.0 percent to 7.7 percent.

Source: January 2018 Consumer Confidence Survey®

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. Our mission is unique: To provide the world’s leading organizations with the practical knowledge they need to improve their performance and better serve society. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.