Analysis

January 29, 2018

Home Prices Rising Faster Than Inflation

Written by Sandy Williams

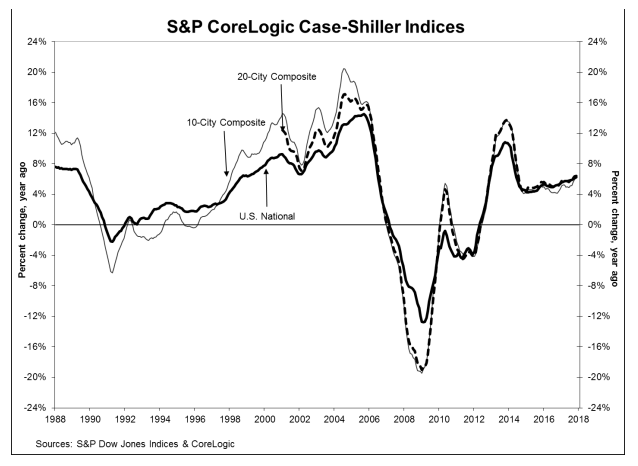

Home prices are rising faster than the rate of inflation, according to the latest S&P CoreLogic Case-Shiller Indices. Data for November shows a year-over-year gain of 6.2 percent for the National Home Price Index.

The 20-city composite posted a 6.4 percent annual gain with Seattle, Las Vegas and San Francisco reporting the highest year-over-year gains. The national index has had annual gains of at least 5 percent for the past 16 months and the 20-city index for 28 months.

The surge in prices is tied to a shrinking inventory, said David M. Blitzer, chairman of the index committee at S&P Dow Jones Indices.

“Home prices continue to rise three times faster than the rate of inflation,” said Blitzer. “Given slow population and income growth since the financial crisis, demand is not the primary factor in rising home prices. Construction costs, as measured by National Income and Product Accounts, recovered after the financial crisis, increasing between 2 percent and 4 percent annually, but do not explain all of the home price gains. From 2010 to the latest month of data, the construction of single-family homes slowed, with single-family home starts averaging 632,000 annually.”

“Without more supply, home prices may continue to substantially outpace inflation,” he added.