Market Data

January 3, 2018

Global Growth in Steel Production Slows

Written by Peter Wright

Global steel production grew by 4.6 percent in the three months through November year over year with negative momentum, according to Steel Market Update’s analysis of World Steel Association data. The reduced growth rate was driven by pollution control cutbacks in China.

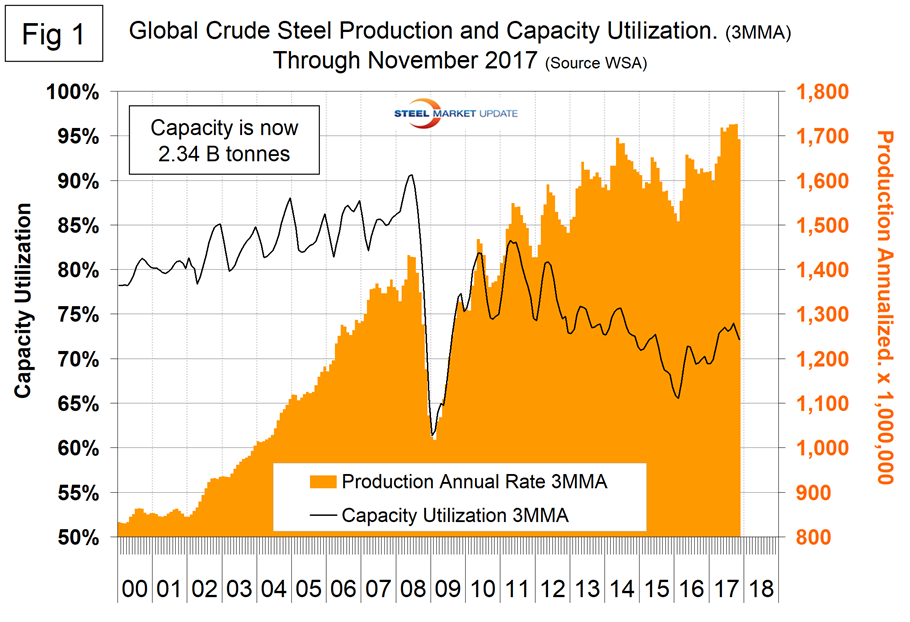

Production in the month of November totaled 136,280,000 metric tons, down from 144,972,000 in October. Capacity utilization decreased from 72.9 percent to 70.0 percent. The three-month moving averages (3MMA) that we prefer to use were 141,042,000 metric tons and 72.1 percent, respectively. Figure 1 shows monthly production and capacity utilization since January 2000.

The summer slowdown that has occurred in each of the last seven years was delayed until November this year. On a tons-per-day basis, production in November was 4.543 million metric tons with a 3MMA of 4.649 million metric tons, which was not far off the all-time high in June of 4.695 million metric tons. In three months through November, production was up by 4.6 percent year over year. On a 3MMA basis, capacity utilization was on an erratically downward trajectory from mid-2011 through February 2016 when it bottomed out at 65.5 percent. There has been a 6.5 percent increase since then. In each of the last nine months, the 3MMA of capacity utilization has been greater than 72 percent for the first time since June 2015. Last November, the OECD’s steel committee estimated that global capacity would increase by almost 58 million metric tons per year between 2016 and 2018 bringing the total to 2.43 billion tonnes. That forecast is coming to pass as capacity is now 2.34 billion tons.

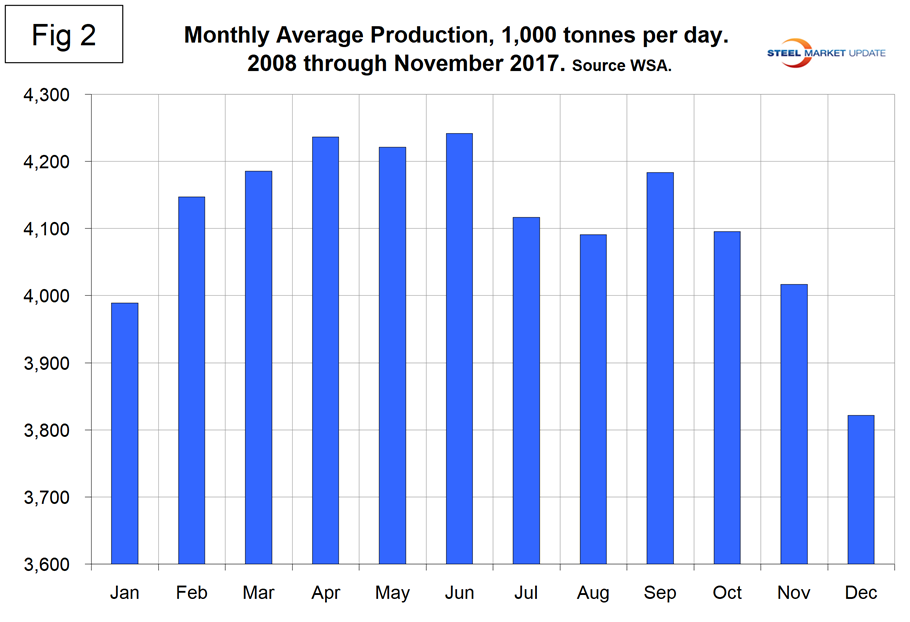

As we dig deeper, we start with seasonality. Global production has peaked in the early summer for the last seven years with April and June on average having the highest volume. Figure 2 shows the average tons-per-day production for each month since 2008.

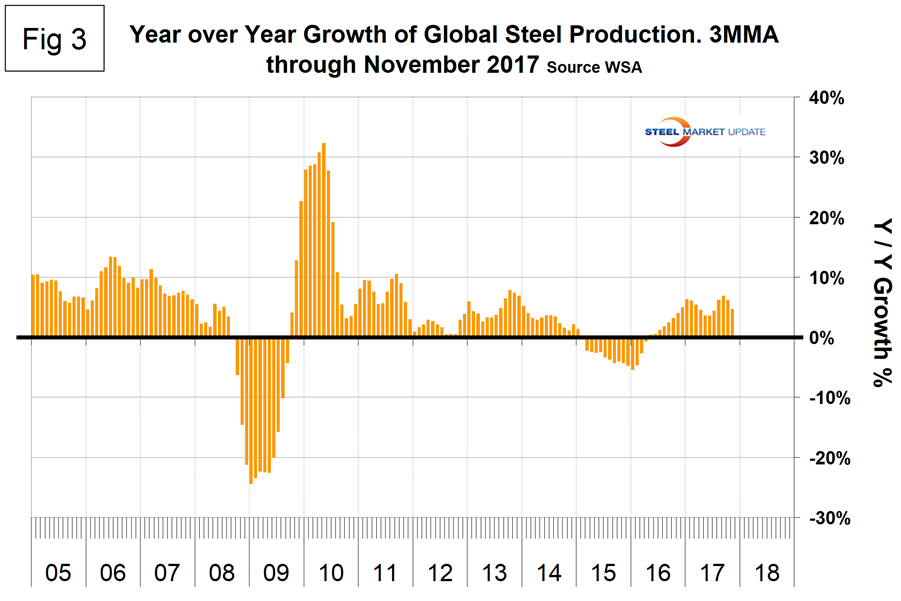

In those 10 years on average, November has been down by 1.93 percent; this year November was down by 2.86 percent. Figure 3 shows the monthly year-over-year growth rate on a 3MMA basis since January 2005.

Production began to contract in March 2015 and the contraction accelerated through January 2016 when it reached negative 5.4 percent. Growth became positive in May last year and averaged 5.2 percent in the first 11 months of 2017. In the 14 months through May 2017, China’s growth rate was lower than the rest of the world. That changed in the five months through October when China began to pull away again. In November, China once again expanded by less than the rest of the world with a growth rate of 3.6 percent compared to 5.6 percent for everybody else. In November, China produced 48.5 percent of the global total, down from 51.6 percent in June.

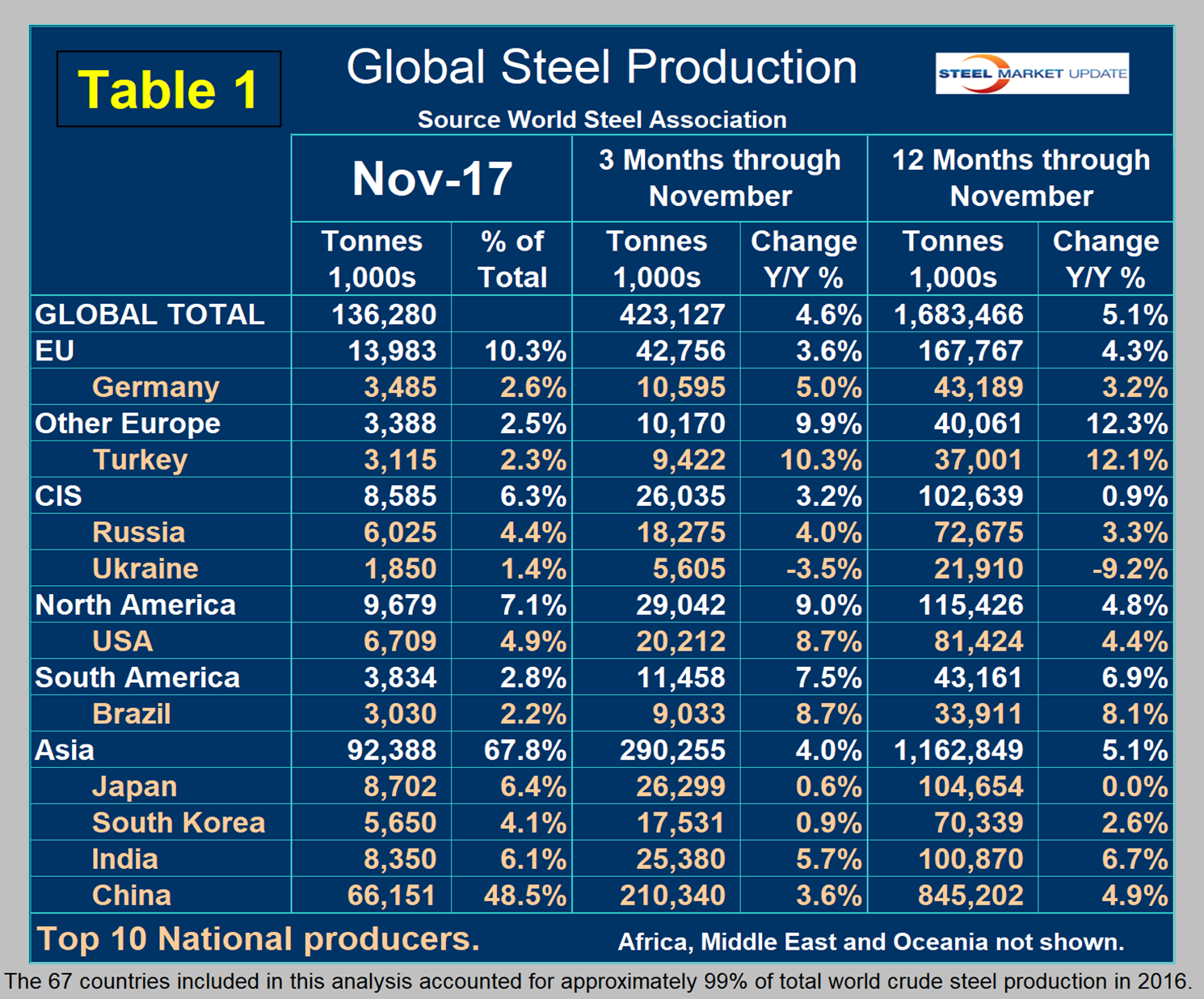

Table 1 shows global production broken down into regions, as well as the production of the top 10 nations in November and their share of the global total. It also shows the latest three months’ and 12 months’ production through November with year-over-year growth rates for each period. Regions are shown in white font and individual nations in beige. The world as a whole had positive growth of 4.6 percent in three months and 5.1 percent in 12 months through November. When the three-month growth rate is lower than the 12-month growth rate, as it was in November, we interpret this as a sign of negative momentum, which is entirely due to China’s pollution-control-driven cutback.

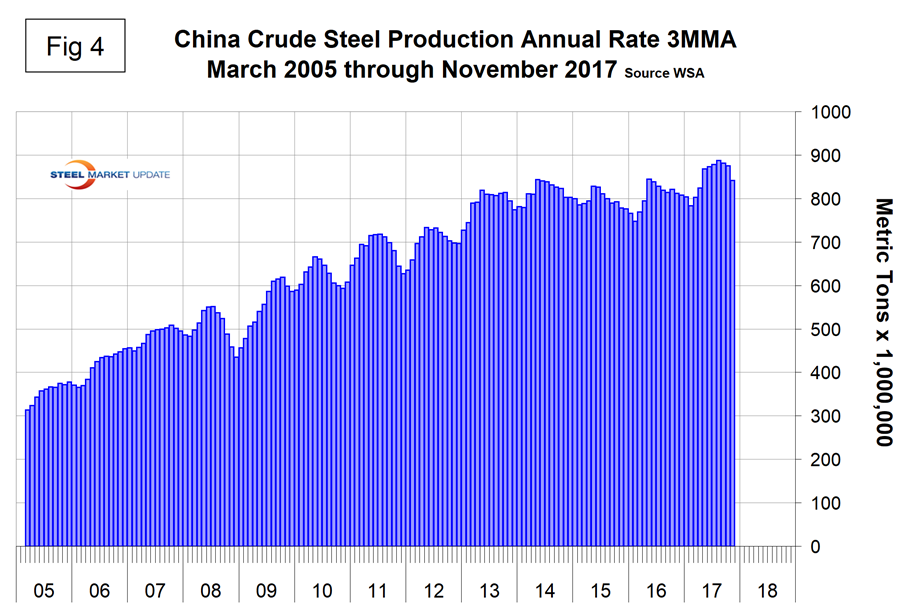

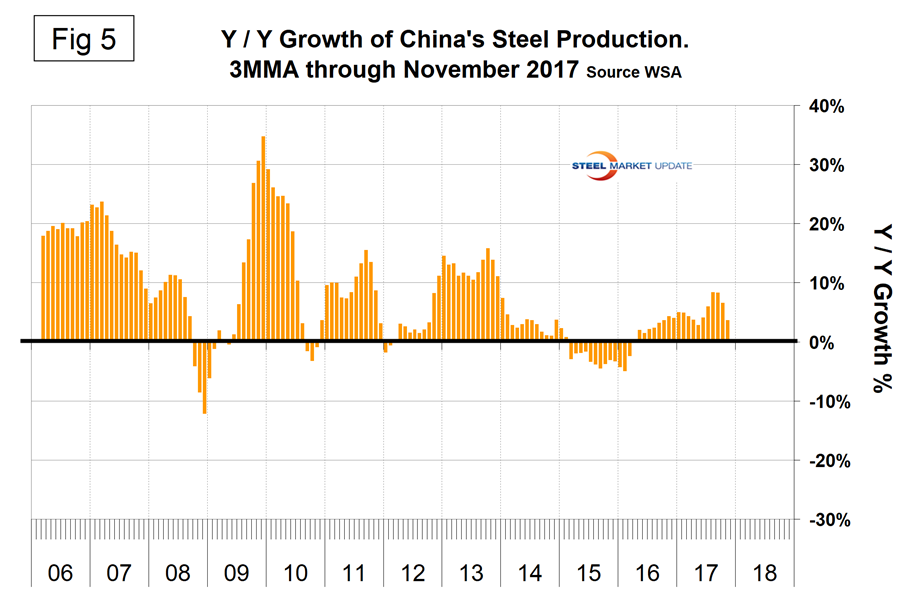

Figure 4 shows China’s production since 2005 and Figure 5 shows the year-over-year growth. China’s production after slowing for 13 straight months returned to positive growth each month in May 2016 through November this year. Platts reports that Tangshan, China’s biggest steelmaking city, began the well-publicized steel output cuts on Nov. 15 in an attempt to improve air quality in Beijing, Tianjin and 26 surrounding cities.

Table 1 shows that in both three and 12 months through November year-over-year, every region had positive growth. At the national level, only Ukraine contracted. North America was up by 9.0 percent in three months. Within North America, the U.S. was up by 8.7 percent, Canada was up by 29.2 percent and Mexico was down by 1.8 percent. In both October and November, Canada had the highest production since our data stream began in January 2012. In the first 11 months of 2017, 105.8 million metric tons were produced in NAFTA of which 70.8 percent, 11.9 percent and 17.3 percent were produced in the U.S., Canada and Mexico, respectively. Other Europe, led by Turkey, had the highest growth rate in three months through November year over year. Asia as a whole was up by 4.0 percent.

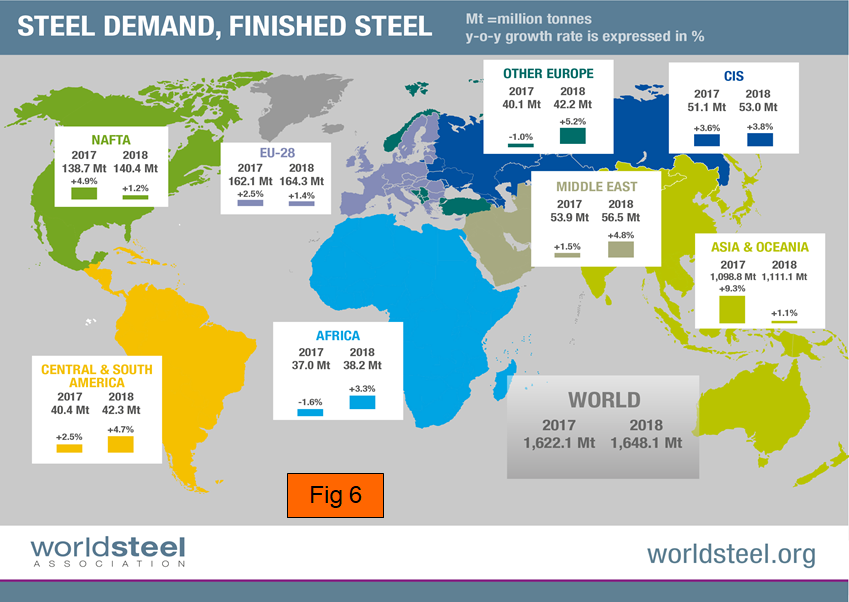

The World Steel Association Short Range Outlook for apparent steel consumption in 2017 and 2018 was revised and published on Nov. 14 (Figure 6). Commenting on the outlook, T.V. Narendran, chairman of the World Steel Economics Committee, said: “Progress in the global steel market this year to date has been encouraging. We have seen the cyclical upturn broadening and firming throughout the year, leading to better than expected performances for both developed and developing economies, although the MENA region and Turkey have been an exception. The risks to the global economy that we referred to in our April 2017 outlook, such as rising populism/protectionism, U.S. policy shifts, EU election uncertainties and China deceleration, although remaining, have to some extent abated. This leads us to conclude that we now see the best balance of risks since the 2008 economic crisis. However, escalating geopolitical tension in the Korean peninsula, China’s debt problem and rising protectionism in many locations continue to remain risk factors. In 2018, we expect global growth to moderate, mainly due to slower growth in China, while in the rest of the world steel demand will continue to maintain its current momentum.”

SMU Comment: WSA increased its April forecast for production in 2018 from 1,548.5 million metric tons to 1,648.1 million metric tons in its November forecast. This would be a projected growth of 1.6 percent in 2018, which based on the present momentum seems low. Globally, steel is back on a roll, driven primarily by construction in the developing world. The emerging and developing economies saw their GDP decline from 2010 through 2015 after which there was a turnaround that the IMF believes will continue through the 2022 forecast.